John P. Hussman

4/17/17 - The Value

of Dry Powder

“The chart below shows

the most reliable market valuation measure we identify, nonfinancial market

capitalization to corporate gross value added, on an inverted log scale (blue

line, left scale), along with the actual 12-year nominal annual total return

for the S&P 500 Index (red line, right scale). As we observed during the

severe market retreats that followed the tech bubble and the mortgage bubble,

substantially higher expected returns are likely to emerge over the completion

of this market cycle, as a result of interim losses in the next few years. Dry

powder has considerable value here, not because of the return it currently

generates, but because of the opportunity it may afford to establish

constructive and even aggressive market exposure over the completion of this cycle,

at higher prospective returns than are currently available. For that reason,

whether investors choose hedged alternatives or cash, I strongly encourage

investors to maintain a regular, disciplined saving plan.”

Business Insider

4/18/17 - Banks are

suddenly scaling back lending, and Wall Street isn't sure what to make of it.

“Bank lending to

consumers and businesses is slowing down.

As of last week,

commercial and industrial lending had not increased since September 7, the

first six-month period of declines since the aftermath of the financial crisis,

Bank of America Merrill Lynch said.

Consumer-loan growth

has also slowed, up by 1.4% since the November election versus 3.1% during the

same period a year earlier.

Depending on who is

asked, this slowdown is either an expected response to some preceding

indicators or another reason to be worried about the economy.”

“The slowdown seemed

to be a bit of a puzzle at the outset. One explanation, for businesses at

least, was that they were awaiting the outcome of the election, and then of

policies like tax reform and immigration, before deciding to borrow for big

investments.

But that argument doesn't

necessarily hold up for consumers, whose spending decisions are less reliant on

Capitol Hill.”

“But from a

business-lending perspective, the slowdown is a bit of a lagging indicator,

considering the big drawdown in inventories last year, he said. Inventories, a

major part of gross domestic product, slowed economic growth during much of

2015 and 2016.

Additionally, the

first quarter was solid for bond issuance, suggesting that companies are

relying less on bank credit, Baird said. High-grade companies issued a record

$414.5 billion of debt in the first quarter, according to Dow Jones.

And from the supply

side — why banks aren't lending as much — David Schawel, a fixed-income

portfolio manager at New River Investments, argues that banks don't stand to miss

out as much by not earning interest on lending.”

Mohamed A. El-Erian: Bloomberg

View 4/19/17 - High

Stock Prices and Low Bond Yields Can't Last

“Unless you believe

the Federal Reserve will ease monetary policy, which I don't, it is getting

harder to reconcile what are still historically low bond yields and relatively

high stock prices. More consistent and sustainable levels probably lie

somewhere in the middle. Exactly where, as well as when and how we would get

there, depends primarily on the balance between geopolitical and

economic-policy influences.

Stock markets

repeatedly have proven extremely resilient in shrugging off both political and

geopolitical worries. In doing so, they have relied on deeply anchored market

beliefs regarding stable growth, supportive central banks and further

liquidity injections. As a result, they view the prospects for stronger

corporate earnings and economic growth as compensations for geopolitical

fluidity.”

“The same isn't true

of government bond markets. There, yields on 10-year Treasuries have languished

recently below the 2.30–2.60 percent range that was established after the

November presidential elections, as geopolitical worries have been compounded

by concerns about both low inflation and subdued growth.

This is not the first

time that government bonds and stocks have sent conflicting signals, and it

won't be the last. Moreover, this inconsistency coexists with several others,

including the divergence between emboldened measures of business/consumer

confidence and hard data that remains sluggish.

Also, let us not

forget the asymmetrical upside/downside prospects. Simply put, at current

levels, stocks heavily dominate bonds when it comes to most current assessments

of the upside return potential segment.

Yet this particular

market inconsistency has persisted for some time, and it has outlasted many

explanations, including those emphasizing the technical positioning of markets.

Indeed, the only proper way to reconcile the two competing market signals at

this stage is through a forecast of renewed monetary policy easing on the part

of the Federal Reserve.

Absent a major economic

downturn that would also rout stock markets, such easing is highly unlikely.

