Last summer we traded the biotech space successfully. We

bought IBB between $259 - $261 and scaled out for a profit between $285 to $297

between July 1, 2016 and August 24, 2016. We accomplished the same trading LABU

buying in the mid-$20’s and selling in the upper $30’s.

There are a few reasons why I anticipate getting back involved

with the biotech space soon.

Seasonality

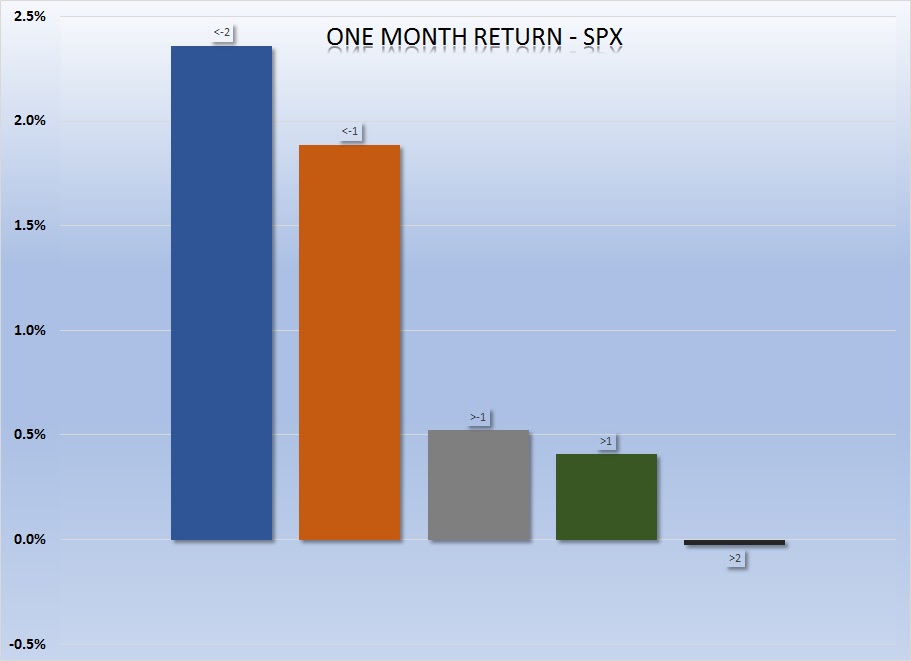

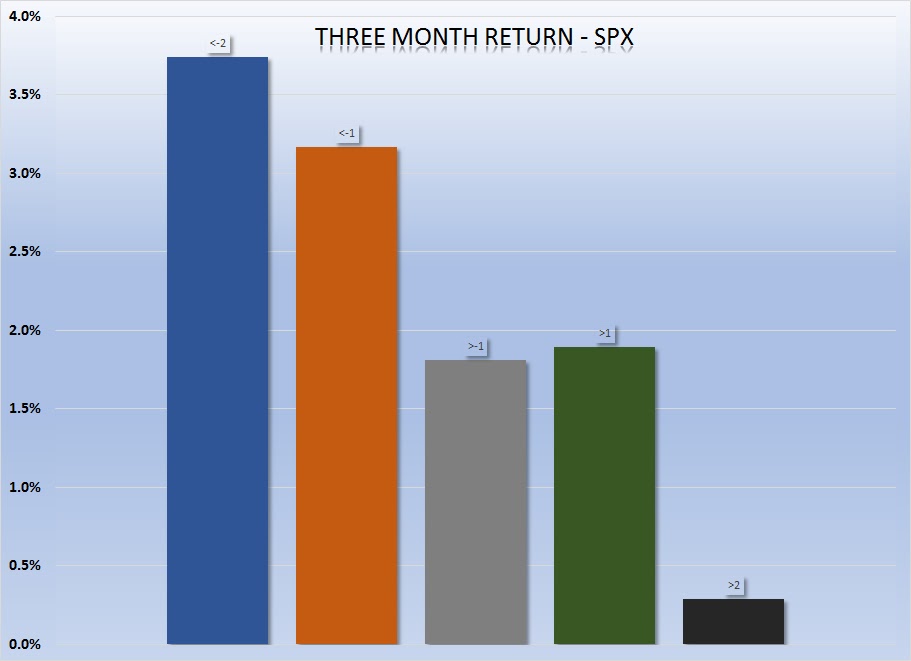

The first point I should make is the seasonality of the

biotech sector. According to research done by Tom Bowley from Stockcharts.com,

“During MarketWatchers LIVE on Wednesday,

I discussed seasonality and mentioned that for the months May through July, the

Dow Jones U.S. Biotechnology Index is the best performing industry group over

these three months. Below is the history by calendar month for the group:”

“July averages gaining

4.3% over the past two decades. May (+1.4%) and June (+0.6%) are also

historically strong months. So while the DJUSBT faces technical

challenges (primarily major price resistance near 1800), it will not hurt to

have historical tailwinds as we approach and enter the summer months.”

