U.S. Dollar Overvalued

I’ll be traveling all week and that offers the opportunity

to catch up on my readings. I have been reading much about the strength of the

U.S. dollar, its weakening uptrend and its effect on corporate earnings in

1Q15. Comments from the strategists at HSBC (via Market

Watch) are warning, “The party is

nearly over, it’s time to gather your belongings and get out while you can,”

They explain the various stages of an asset bubble as explained in the chart

below and warn that the U.S. is in the fourth and final stage of the run and a

fall is inevitable.

A recent article in Pipczar

provided this U.S. analysis that I thought was interesting. “The DXY index broke higher following the

FOMC minutes yesterday. This created a double bottom in the USD index, broke a

“bearish wedge” (should have broke lower but instead broke higher) and looks to

be on the way to testing range highs. However, the double bottom has a

projected target above the recent trend highs. If we break higher, I am looking

for a target of about 101.50 which is a 127% extension of the recent range:”

“If this rally does

happen, it is likely to be viewed as a squeeze as there have been so many

traders trying to call a “top” in the USD as of late. That type of behavior is

very common when you see very explosive and strong trend like the one in the

USD index in recent months. Frankly (I have to admit) I agree with that thesis,

however have had a difficult time trading it lately. So, I have been buying the

USD (mostly) on dips as of late instead of trying to short the USD.

If the DXY does move

higher as planned and makes a brief new high, the monthly 61.8 retracement

level is at about 102.00. I have felt the last couple weeks that the 61.8%

Fibonacci level at 102.00 has been “unfinished business” for the USD bulls

anyway. . If we hit the 101.50-102.00 I would be looking for a longer term

reversal (or bigger consolidation) of the US Dollar Index.”

Stockcharts.com

on the coming correction of the U.S. dollar: “The U.S. Dollar has been chopping around its recent high for over a

month, and we think it is probably topping out after a major advance. While the

current EMA structure is still strongly bullish (50EMA above the 200EMA, and

20EMA above the 50EMA), we can see some technical deterioration in our

indicators. (We use UUP as a surrogate for the dollar.)

(1) Price has broken

to the right of the parabolic arc that supported the recent advance, giving an

initial warning. It is primarily a sideways move and could be interpreted as a

consolidation, but some other things undermine that idea.

(2) The April price high

is lower than the March price high, but the recent OBV top is higher than the

March top. This is a reverse divergence, which essentially tells us that higher

volume was unable to push price higher--kind of an internal blow-off.

(3) Finally, the PMO

has topped below the signal line, which we always view as bearish.”

“On the weekly chart

we see the near-vertical advance over the last nine months, a situation that

often results in a collapse to more reasonable levels. Also, the weekly PMO has

topped again in very overbought territory. The DecisionPoint Trend Model for

UUP is on a BUY signal in both the intermediate and long term, however, we are

seeing technical deterioration in those time frames as well as in the short

term. We think there is likely to be a sharp correction soon. As for a downside

target, it is typical for a parabolic advance to collapse into the basing

pattern that preceded it, in this case a range of 20 to 23.”

U.S. Equities Overvalued

Market valuations continue to drive the financial headlines

with more and more analysts calling the U.S. equity market a bubble that will

eventually deflate leaving a trail of devastation behind it. I too believe the

market is overvalued but understand that market

sentiment can be a powerful driver of equity prices. This article from Forbes

provides several charts to show the lofty valuation of our stock market. The

author uses five charts to make the case that excessively loose monetary policy

has expanded multiples to extreme levels. Using Tobin’s Q, market

capitalization to GDP (Buffet), CAPE valuation (Shiller), price to peak

earnings (Hussman) and historical dividend yield he goes on to show that for

each valuation metric, the story is the same – the market is overvalued. His

argument is that when interest rates start to rise, much of the energy behind

this market rally will fade.

