October was a very challenging month and our synopsis for

market strength through the tail end of October was wrong (see Positioning

for 4Q16). Many of our holding showed strong earnings reports and bright

guidance but sold off aggressively nevertheless. We were forced to take stop

losses and lost value in the portfolio last month.

We expect to see market strength in the near-term, perhaps

getting through the election will be the catalysts. In hindsight waiting until

after the election would’ve been a better time to position ourselves. A few

items that warrant attention and confirm the possibility of a near-term rally

(or at the very least bounce) are the VIX, the put/call ratio, transports and

the extended losing streak.

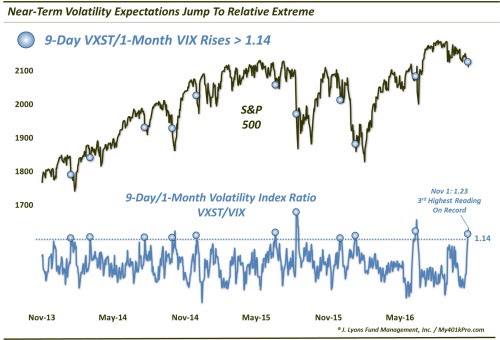

The VIX

The VIX is approaching levels of extreme market angst that

has been typically associated with a market bottom in the near-term. On the

chart below the future and spot pricing has been thrown into an inverted

reading (above one) that signals the market selling should be abating. The five-day

rate of change in the VIX is 39%. We typically like to see a +50% move in the

VIX over five days to confirm a wash-out of aggressive selling. Perhaps one

more day of extreme selling (post-election) would bring us to a level when we

step in aggressively.

On Dana

Lyons’ Tumblr, “Let’s look at the

most popular stock market barometer, the S&P 500. While the large-cap index

did close at a 3-month low today, it is only a mere 3.6% off of its all-time

high. And yet, if we look at the relative near-term volatility expectations of

the index – by comparing the 9-day VXST to the 1-month VIX – it is actually at

its 3rd highest reading since its inception in 2013. Why is that? We’re

guessing it is event risk – in the form of election-related headlines in

addition to the election itself.”

“Specifically, we

looked at all unique spikes above 1.14 in the VXST/VIX ratio. Since the

inception of the VXST in 2013, there had been 10 prior such spikes before the

current move. Here are the dates:

1/24/2014

3/14/2014

7/31/2014

10/9/2014

12/10/2014

6/29/2015

8/21/2015

12/11/2015

1/19/2016

6/20/2016

In most cases, the

extreme jump in relative short-term volatility expectations presaged more

selling pressure in the short-term. 8 of the 10 occurrences saw the S&P 500

lower at some point within the first week, with a median drawdown around -2% at

some point within that first week. That’s 4 times the normal median weekly

drawdown. That’s the (surprising) good news for bears.

The bad news for the

bears is that the jump in short-term volatility expectations would not continue

to pay off for long. In fact, after the rough first week, in a staggering

turnaround, 9 of the 10 precedents would close higher by the end of week 2 – at

a median return of +1.2%. Here are the aggregate numbers.”

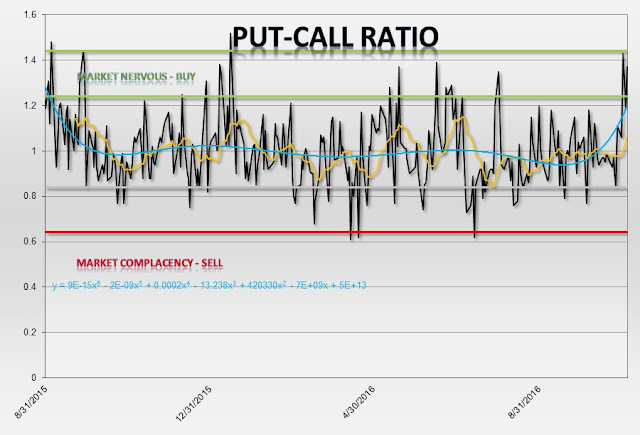

Put/Call

The put/call ratio is also showing extreme caution in the

market with a reading of 1.37, well above the 1.25 reading we like to see

before stepping back into the market. In fact, this past week the Put/call

ratio hit 1.43 which is a full three standard deviations from its mean. This

has occurred 34 times since 2000. The market went higher in the next month 62%

of the time with an average return of 1.1% which is much higher than the average

one month return for the market of 0.3%. In the following three months after

these occurrences the market was higher 80% of the time with an average return

of 3.7% which is higher than the three-month average market return of 0.9%.

Assuming we are not headed for a recession and excluding the readings from the

2000 and 2008 periods the results are much stronger. This could be signaling a

bounce in the market over the next several months.

Similar analysis was done on Dana

Lyons’ Tumblr. He notes, “One nice

way of viewing the overall options sentiment picture is to divide the CBOE

Equity Put/Call Ratio by the ISEE Call/Put Ratio. Since a high CBOE ratio

is indicative of fear as is a low ISEE figure, the higher the CBOE/ISEE number

is, the more fear that is present, in the way of relative put activity.

Historically, we have

found the nice, round number of “1.00″ to be indicative of an extreme level

of puts relative to calls. That is, when the CBOE Equity Put/Call Ratio is

higher than the ISEE Call/Put Ratio. Since the inception of the ISE in 2006,

there have been 28 days registering a reading of 1 or higher, with yesterday

being the latest occurrence.”

