If I were to shut the television off and completely stop

watching stock market levels, only focusing on market sentiment and safe haven

assets, one would believe US equities are in the throes of a market sell-off

that is nearing its completion and possibly forming a bottom. Yet here we are

making new 52 week highs and quickly approaching all-time highs, at least for

large cap stocks. Negative sovereign debt yields and a risk-on and off US

market is a unique education so we are taking notes.

Last week we

wrote about the prospect of US equities breaking to new highs. We also

commented on subdued market sentiment and fund flows as the fuel that could

drive the market much higher. We have found additional evidence of that theory

in our reading this week.

In Yahoo

Finance this past week, “When

volatility spikes in the financial markets, so does fear of an impending market

crash. This fear went parabolic last month as the UK unexpectedly voted to

leave the European Union. In the days that followed, markets around the world

sold off sharply.

"Feelings of

'This is it!' rise again," Oppenheimer's Ari Wald said.

Ironically, history

shows that fear of a crash has a poor track record of predicting crashes.

Conversely, some of history's worst crashes came when no was expecting one.

"We continue to

note that the sentiment backdrop is far from extreme optimism and instead

quickly shifts to gloom and doom during market downturns," Wald wrote in a

note to clients. "We saw this again last week as shown by a spike in the

number of news stories referencing the words 'Stock Market Crash' to its

highest level in years. For comparison purposes, there were significantly fewer

occurrences of this through the topping process in 2007."

In other words, very

few people were looking into stock market crashes before the last big crash

actually happened.”

“"Our view is

that with many investors seemingly eager to call the next market crash, the

risk of one is likely not yet significant," Wald said.

Yale School of

Management tracks this fear through surveys, which feed into the school's

proprietary Crash Confidence Index. The index represents the percentage of

respondents who think there's a less than 10% probability the market crashes in

the next six months.

Similar to Wald's

observation, Yale's Crash Confidence Index showed that many folks didn't fear a

crash as the stock market peaked and tumbled from 2007 through 2008.”

“"Crash

confidence reached its all-time low, both for individual and institutional investors,

in early 2009, just months after the Lehman crisis, reflecting the turmoil in

the credit markets and the strong depression fears generated by that event, and

is plausibly related to the very low stock market valuations then," Yale

analysts observed. "The recovery of crash confidence starting in 2009

mirrors the strong recovery in the stock market."

In other words, the

bottom in the stock market coincided with peak fears of an impending market

crash.

Some of Wald's peers

on Wall Street are coming to similar conclusions that the fear these days may

be overblown.

“In June, the Sell

Side Indicator — our measure of Wall Street’s bullishness on stocks — fell for

the third month in a row to 50.7 (from 51.6), its lowest level in three years,”

Bank of America Merrill Lynch’s Savita Subramanian said on Friday. "The

indicator is now firmly in 'Buy' territory … While sentiment has improved

significantly off of the 2012 bottom — when this indicator reached an all-time

low of 43.9 — today’s sentiment levels are still well-below where they were at

the market lows of March 2009.””

“Subramanian says this

indicator, which is based on recommended equity allocations among Wall Street

strategists, is predicting a 12-month total return of over 21% for the S&P

500 (^GSPC).

Over at Citi,

strategist Tobias Levkovich sees a similar signal coming from his firm's

proprietary Panic/Euphoria model, which is based on various market measures of

sentiment.

“[S]entiment remains

quite poor, similar to the lows in 2011-12 when investors should have been

buying stocks,” Levkovich said following the Brexit vote.”

As mentioned last week, it seems the next market

correction/bear market is so anticipated that it just may not happen yet.

Short-term technical

Just a few interesting market observations last week. On CNBC

Canaccord Genuity chief investment strategist Tony Dwyer said “the combination of historical precedent and

fundamental backdrop suggests a 15 to 20 percent upside over the next 6-12

months.”

“Here's what happened:

On June 28 and June 29, 90 percent of the New York Stock Exchange (NYSE) volume

was positive. "If you go back to look at 1950 on just occurrences, when

you had two upside 90 percent days you have never been negative three, six and

twelve months later. As a matter of fact, your median gains are 12 percent, 18

and a half percent, and 29.2 percent," Dwyer recently told CNBC's

"Futures Now."”

“"The data is very

clear. The market is up every time after you get this kind of buying thrust

that we've had" over last week, he said. "And, the last time that you

had a similar environment of low interest rates, flat yield curve, European

crisis.... that was the time to buy the banks," said Dwyer.”