Indeed, while the balance of risk may be shifting, the baseline still favors

two additional interest rate hikes this year, together with an action plan for

balance-sheet normalization.

The more likely

outcome is a reconciliation of market signals with government bond yields

moving up and stock prices down. When this happens, where the two settle, and

the orderliness of the process will be mainly a function of two influences: the

extent to which geopolitics has an adverse effect on the outlook for growth,

and the extent to which U.S. policy reforms improve the prospects for actual

and potential growth. In the meantime, investors should be increasingly wary

about betting on durable market inconsistencies.”

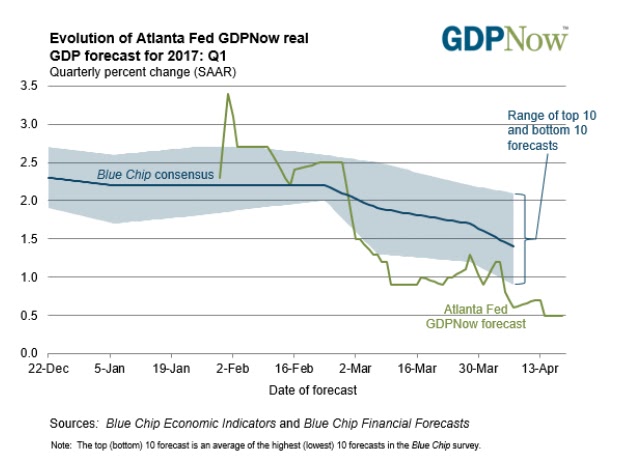

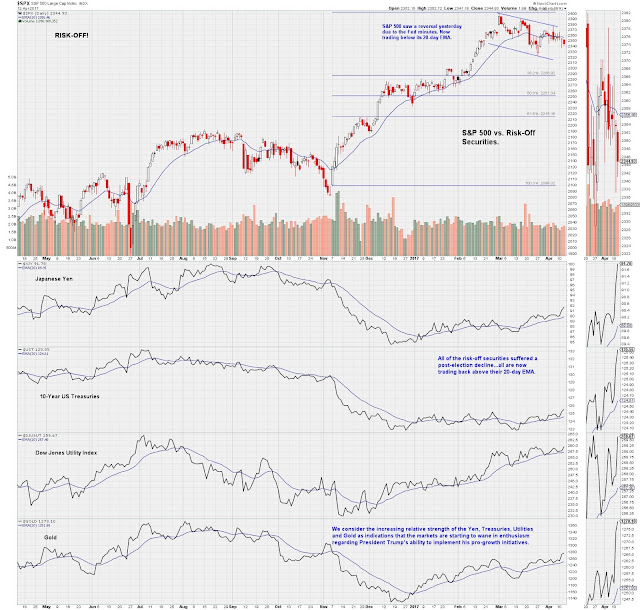

CNBC 4/19/17 - Santoli:

Stocks have been in a 'quiet correction' for months

“Yet by last week,

nearly half of all stocks in the broad S&P 1500 were down at least 10

percent from their 52-week high, the popular bank sector remains down that much

and economically attuned groups such as transportation and steel have lagged

badly.

Since around the time

of the market high, the 10-year Treasury yield has ebbed to 2.2 percent from

2.6 percent, the CBOE S&P 500 Volatility Index (VIX) has climbed into the

mid-teens from around 11 and the Atlanta Fed's GDPNow forecast model for

first-quarter growth has tumbled to 0.5 percent from 2.5 percent. Investor

attitudes have also run from excessive bullishness to a warier outlook, with

weekly investment-advisor polls, the CNNMoney Fear & Greed Index and the

Bank of America Merrill Lynch Global Fund Manager Survey suggesting that the

so-called wall of worry is gradually being rebuilt.

This subtle but

noteworthy change in market character means we're again at a point where market

handicappers are asking whether the market's internal weakness has been

dramatic enough, with enough "oversold" conditions popping up, to set

up a strong rebound. So far, according to close students of tactical market

clues, the answer is "Close, but not quite."

