At the start of last year, we released our outlook for 2016

and the picture was a bit pallid. In our blog post Four Red Flags to Watch for in 2016 we

wrote, “We believe there are several

indicators that are pointing to a tough and volatile year in 2016. High Yield

spreads, interest rates, corporate earnings trends and technical deterioration

are on our radar as hints that the market could be heading lower. Will this

lead us into a bear market next year? We don’t think that is likely unless the

US suffers a recession. While it doesn’t appear that we are heading for one, I

also recall at the start of 2000 and 2008 market experts didn’t expect a

recession or a bear market then either. I’m not looking to be right or wrong in

the call…just aware and prepared.”

This year we are thinking the opposite. We could very well

be in for a “blow-off top” that could propel the S&P 500 to $2600 to $2700

before entertaining the next bear market. A large part of our thinking

materializes from monetary and fiscal policy trends, global economic growth,

corporate earnings and technical analysis.

We believe that the US equity markets are chugging higher

more on investor sentiment than underlying fundamentals. Should we get

confirmation that expectations are becoming a reality then we could see the

next leg higher in the stock market. This will most likely happen as the

economy experiences a “sugar high” from continually accommodative monetary

policy and a burst of fiscal stimulus.

Fiscal Stimulus

The proposed infrastructure

spending plans by the Trump Administration may very well be a shot in the arm

for the US economy and set it on pace for more robust growth. According to a

recent spending priority list of Emergency & National Security Projects,

the plan is calling for an immediate $137.5 billion spending proposal that is

estimated to produce 193,350 direct job years and 241,700 indirect job years.

According to the McClatchy

DC web site, “The preliminary list,

provided to the National Governor’s Association by the Trump transition team,

offers a first glimpse at which projects around the country might get funding

if Trump follows through on his campaign promise to renew America’s crumbling

highways, airports, dams and bridges. The governor’s association shared that

list with state officials in December. The group told the officials the

projects on that list were “already being vetted.””

We are unsure if President Trump will meet his targeted 4%

GDP growth in the US if the rest of the global economy remains in its current

sluggish state, but certainly it is of our opinion that this type of spending

plan, if done correctly could boost our economy beyond the sluggish pace during

the previous administration. We reiterate that it needs to be done correctly as

it seemed President Obama’s fiscal stimulus into “shovel ready” projects never

really made it to the real economy but certainly boosted capital market

returns. This fiscal stimulus is expected to be different as can be seen in the

infrastructure trade in the stock market. Industrials, materials and those hard

economy cyclical sectors have rallied hard upon the Trump election. According

to recent reports, Democrats are preparing to release their own $1 trillion

infrastructure spending plan in the days to come. With bipartisan support of

fiscal spending (something the Republicans resisted during President Obama’s term)

there is a better than average chance that spending will increase. For fiscal

conservatives and limited government proponents, this is undoubtedly a hard

pill to swallow but should we see economic growth confirm expectations, that

would be a key driver of equities moving forward.

Other pro-growth policies such as tax cuts and deregulation

are also a tail wind for equity prices. According to JP Morgan (via Business

Insider), “Donald Trump’s

administration , backed by a Republican majority in both houses of Congress,

has unveiled a strongly pro-business, pro-growth agenda. While some

initiatives, such as cutting regulations and boosting infrastructure spending,

may take several years to impact the economy, the promise of tax reform has

already spurred a stock market surge.

Tax cuts for

businesses and households stand a strong chance of becoming law in early 2017,

as procedural rules make them far easier for Congress to pass than traditional

legislation. The GOP has largely coalesced around House Speaker Paul Ryan’s

“Better Way” plan, a comprehensive package of reforms designed to encourage

investment and promote growth.

The stock market

responded to the presidential election by climbing 7 percent in the fourth

quarter of 2016, creating almost $2 trillion in new wealth. This winter’s

anticipatory equities surge could be followed by a boost in GDP as the

implications of tax reform become clear. Nonpartisan tax economists estimate that

the planned stimulus could raise GDP by as much as 1 to 1.5 percentage points.”