Indeed we found something similar on Dana

Lyon’s Tumblr, “While the S&P 500

missed out on an all-time high today by 92 cents, it did receive consolation in

the fact that it was a 52-week high. It was also the first such high in more

than a year. Since 1950, this was the 13th time the index has had to wait more

than a year to hit a new 52-week high.”

“How did the index

respond following the previous 12 long waits? Quite well, thank you very much. As

the table shows, the median return was positive across every time frame, from 1

week to 2 years. Not only that, but gains were unanimous 1 and 2 years later.”

John Murphy from Stockcharts.com

also made the case for higher equities from here. He goes on to write, “My May 25 message referred to the flat line

drawn over the highs of the fourth quarter and this spring as a

"neckline" which is normally part of bullish "head and

shoulders" bottoming formation (see Chart 1). To complete that bottom,

however, prices have to close decisively above the neckline. That hasn't

happened yet. Technical indicators, however, suggest that an eventual upside

breakout is likely. First of all, the 14 week RSI line (top of chart) remains

above its 50 line which reflects positive momentum. More importantly, weekly

MACD lines (below chart) have risen above a falling trendline extending back to

the middle of 2014. Both MACD lines are also above their zero lines. It was the

bearish divergence in those two lines in mid-2015 that signaled problems ahead

(red arrow). At the moment, the two weekly MACD lines are sending a more

bullish message. So is the fact that the blue 10-week average is well above the

red 40-week line. All of those indicators (combined with a bullish chart

pattern) portray a positive image.”

“One of the hallmarks

of a potential "head and shoulders" bottom is the volume pattern. In

other words, volume should form a bottoming pattern of its own. And it appears

to be doing that. The green line above Chart 2 is an On Balance Volume (OBV)

line of the NYSE Index. The OBV line is a cumulative total of upside and

downside volume. Volume is added on up days and substracted on down days. As a

result, the trend of the OBV line tells whether there's more buying or selling.

More importantly, it should trend in the same direction of the price action. In

many cases, the OBV leads the price action higher. The green line in Chart 2

shows the OBV line forming a potential "head and shoulders" pattern

of its own. More importantly, the OBV line has already risen above its

"neckline" and is close to exceeding its October high. It looks to me

like the OBV line has already bottomed. That increases the odds that prices

will eventually trend in the same direction. I'll leave it up to you to decide

that for yourself.”

He goes on to point out that the NYSE AD line and the common

stock only NYSE AD line are hitting new highs ahead of the market. That is also

taken as a bullish signal.

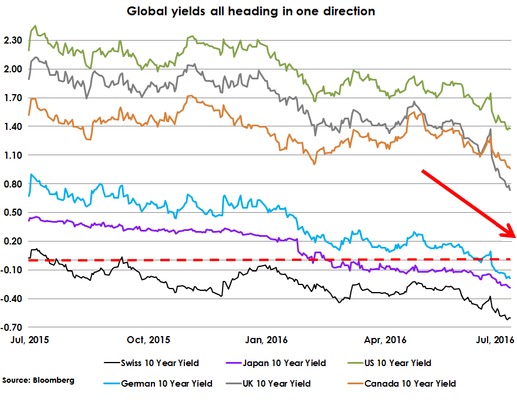

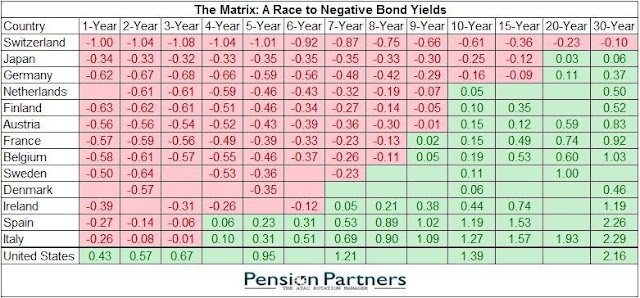

Sovereign Debt

What is the story with global bond yields? Our 10-year yield

hit lows of 1.37% while our 30-year fell to 2.11%. Imagine that, 2.11% for 30

years. And to think these yields are high relative to other nations. From Wolf

Street, “The German government,

paragon of fiscal rectitude at the moment, one of the few AAA-rated governments

left on earth, is able to charge investors for lending it money: the 10-year

yield ended the week at a negative -0.187%; the 30-year yield is still positive

at 0.35%, but creeping closer to zero.