Taken from Business

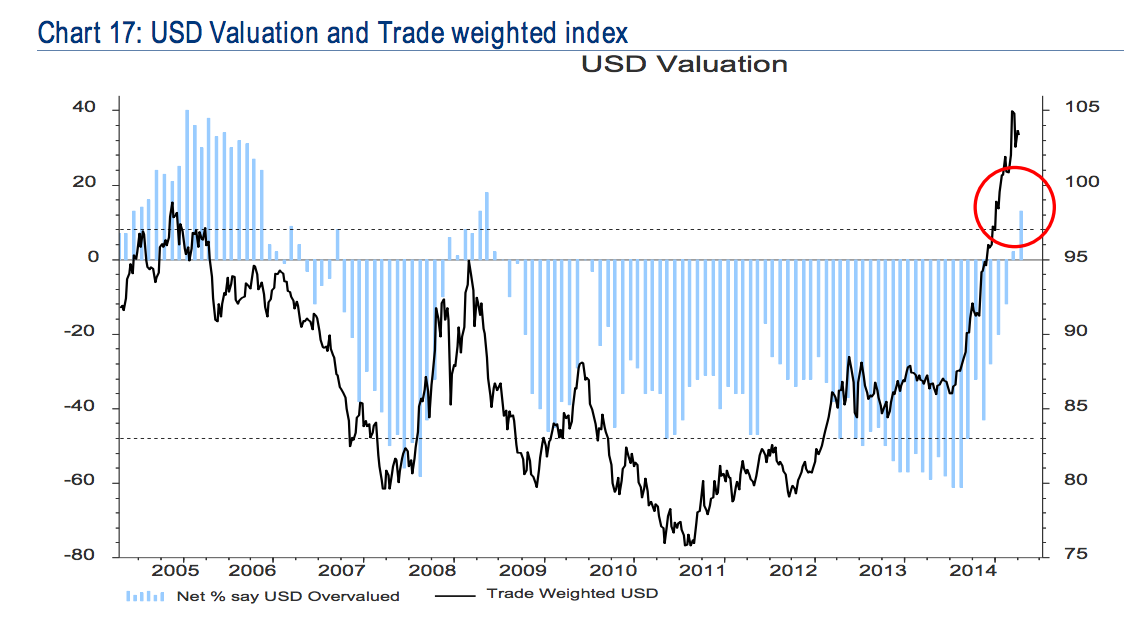

Insider, “More investors are worried

about overvalued stocks and bonds than at any time in at least the past 12

years. That's the message from Bank of America Merrill Lynch's latest survey of

fund managers, which polls 145 participants managing a combined $494 billion

(£337.4 billion) in assets on how they feel about a bunch of different

investments.” A Similar survey paints the same picture for investors that

think the U.S. dollar is overvalued at this point.

Tom Bowley from stockcharts.com

used an analysis of the VIX trading patterns to offer warning signs that the

market is due for a correction. He goes on to write, “On the next chart, take a look at how the VIX performed relative to the

S&P 500 throughout the bull market from 2002 to 2007: Volatility declined

throughout the bull market - until early 2007.

Despite an ongoing bull market that lasted into the 4th quarter of 2007,

the VIX started ramping up and moving against the grain. Put another way, the stock market was getting

nervous BEFORE the stock market topped.

That's a warning sign. From a

common sense perspective, if fear is increasing and nothing bad has happened

technically, what might happen once an actual technical breakdown occurs? Well, we know what happened and it wasn't

pretty.”

“Now let's fast

forward to the six year bull market that we're currently enjoying. We'll look at the same chart: Recent S&P

500 highs have been accompanied by slightly higher lows on the VIX. It's pretty obvious on the chart that this

normally doesn't occur. Also, bear

markets don't begin when volatility is high, they begin when the stock market

is complacent and the VIX is low.

In 2007, there were a

TON of warning signs that the market was topping and central bankers around the

globe weren't supporting that bull market the way they've been supporting this

one. And the rise in the VIX was much

more pronounced in 2007 despite the S&P 500 attempts at setting further

all-time highs. Clearly, we have a

completely different set of circumstances in 2015 and the rise in the VIX is

much more subtle. Nonetheless, sentiment

is an important secondary indicator when evaluating the health of a stock

market advance. If nothing else, keep

this chart on your radar and if volatility continues rising on further rises in

the S&P 500, you may want to grow much more cautious.”