Stronger Economic

Growth

We are seeing improvement in the US and global economic

picture. Sentiment aside, there are signs that the world is emerging from years

of lackluster economic growth. In the latest GDP report, the headline growth

figure of 1.9% 4Q16 was weaker than expected. That said, the New

Deal Democrat blog has brought to light several insights that point to

stronger growth ahead. They write, “This

morning's release of 4th Quarter 2016 GDP gives us our first look at several

long leading indicators for 2017: proprietors' income and real private

residential investment.

Let's turn first to

proprietors' income. One of the 4 long leading indicators identified by

Prof. Geoffrey Moore was corporate profits. The only problem with that

is, they aren't reported until the second estimate of GDP, which we will see next

month -- in other words, 2 to 5 months after the events have actually happened.

Proprietors' income almost but not quite always trends in the same

direction as corporate profits, and gets reported with the first estimate, so

it is more time.

In the 4th Quarter,

proprietor's income (blue), which unlike corporate profits (red), never turned

down in the last several years, continued to rise:”

“This tells us that

domestic US businesses with little exposure to foreign exchange issues continue

to improve their top lines. Now that the strong 2015 US$ has disspiated, he

likelihood is that corporate profits will follow. Needless to say, this

is a positive for the next 12 months.

Now let's turn to real

private residential investment. This is the long leading indicator

identified by Prof. Edward E. Leamer of UCLA in his presentation a decade

ago, "Housing IS the business cycle." The most accurate way to

measure this is as a share of overall GDP. This indicator typically turns

5 quarters before the economy as a whole turns. This morning it was also

reported to have increased:”

“Real private

residential investment declined in Q2 and Q3 from its Q1 peak, and whlle Q4

turned up, we still have not made a new high.

As of the end of 2016,

housing continued to give us a mixed picture. Both single family permits

and real residential construction, the two least noisy of all of the monthly

housing readings, have been rising:”

The Federal Reserve Bank of New York NowCast Report now

has 1Q17 GDP forecasts at 2.7% with the largest increases in growth coming from

the manufacturing sector.

The improvement in the manufacturing figures have been

astonishing. We blend several manufacturing reports into an aggregate reading. This

aggregate combines the various manufacturing surveys from all the regional

Federal Reserve banks into on easy to read model. Anything above zero

represents growth. The chart below shows the movement in our model over the

past several months.

On manufacturing, Scott Grannis of Calafia

Beach Pundit writes, “A

stronger-than-expected ISM manufacturing report helped get the stock market off

to a good start for the year.”

“As the chart above

shows, the ISM manufacturing index is pretty representative of strength in the

broader economy. Today's December ISM report is consistent with fourth quarter

GDP growth of 3-4%, and that is somewhat better than the market had been

expecting. The Atlanta Fed's GDPNow forecast for the fourth quarter had been

2.5%, and today it rose to 2.9%.”

“Export orders, shown

in the chart above, were usually strong in December, a good sign that overseas

economic activity is picking up. It's also encouraging that export orders have

strengthened even as the dollar has strengthened (normally a stronger dollar

would be expected to make life more difficult for U.S. exporters). This further

suggests that animal spirits are rising both here and abroad.”

“The chart above

provides confirmation of this, in that it shows that manufacturing conditions

in both the U.S. and the Eurozone have improved quite a bit in recent months. A

synchronized strengthening of economic conditions around the world is a very

welcome development.”

Industrial production and capacity utilization have improved

year-over-year.

According to the American Chemistry Council,

“American chemistry is essential to the

U.S. economy. Chemistry’s early position in the supply chain gives the American

Chemistry Council (ACC) the ability to identify emerging trends in the U.S.

economy and specific sectors outside of, but closely linked to, the business of

chemistry.

The Chemical Activity

Barometer (CAB), the ACC’s first-of-its kind, leading macroeconomic indicator

will highlight the peaks and troughs in the overall U.S. economy and illuminate

potential trends in market sectors outside of chemistry. The barometer is a

critical tool for evaluating the direction of the U.S. economy. The index

provides a longer lead (performs better) than the National Bureau of Economic

Research (NBER).”

“The Chemical Activity

Barometer (CAB), a leading economic indicator created by the American Chemistry

Council (ACC), started the year on a strong note, posting a monthly gain of 0.4

percent in January. This follows a 0.3 percent gain in December, November and

October. All data is measured on a three-month moving average (3MMA).

Accounting for adjustments, the CAB was up 4.6 percent over this time last year.