In Japan, it’s even

worse. Fiscally, Japan is the opposite of Germany. It has a lowly A+ credit

rating, a gross national debt that has ballooned to 250% of GDP, by far the

worst in the developed world, and mega-deficits year after year. Yet its

lost-cause debt sports a 10-year yield of negative -0.288%. Even the 30-year

bond is dabbling with zero.

Swiss government bonds

are the negative-yield-absurdity trailblazers: the 10-year yield, at -0.60%, is

the most negative 10-year yield in the world. Even the 30-year yield is

negative.”

“At the end of May,

the total amount of government debt with negative yields had reached $10.4

trillion. By June 27, it had jumped to $11.7 trillion, according to Fitch

Ratings. Since then, even more debt has skidded into negative-yield absurdity,

now exceeding $12 trillion, and moving inexorably higher.

“Merrill Lynch now

says 29% of the global fixed income market is sporting negative rates, up from

24% pre-Brexit,” explained Christine Hughes, Chief Investment Strategist at

OtterWood Capital, in her newsletter. It’s “a continued march south in global

yields courtesy of the relentless demand for bonds””

So there is a war being waged. Bonds vs. stocks. Simultaneous

risk-on and off. If the bond market proves to be right and win the battle, then

we are looking at global deflation and most likely a very bad period of global economic

growth and equity returns. If stocks win the day, then we should expect the bull

to resume and global yields rise. This will hurt bond holders and could be the

blow-off top to the bond bubble that has been in place for some time.

The folks at Pension Partners write, “The behavior of bonds is wildly disturbing globally, and the US is not

immune. If bonds are right, then a

deflation tsunami is coming. And that

means stocks likely have a lot of downside and volatility to come in the years

ahead. If bonds are right, we are at the end of the bull markets and period of

low volatility for stocks…If indeed stocks are right about the future, then it

is the end of the bond rally, and rising rates finally will come. We should all be cheering for that to be the

case. Either way though, I believe we

are nearing the end of one of the most historic disconnects of all time. When we find out the answer of who is right

is unclear. Every day that goes by

though, we are closer to one class of investors being dangerously wrong.”

Based on our reading it appears many strategists believe the

bond rally will soon end. Unfortunately, many of these same strategists have being

calling for the end of the bond boom for years now and have completely missed

the mark. From Bloomberg,

“And yet here comes Goldman Sachs,

sounding an alarm yet again about how U.S. yields are poised to increase and

that investors are overreacting to Britain's vote to leave the European Union.

"The U.K. is not

a global economic bellwether, and hence any economic activity slowdown should

have a limited impact," Rohan Khanna, a London-based interest rates

strategist at Goldman, wrote in a note cited by Bloomberg News reporter Kevin

Buckland on Tuesday.

Goldman is not a

complete outlier when it comes to believing Treasury yields will rise soon.

Bank analysts surveyed by Bloomberg still predict that U.S. benchmark borrowing

costs will generally increase this year.”

The article goes on to give several reasons why a rise in

rates in the near-term are unlikely citing (correctly so in our opinion); (1)

cross-country yield correlations; (2) The remaining hangover effects of Brexit

(whatever they may be) and (3) lack of inflation.

In Bill

Gross’s June newsletter, he summed up the dilemma facing fixed income

investors. He writes, “Since the

inception of the Barclays Capital U.S. Aggregate or Lehman Bond index in 1976,

investment grade bond markets have provided conservative investors with a 7.47%

compound return with remarkably little volatility…GMO’s Ben Inker in his first

quarter 2016 client letter makes the point that while it is obvious that a

10-year Treasury at 1.85% held for 10 years will return pretty close to 1.85%,

it is not widely observed that the rate of return of a dynamic “constant

maturity strategy” maintaining a fixed duration on a Barclays Capital U.S.