Katie Stockton,

technical strategist at BTIG, says last Thursday's high-volume sell-off sent

some of her preferred indicators to extreme readings that often set up a good

rebound. Yet, she concludes that "down-volume was strong enough to suggest

the pullback still has a hold on the market." Confident that the

longer-term market uptrend remains intact, she says, "We remain on the

lookout for a buying opportunity, which appears more likely after a shakeout in

high-beta areas of the market."

Similarly, BAML's Stephen

Suttmeier sees this little downside reset in the market as incomplete. One

notable shift is the arrangement of the short-term and longer-term VIX futures

prices, with immediate volatility expectations appearing puffed-up relative to

more distant ones. Without getting into the statistical weeds, it's another

"oversold" condition, one that says traders are paying up

aggressively for a possible sudden spike in market risk, despite the

still-placid behavior of the indexes themselves.

While this is a start,

Suttmeier argues that broader measures of downside hedging with options

"are nowhere near the oversold levels that have coincided with important

S&P 500 lows." He figures the index has another 2 to 4 percent of risk

to the downside in the fairly near future based on the weight of the evidence.

The quirk this time is

that when the VIX makes a five-month high (as it did in recent days), the

S&P 500 is usually down a whole lot more than 2 or 3 percent from an

all-time high. Does this mean traders are overreacting to modest weakness, or

are the options guys foretelling a stormier period ahead? Worth watching is the

corporate-credit market: It remains firm, but risk spreads have modestly

widened in recent weeks, slightly weakening one of the stock market's key

sources of strength in the past year.

Even the strongest

years tend to have one or more declines of more than 5 percent from a high, so

this would be consistent with the rhythm of an ongoing market advance – one

that is strongly suggested, based on historical patterns, by the impressive

start to the year. If the late-March lows were as deep as this quiet correction

gets, it might be comforting, but it also likely means the market won't have

built up sufficient fear or reloaded with enough fresh buying power to vault

the market too quickly on a powerful new leg higher. This is often the

trade-off traders face – muted volatility can contain the market in both

directions for long stretches of time.”

OilPrice.com (via The

Fiscal Times) 4/20/17 - Why

the Oil Markets Are Headed for a ‘Decade of Disorder’.

“But investment fell by over $300 billion in the two-year

period of 2015 and 2016 – “an unprecedented occurrence,” the IEA noted in a

2016 report on energy investment. 2017 could show marginal increases in

spending, but the industry is not returning anywhere close to the pre-2014

levels of investment.

That could set the world up for a supply shortfall by the

end of the decade when large deepwater projects that were not given the

greenlight over the past three years would have started to materialize. The

lack of new production will mean that suppliers struggle to keep up with

demand.

Michael Cohen, head of energy markets research at Barclays,

told the Platts Capitol Crude podcast that a supply shortfall could hit as soon

as the 2020-2022 period, assuming annual oil demand growth of 0.8 to 1 mb/d,

which is lower than the 1.3 mb/d of demand growth the IEA expects for this

year. Of course, if demand grows each year at a more than 1 mb/d rate – not an

unreasonable scenario – the supply shortage would be even more acute. “The

question is whether the market will see that eventuality and try to price it in

beforehand,” Cohen said on the Platts podcast. “It is our view that prices need

to rise” in order to incentivize new supply coming online to cover that

eventual gap, he added.

Bloomberg 4/20/17 - The

Real World of Oil Has a Warning for Financial Markets

“The Brent physical

oil market is flashing signs of weakness again as dwindling Asian

purchases, an influx of American crude to Europe, and supplies flowing out of

storage all combine to recreate a glut in the North Sea.

The weakness comes at

a time when speculators have started rebuilding bullish positions after a

sell-off last month, betting the market will tighten in the second quarter.

Yet, Brent physical oil traders say the opposite is happening so far, according

to interviews with executives at several trading houses, who asked not to be

identified discussing internal views.

“We need to see the

market going really into deficit for oil prices to rise,” Giovanni Staunovo,

commodity analyst at UBS Group AG in Zurich, said. “If this is temporary, it

could be weathered, but it needs to be monitored.”