On an unadjusted basis the CAB climbed 0.3 percent in January, following a 0.5

percent gain in December.”

Retail sales year-over-year growth has broken its downward

trending pattern.

The Citigroup Economic Surprise Index has been trending up

with higher highs and higher lows.

The ratio of gold to lumber prices is also indicative of

stronger economic growth ahead and is a bullish sign for equities.

We are anticipating 3.1% to 3.3% US GDP growth this year. On

the global economic front, we anticipate Japan and Europe growing 1.5% to 1.7%

this year and China to post 6.0% to 6.5%. The business cycle is obviously

nearing its peak so we may see a pickup in productivity as capital investment

starts to pay off.

Normalized Monetary

Policy

As economic growth picks up and deflation themes erode, the

reflation trade and increase of inflationary pressures should prompt the Federal

Reserve to be more aggressive in their journey back to interest rate normalization.

Richard Bernstein from Richard

Bernstein Advisors writes, “However,

this past summer’s hackneyed theme of “lower for longer”, meaning that interest

rates would stay lower for longer than investors might expect, might prove to

be the swan song for the deflation investment theme. Secular global stagnation

and deflation probably ended last February, and our portfolios have been

positioned for improving nominal growth for much of 2016.”

As Trumponomics and additional global stimulus is enacted

this year, inflationary pressures will return after years of subdued readings. Bernstein

writes, “inflation expectations, measured

using the Fed’s supposed favorite measure of inflation expectations, actually

troughed last February. The upcoming administration has so far argued for the

largest Keynesian stimulus package since the Depression, and thus the upward

move in expectations for inflation and nominal growth has accelerated. The new

administration’s economic package might not match that promised during the

campaign, but it seems reasonable to assume that there will be more fiscal

stimulus rather than less, and that the positives of fiscal stimulus will be

greater than the potential negatives from the normalization of monetary policy

and rising interest rates.”

“The global economy

might still be in secular stagnation (although we are increasingly doubtful),

but cyclical acceleration is clearly underway. Leading economic indicators

(LEIs) around the world are strengthening in a unified manner that hasn’t

existed since the credit bubble.

Chart 6 shows the

relationship between the current global LEIs to those of three months ago. If a

country lies above the diagonal line in the chart, then the rate of change in

that country’s LEI is stronger than it was three months ago. If a country is

below the line, then the rate of change is deteriorating. Most LEIs are

improving in unison, which indicates broad improvement in the global economy

and an increasing chance of rising interest rates over the next year or so.”

“The slope of the

yield curve is one of the most reliable indicators of future nominal growth.

Steeper curves forecast faster nominal growth, flatter yield curves forecast

slower growth, and inverted yield curves forecast recession.

Global yield curves

are steepening, which supports the forecasts

of global leading indicators. Chart 7 shows the percentage of

global yield curves that are inverted

(i.e., forecasting a recession). In 2008, 41% of global yield curves were

inverted. Currently, it is only 2%. The

US yield curve, for example, has been steepening for 5 months.”

Scott Grannis of Calafia

Beach Pundit writes, “The December

CPI reading showed prices up 2.1% over the past year—the highest reading since

oil prices started to plunge beginning in mid-2014.”

“What happened with

oil and the CPI in the past few years was remarkably similar to what happened

in the mid- to late 1980s, when oil prices also collapsed and headline

inflation followed suit. Once oil prices stopped declining, as they eventually

did both times, then headline inflation jumped back up to where it was before

the oil price shock, as the chart above shows. To the extent that the world has

been worried about inflation being "too low" in recent years, it was

a mistake. Inflation has been alive and well all along.”

“The chart above is

remarkable, because it shows that there has been a very close relationship

between nominal GDP and the M2 measure of money supply for many decades. This

is why economists tend to prefer M2 above other measures of inflation: it's

demonstrated a fairly predictable relationship to nominal GDP over long

periods. But what is also apparent in the chart is the divergences of these two

dissimilar variables over the past few decades. M2 "undershot"

nominal GDP in the 1990s, and it "overshot" nominal GDP in the 2010s.

Currently it looks like there is about $2 trillion of "extra" money

sloshing around the U.S. economy. This is money that has for the most part been

stockpiled in bank savings deposits which pay very little interest and which

have more than doubled in the past 8 years (to almost $9 trillion currently).”