Technical Analysis

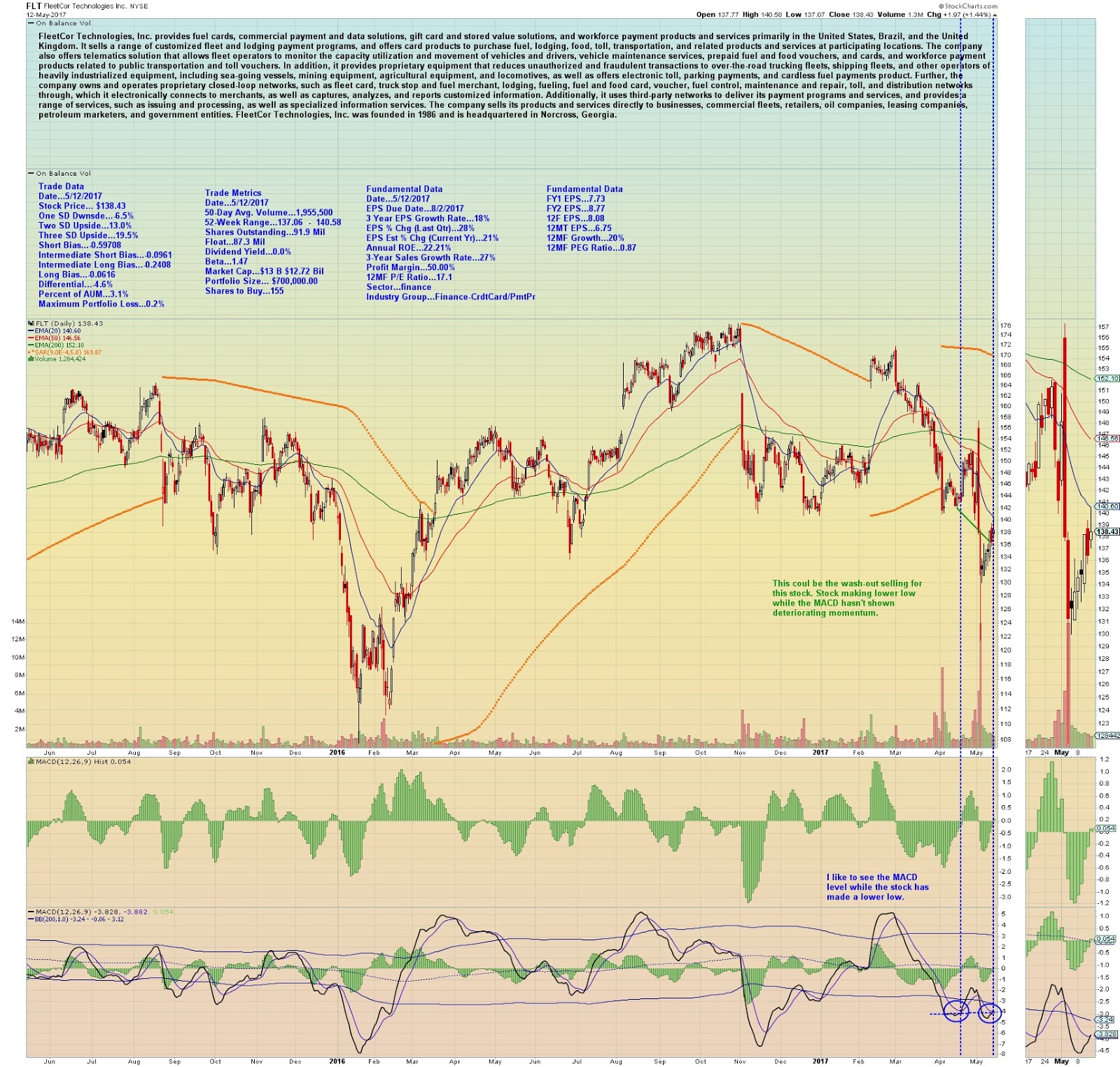

On the daily chart for IBB biotech ETF, we see an ascending triangle

pattern that has developed and this is usually a bullish pattern. A break-out

above $300 is an entry point for us. We’ll buy some IBB and perhaps the 3x

levered (very volatile) LABU.