The weakness is

particularly visible in so-called time-spreads -- the price difference between

contracts for delivery at different periods. Reflecting a growing surplus that

could force traders to seek tankers as temporary floating storage facilities,

the Brent June-July spread this week fell to an unusually weak minus 55 cents

per barrel, down from parity just two months earlier. The negative structure is

known in the industry as contango.”

“In the world of

contracts for difference, which allow traders to insure price exposure for

their North Sea crude shipments week-by-week, the one-week CFD spread plunged

this week to minus $1.84 a barrel, the weakest since late November and just

before the Organization of Petroleum Exporting countries and allied nations

announced their first joint effort to manage supply in over a decade. A month

ago, the comparable CFD traded at just minus 50 cents barrel.

"It will not take

much before we see headlines about floating storage starting to increase

again," said Olivier Jakob, head of oil consultant PetroMatrix GmbH, in

Zug, Switzerland.”

“The differentials

between physical grades and benchmarks have also weakened in recent weeks.

Glencore Plc, the world’s largest commodities trader, on Thursday bought from

French oil giant Total SA a cargo of Brent crude at $1 a barrel below the main

North Sea benchmark, the widest discount in 22 months, according to a trader

monitoring deals.

Oil traders said OPEC

was initially successful, driving oil prices higher and tightening

time-spreads. But the group was a victim of its own success, as those same

spreads forced crude out of storage, flooding an already weaker physical market

with supply. Higher headline prices also boosted U.S. shale producers.”

“Through April 13,

only 30 percent of the 148 subindustries in the S&P Composite 1500 stock

index were trading above their 10-week, or 50-day, moving averages, noted Sam

Stovall, chief investment strategist at CFRA Market Advisor. “While this is

certainly an indication of recent weakness, it may also be viewed as a source

of near-term optimism, since it implies that the market may be oversold,”

argued Stovall.

He also noted that in

any given week since Dec. 31, 1995, 60 percent of the subindustries in the

S&P 1500 traded above their 10-week moving average. And whenever S&P

1500 had 30 percent or fewer of its subindustries trading above their 10-week

averages, the S&P 1500 outpaced its average for all periods over the coming

three, six, and nine weeks. “Indeed, the S&P 1500 rose in price 1.5

percent, 2.7 percent and 3.5 percent during the subsequent three, six and nine

weeks after touching 30 percent or lower,” Stovall pointed out.

And if you’re worried

that the market may weaken further, you have more gains to look forward to, he

added. That’s because whenever the percentage declined to 25 percent or less,

the S&P 1500 improved during the following three, six and nine weeks,

rising 1.7 percent, 3.2 percent and 4 percent, respectively, and posting higher

frequencies of advance during all periods.”

Joseph S. Kalinowski, CFA

Email: joe@squaredconcept.net

Twitter: @jskalinowski

Facebook: https://www.facebook.com/JoeKalinowskiCFA/

Blog: http://squaredconcept.blogspot.com/

Tumblr: trader-rants

No part of this report may be reproduced in any manner

without the expressed written permission of Squared Concept Asset Management,

LLC. Any information presented in this report is for informational

purposes only. All opinions expressed in this report are subject to

change without notice. Squared Concept Asset Management, LLC is a Registered

Investment Advisory and consulting company. These entities may have had in the

past or may have in the present or future long or short positions, or own

options on the companies discussed. In some cases, these positions may

have been established prior to the writing of the report.

The above information should not be construed as a

solicitation to buy or sell the securities discussed herein. The

publisher of this report cannot verify the accuracy of this information.

The owners of Squared Concept Asset Management, LLC and its affiliated

companies may also be conducting trades based on the firm’s research

ideas. They also may hold positions contrary to the ideas presented in

the research as market conditions may warrant.

This analysis should not be considered investment advice and

may not be suitable for the readers’ portfolio. This analysis has been written

without consideration to the readers’ risk and return profile nor has the

readers’ liquidity needs, time horizon, tax circumstances or unique preferences

been considered. Any purchase or sale activity in any securities or other

instrument should be based upon the readers’ own analysis and conclusions. Past

performance is not indicative of future results.