Aggregate portfolio now yielding 2.17%, will almost assuredly return between

1.5% and 2.9% over the next 10 years, even if yields double or drop to 0% at

period’s end. The bond market’s 7.5% 40-year historical return is just that –

history. In order to duplicate that

number, yields would have to drop to -17%! Tickets to Mars, anyone?” {Emphasis

Added}

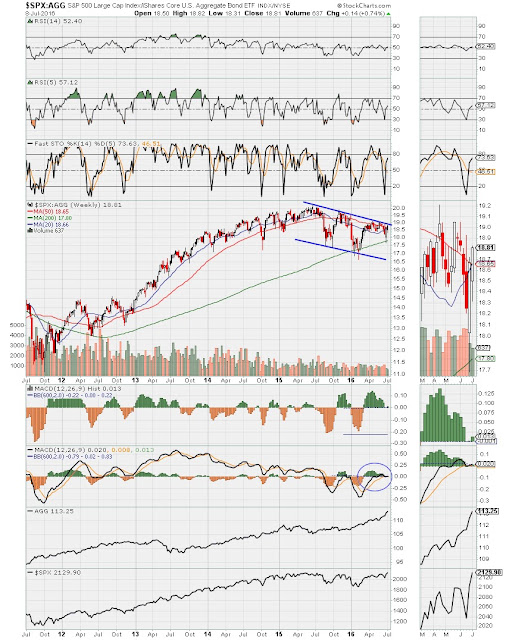

Risk-off prevails despite the recent run in equities. In the

chart below we are looking at the relative performance between long yields (TLT)

and the S&P 500 (SPY). The channel is trending lower with RSI (14) below 50

and a negative MACD cross. The same can be said when comparing US equities to

investment grade bonds (AGG). This doesn’t necessarily mean stocks will head lower;

it points out that treasuries are outperforming stocks to this point. This is

not a ringing endorsement for strong economic growth or a positive equity investment

environment.

That said, we will be watching closely as (if) the stock

market starts breaking new all-time highs. If we see an improvement in

contrarian market sentiment and fund flows improve then that will be the fuel

higher. The money flowing back into equities could very well come from the

risk-off sectors that remain elevated.

In fact, across many risk-off safe haven assets, the US

stock market, while rallying is underperforming. Gold, silver and the Japanese

Yen are all considered safe haven assets and they continue to do quite well

against US equities.

Bottom Line: So here’s

what needs to happen. I am already long into this potential rally. If we break

new highs in the US equity markets and safe-haven assets start to weaken

relative to US equities and we get renewed leadership within the market (i.e.

once utilities and consumer staples stop being the best performing sectors) then

we will be much more aggressive in our long positions. Forgetting market

fundamentals, global economic growth and corporate earnings for a second, the

market is on the cusp of an irrational blow-off top driven by sentiment and

fund flows stemming from sector rotation. This could be the opportunity to get

some decent returns out of what has been a dismal year for many asset managers.

If we start to

breakdown, then we will wait for a retest and breach of the February lows and

position our portfolio accordingly, focusing on safe-haven and flight to

quality issues. The market will breakout or breakdown. We don’t have the

direction with certainty but we do have our strategy prepared for either event.

Joseph S. Kalinowski, CFA

Email: joe@squaredconcept.net

Twitter: @jskalinowski

Facebook: https://www.facebook.com/JoeKalinowskiCFA/

Blog: http://squaredconcept.blogspot.com/

Web Site: http://www.squaredconcept.net/

Additional Reading

On the stock market

The

Stock Market Is Heading for a Wile E. Coyote Moment – The Fiscal Times

Why

the global melt-up in stocks is nearly upon us – Market Watch

Beware

of “Perma-Bears” in Volatile Markets – AB Blog on Investing

“It’s

Starting to Feel Like 2008” – Daily Reckoning

On bond yields

Bond

Yields: The Anti-Risk Bubble? – A Wealth of Common Sense

Technically

Speaking: The Bond Ratio Warning – Real Investment Advice

On Gold Prices

Alan

“Bubbles” Greenspan Returns to Gold – Wolf Street

No part of this report may be reproduced in any manner

without the expressed written permission of Squared Concept Asset Management,

LLC. Any information presented in this

report is for informational purposes only.

All opinions expressed in this report are subject to change without

notice. Squared Concept Asset

Management, LLC is a Registered Investment Advisory and consulting company.

These entities may have had in the past or may have in the present or future

long or short positions, or own options on the companies discussed. In some cases, these positions may have been

established prior to the writing of the particular report.

The above information should not be construed as a

solicitation to buy or sell the securities discussed herein. The publisher of this report cannot verify

the accuracy of this information. The

owners of Squared Concept Asset Management, LLC and its affiliated companies

may also be conducting trades based on the firm’s research ideas. They also may hold positions contrary to the

ideas presented in the research as market conditions may warrant.

This analysis should not be considered investment advice and

may not be suitable for the readers’ portfolio. This analysis has been written

without consideration to the readers’ risk and return profile nor has the

readers’ liquidity needs, time horizon, tax circumstances or unique preferences

been taken into account. Any purchase or sale activity in any securities or

other instrument should be based upon the readers’ own analysis and

conclusions. Past performance is not indicative of future results.

No comments:

Post a Comment