That said, not everyone believes the market is overvalued.

Derek Tomczyk, CFA points out in an article he wrote for Seeking

Alpha, “The chart below shows the

trailing EY and excess EY (eEY) as well as the real interest rate over the past

132 years. The inflation figure used to convert the nominal interest rate into

the real interest rate is a 10-year trailing annualized CPI increase. This is

why the EY series starts in 1881 instead of 1871, as in last year's chart.”

He goes on to conclude, “What

we see is that outside of the depths of the 2008 financial crisis, the S&P

500 is still the cheapest it has been since around 1988. What is also evident

is that the bull market that followed 1988 drove stock valuations to extremely

overvalued levels but did not actually end until 2001. It also proves that

stock markets do not trade at fair value very often and can become wildly over-

or undervalued. If the stock market price reflected valuations at all times,

the red line on the above graph would be almost entirely flat. To determine the

fair value eEY level, we assume the average eEY over the past 132 years should

give us a good indication. This comes in at 5.04% and is very close to the

current level of 4.94%. This appears to say that we are very close to fairly

valued as the S&P currently stands.”

I suppose I see the point in using the 10 year treasury rate

as a means to measure equity risk premium. The so called “Fed Model” has worked

in the past as a warning against excessive valuations, but there is one point

to make. Since the Federal Reserve started its quantitative easing and more

importantly in this case operation twist campaigns, its stated goals were to

keep rates low (perhaps artificially) and transfer assets into higher risk

assets for those investors seeking yield. While Mr. Tomczyk’s analysis is

thorough and sensible, one needs to wonder (and that’s all we can really do

until we understand the consequences of our years of unorthodox monetary

policy) how monetary policy has altered the usefulness of this equity risk

premium analysis. Given the current state on monetary policy, the average yield

used may not be appropriate given the actions of the Fed. I believe this

distortion will be a temporary one but one to consider nonetheless.

Richard

Bernstein made the case that given today’s inflation environment, stocks

are fairly valued given the stage of the economic cycle we are in. The chart

below is the analysis that he provided and one can see where we are on his

trailing P/E and inflation model. I have a great respect for Mr. Bernstein and

have followed his brilliant work for years. I appreciate the analysis but when

I look at where we are currently positioned on his chart, it seems a little off

the beaten path. Would untethered market forces have that data point drift so

far to the left or is there some monetary policy influence assisting it?

Only time will tell. We wrote a blog

note a few weeks ago that agreed with the general consensus that the market

appears overvalued. That said, the market is a function of intrinsic value AND

market sentiment. We have a cautious outlook but understand that market

sentiment can be a powerful force. The trend is up and will most likely

continue until there is a catalyst that changes that direction.

Joseph S. Kalinowski, CFA

No part of this report may be reproduced in any manner without the expressed written permission of Squared Concept Partners, LLC. Any information presented in this report is for informational purposes only. All opinions expressed in this report are subject to change without notice. Squared Concept Partners, LLC is an independent asset management and consulting company. These entities may have had in the past or may have in the present or future long or short positions, or own options on the companies discussed. In some cases, these positions may have been established prior to the writing of the particular report.

The above information should not be construed as a solicitation to buy or sell the securities discussed herein. The publisher of this report cannot verify the accuracy of this information. The owners of Squared Concept Partners, LLC and its affiliated companies may also be conducting trades based on the firm’s research ideas. They also may hold positions contrary to the ideas presented in the research as market conditions may warrant.

This analysis should not be considered investment advice and may not be suitable for the readers’ portfolio. This analysis has been written without consideration to the readers’ risk and return profile nor has the readers’ liquidity needs, time horizon, tax circumstances or unique preferences been taken into account. Any purchase or sale activity in any securities or other instrument should be based upon the readers’ own analysis and conclusions. Past performance is not indicative of future results.