“As the chart above

shows, M2 is now about 70% of nominal GDP, whereas for over three decades it

tended to average about 57% of nominal GDP. The pronounced rise in the ratio of

M2 to GDP is symptomatic of a general increase in the world's demand for dollar

cash and cash equivalents. (M2 is comprised of currency, retail checking

accounts, time deposits, retail money market funds, and bank savings deposits.)

Not coincidentally, the dramatic rise in the demand for money has coincided

with a pronounced increase in risk aversion, as I've been noting repeatedly

over the years. But as I noted last week, small business optimism has improved

rather dramatically of late, and consumer confidence is on the rise as well.

And of course the stock market has hit new highs.

Optimism is making a

comeback, and that in turn suggests that the world's demand for money is not

going to continue to rise, and is more likely to begin to fall. If the demand

for money does begin to fall, then the rate of M2 growth is likely to slow

and/or the rate of nominal GDP growth is likely to pick up. Faster nominal GDP

growth would likely include some pickup in both real growth and inflation. With

inflation already running at 2% or so, any inflation pickup could—over the next

year or so—begin to flash warnings signs that the Fed is falling behind the

inflation curve.”

If the inflation picture and economic growth trajectory keep

pace or accelerate from the current levels, the Fed may be forced to increase

the pace of normalization. It will be

very interesting to see how the Bank of Japan and the European Central Bank

respond to these events. Both are in the throes of quantitative easing measures

and changing data points on a global scale may alter their current policies. In

our opinion this would impact foreign equity markets and put further pressure

on fixed income.

US Dollar

The US dollar broke to the upside upon the election of

Donald Trump. It has since pulled back. On the weekly chart, it appears 100 is

the support. That said, the MACD and several oscillators are heading lower. A

break below 100 could mean an extended downward path for the greenback.

On the monthly US dollar chart, we are seeing bearish

divergences everywhere. This could also spell a prolonged downturn for the US

dollar. Support would most likely be in the 92 range.

With US economic growth expected to outpace the global

average and the Fed embarking on a monetary tightening policy, it wouldn’t make

sense that the dollar is looking weaker. That said, if the global outlook

improves and inflationary pressures arise, many other central banks will need

to move much quicker than the Federal Reserve in that they never stopped their

monetary easing campaign while the Fed started their tightening policy. If the

Fed turns out to be ahead of the curve and many of their global counterparts

are forced into a rapid policy shift, that could have negative implications for

the US Dollar that has, in our opinion already priced global monetary dynamics.

President Trump has been speaking openly about the strength

of the dollar and has broken protocol of past administrations that were

supportive of a stronger dollar. According to CNBC,

“President-elect Donald Trump's shock

comment that the dollar is too strong suggests the U.S. is about to declare as

dead a two-decade policy of publicly favoring a strong currency.

"There's no

question that the Trump administration would not want a strong dollar. A strong

dollar does nothing good for whatever Trump is basically trying to do,"

said David Woo, Bank of America Merrill Lynch's head of global rates and

foreign exchange research. "Yes, the U.S. fundamental story is bullish for

the U.S. dollar, but the problem here is they actually don't want a strong

dollar. I think it's going to go up. However, it's going to be a much more

volatile climb."

Trump's remarks also

took a shot at one of the most crowded trades on the planet — long wagers on

the dollar. That trade has been a bet that Trump's policies will reflate the

economy, causing interest rates and the greenback to rise. But that dollar move

is at odds with building a more powerful American manufacturing base, because a

strong dollar makes exports more expensive for foreign buyers.”

We would not be going short the US Dollar, even though it’s

a fairly crowded long trade right now. But we do consider the weakening dollar

as a possibility and that would have a profound impact on corporate earnings.

Earnings Picture

The corporate earnings picture has improved greatly from

this time last year. As the next chart shows, the twelve-month forward earnings

per share projections for the S&P 500 have started to head higher after a

brief earnings recession last year.

The one month slope of earnings, a statistic we watch

closely for earlier indications of a market correction – bear market has

improved from last year as well and is solidly sloping positive.