On the weekly chart, we are also seeing bullish

developments. We see a bullish cup and handle formation with the break-out

level above $300. This provides us further confidence of a potential trade in

the works.

The point and figure graph is also exhibiting a spread

triple top formation within a bullish P&F pattern. Most times this will

represent consolidation and then continuation of the previous trend. It’s in a

bullish pattern now so a break-out to the $304 level may see the continuation

of the bullishness we’ve seen thus far.

Fundamental Analysis

Looking at both price to sales ratio and price to earnings

ratio, the quant team at BAML has pointed out that the biotech sector is trading

at multi-year lows relative to average valuations. A large part of this is due

in part to the political environment that has placed the drug sector in a

negative light. We agree with the analysis by BAML that most of this negative

news is already reflected in asset prices and we believe any bit of good news

on the political front, i.e. tax reform, repatriation or reduced regulatory

burdens could be the fuel to drive this sector much higher.

Relative to the expected earnings growth in the coming year,

GARP investors are probably watching this sector very closely. In this environment,

it is difficult to find a sector offering potentially 15% forward earnings

growth trading only 13x forward earnings.

They also make a point to show how underrepresented this

sector is with large institutional investors. Once the political backdrop

clears, we would expect rather large fund flows to find its way into the

biotech space.

Political Update

According to a recent article in SeekingAlpha,

“Investor sentiment has been poor for

several years, and it seems that with Trump policies there could still turn out

to be some pretty scary headlines ahead.

An examination of the

charts for the biotech indices and immunotherapy ETF CNCR, however, provide

some insight into current sentiment. Two years of index corrections should have

already compensated for a reduction in corporate profit.

As reported by Fierce

Biotech in March, President Trump reiterated the need to repeal Obamacare, but

emphasized that the FDA process is too slow:

“But some of his

toughest words were reserved for the FDA and the drug approval system, which

for months now he has signaled is too slow, and could very soon be about to get

a new, and possibly radical, commissioner.”

Meanwhile NPR reported

on the options that the Trump administration has to tweak Obamacare, without

requiring the help of Congress.

Analyst Michael Yee

reported that cutting approval time could itself reduce industry costs, as well

as increasing competition by moving Medicare from Part B to Part D, he also

made the valid point that potential Biotech company profit reductions have

already been priced in:

The "bottom

line" is that biotech investors are looking at how bad it's been over the

past year, but a lot of that movement has already been priced in, Yee said.

Trump's policies won't result in a "worst case scenario" for the

sector, he reiterated.

For example,

Republicans could choose to go a number of routes to slash drug prices,

including: cutting the patent life of drugs shorter to increase the pathway to

generics, moving Medicare from Part B to Part D or accelerating more drugs to

be approved faster, Yee said. All three would increase competition in the

market.”

Joseph S. Kalinowski,

CFA

Email: joe@squaredconcept.net

Twitter: @jskalinowski

Facebook: https://www.facebook.com/JoeKalinowskiCFA/

Blog: http://squaredconcept.blogspot.com/

Tumblr: trader-rants

No part of this report may be reproduced in any manner

without the expressed written permission of Squared Concept Asset Management,

LLC. Any information presented in this report is for informational

purposes only. All opinions expressed in this report are subject to

change without notice. Squared Concept Asset Management, LLC is a

Registered Investment Advisory and consulting company. These entities may have

had in the past or may have in the present or future long or short positions,

or own options on the companies discussed. In some cases, these positions

may have been established prior to the writing of the report.

The above information should not be construed as a

solicitation to buy or sell the securities discussed herein. The

publisher of this report cannot verify the accuracy of this information.

The owners of Squared Concept Asset Management, LLC and its affiliated

companies may also be conducting trades based on the firm’s research

ideas. They also may hold positions contrary to the ideas presented in

the research as market conditions may warrant.

This analysis should not be considered investment advice and

may not be suitable for the readers’ portfolio. This analysis has been written

without consideration to the readers’ risk and return profile nor has the

readers’ liquidity needs, time horizon, tax circumstances or unique preferences

been considered. Any purchase or sale activity in any securities or other

instrument should be based upon the readers’ own analysis and conclusions. Past

performance is not indicative of future results.