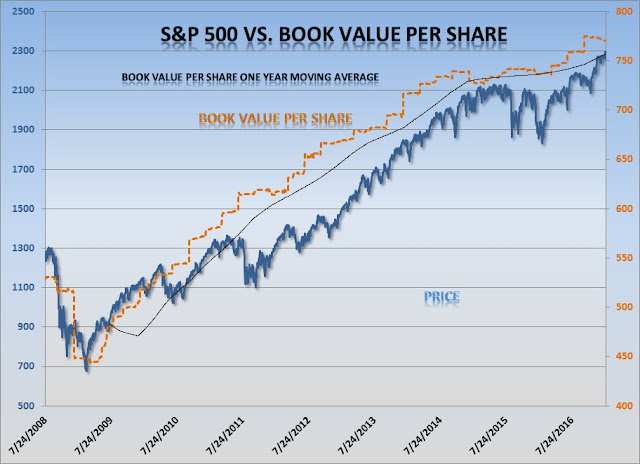

Book value per share for the S&P 500 is heading higher

although cash flow per share seems to have leveled off. This could be an early

indication of earnings quality deterioration and we will monitor is closely.

With improving prospects of domestic economic growth, a stabilizing

global economy and a weaker US Dollar, the corporate profit picture has room to

run. Aggregate profit margins are off their peak from a few years ago, so

margin expansion that originates from new sales as opposed to financial

engineering is a very bullish sign for the stock market.

Market Technicals

On the long-term S&P 500 technical reading, it appears

we are out of the woods from the negative readings received last year. On the

monthly chart, we take a short bias in the market when the following steps

occur. First, we need to see a MACD bearish cross. Once that occurs we wait for

the index price to fall below its 20-month moving average and RSI to fall below

50. If the 20-month moving average slopes negative and the index retests and

fails, then we position ourselves for the bear market. The chart below shows

our warning signs (orange shaded area) and our bearish confirmation (red shaded

area). Once the MACD crosses bullish, we remove the short bias.

At the start of last year, we were receiving several signals

as a warning but never got the confirmation. The warning period (red box)

turned out to be a consolidation period only.

Now all the signals are telling us to remain long the

market.

Bottom Line: We

understand that the market is not cheap at these levels and stock appreciation

is being driven more by sentiment than by underlying fundamentals at this

point. We do not want to fight the current trend. There are conditions that

exist that we believe could drive the market 10% to 20% higher.

Fiscal Policy –

Proposed infrastructure spending by the Trump Administration, if deployed

correctly can provide a boost to economic growth and equity prices.

Economic Growth – We are

seeing signs of life from the manufacturing sector that seems to have been so

dormant for the longest time.

Monetary Policy – Any

tightening from this already accommodative policy will more than be offset by

introduced fiscal easing.

US Dollar and Profits

- A weakening US Dollar and an accelerating corporate profit picture will be

good for the stock market in our opinion.

Market Technicals –

We believe the longer-term S&P 500 chart has given us the confirmation (at

least temporarily) to be long the market.

Joseph S. Kalinowski,

CFA

Email: joe@squaredconcept.net

Twitter: @jskalinowski

Facebook: https://www.facebook.com/JoeKalinowskiCFA/Blog: http://squaredconcept.blogspot.com/

No part of this report may be reproduced in any manner

without the expressed written permission of Squared Concept Asset Management,

LLC. Any information presented in this report is for informational

purposes only. All opinions expressed in this report are subject to

change without notice. Squared Concept Asset Management, LLC is a

Registered Investment Advisory and consulting company. These entities may have

had in the past or may have in the present or future long or short positions,

or own options on the companies discussed. In some cases, these positions

may have been established prior to the writing of the report.

The above information should not be construed as a

solicitation to buy or sell the securities discussed herein. The

publisher of this report cannot verify the accuracy of this information.

The owners of Squared Concept Asset Management, LLC and its affiliated

companies may also be conducting trades based on the firm’s research

ideas. They also may hold positions contrary to the ideas presented in

the research as market conditions may warrant. This analysis should not be considered investment advice and may not be suitable for the readers’ portfolio. This analysis has been written without consideration to the readers’ risk and return profile nor has the readers’ liquidity needs, time horizon, tax circumstances or unique preferences been considered. Any purchase or sale activity in any securities or other instrument should be based upon the readers’ own analysis and conclusions. Past performance is not indicative of future results.