“So what are the

implications of this elevated level of hedging on the 2 exchanges? Is it

necessarily a buy signal based on the contrarian concept? For the most part,

yes. However, like Tuesday’s post on the ramp in volatility expectations, the

contrarian behavior doesn’t always kick in immediately. It’s certainly not

uncommon for selling pressure to continue in the days following readings of 1

or higher. However, after a week, most occurrences have led to consistently

positive and above-average returns.”

Transports

We also like to see the market weakness unconfirmed from the

transportation sector. In the chart below we are finding a divergence between

the performance of the transportation sector (IYT) and the S&P 500 (SPY).

This “non-confirmation between the two

indexes usually reflected a degree of uncertainty that typically precedes a

change or a pause in trend, if not a reversal, in the market and in the

economy, implications that are as pertinent today as in Dow's day.” (AAII Journal).

From See

It Market, “Aaron Jackson

(@ATMcharts) continues to contribute some great charts to our stream. He

points out that the Transports (NYSEARCA:IYT) are showing relative strength.

If Transports can hold there own, perhaps the selloff is nearing an end…

or close to it.”

Extended Losing

Streak

We have now had nine straight days of losses in the S&P

500. This is a very long time. According to Jeff Hirsch with Almanac Trader, “Since 1950, there have only been 22 other S&P 500 daily losing

streaks of eight or more days. 11 of 22 went onto last 9 or more days. The

worst by performance occurred early in October 2008 when S&P 500 plunged

22.9% in eight trading days. The longest losing streak was in April and May

1966 at twelve days. Once the streak ended, S&P 500 generally enjoyed a

nice bounce and reversal of trend. This bounce and reversal can be seen in the {following} chart of S&P 500 30 trading days before

and 60 trading days after a losing streak of eight or more consecutive trading

days.”

“In the following

table, S&P 500 performance 1-, 3-, 6- and 12-months after an eight straight

day losing streak appears. 1-month later is somewhat mixed however, the average

gain is 1.81%. 3-months after is stronger with S&P 500 up 68.2% of the time

averaging 4.5%. 6-months and 1-year later S&P 500 further improved.”

Technical Picture

We are resting on the 200-day moving average for the S&P

500. All the daily oscillators are reading oversold and the MACD appear to be

heading lower indicating increasing negative momentum. If the 200-day moving

average won’t hold then we’ll most likely test the 2050 area which is the 38.2%

retracement from the February lows. The Nasdaq is also quickly approaching the

key 5000 support level while the Russell 2000 is approaching 1150. All the

oscillators and MACD paint a similar picture. If these levels hold as the

election cloud is lifted, this could be the case to start to buy stocks

aggressively in anticipation of a year-end rally. This will be a key week for

the markets. Should we see renewed interest in owning stocks with higher volume

and improvement in the MACD momentum picture we will make the appropriate

trades.

Longer-term Picture

As per Dana

Lyons’ Tumblr, “Coming into the week,

it didn’t immediately occur to us that we were on the verge of such an

important juncture across asset classes. However, the fact that our Trendline

Wednesday feature on Twitter and StockTwits included an unprecedentedly large

number of assets and indices suggests that we are indeed at a significant

juncture.

One such index

pertaining to the equity market that we did not cover on Wednesday is the Value

Line Arithmetic Index (VLA). It measures the “average performance” among a

universe of roughly 1800 stocks. Because of its construction, it is an

important barometer of the health of the overall market. The VLA’s present

relevance here is due to the fact that it is testing its Up trendline stemming

from the lows in 2009, currently around 4700.”

“Now, if the trendline

is broken, it doesn’t mean that the market has to necessarily tank. For one, it

could come back and regain the trendline like it did in March – although, that

feat isn’t likely to get repeated too many times. Furthermore, even if the VLA

breaks the line, it may merely enter a sideways pattern rather than a

significant correction. It is even possible that the index resumes its uptrend,

albeit at a shallower trajectory. Still, those would be less desirable outcomes

than having the VLA successfully hold the trendline.

Will it hold? We don’t

have a crystal ball. With our proprietary risk indicators still firmly pointed

lower, and coming off of elevated levels, there is a case to be made for lower

prices. Then again, as we discussed on Tuesday and Thursday, the short-term

sentiment picture has shifted completely and could easily support a bounce.

So this one could go

either way. And considering the importance of this index, it pays to keep close

attention on the 4700 level in the VLA.”

Lance

Roberts at Real Investment Advice went on to point out, “Importantly, as I addressed in the latest newsletter, the violation

of that crucial support suggests a further correction is likely. However, by the

time a break is completed, the market has already become short-term oversold

and a “sellable bounce” is very likely. As Bloomberg noted:

“The index’s

longest-ever run of losses was eight days, matched at the height of

the financial crisis in October 2008. The S&P 500 started falling on

Monday, September 29 and saw lower closes at the end of every trading day until

October 10, in what was its worst week in history.”

But a bounce and a

resumption of a bull-market are two different things. As was seen in both 2008

and 2011, the consecutive 7-day declines led to further selling before a bottom

was eventually found.”

“Given that we are

very oversold short-term, a bounce back towards previous support levels (now

resistance) is likely and will provide a better opportunity to rebalance equity

risk in portfolios. A failure to break back above 2125 very soon will

likely lead to further losses before the next buying opportunity is found.

Caution is advised.”

From Kimble

Charting, “Below looks at the

Valu-Line Geometric Index, on a “monthly basis,” over the past 28-years. The

Value Line Geometric Composite Index is the original index released, and

launched on June 30, 1961. It is an equally weighted index using a geometric

average. Because it is based on a geometric average the daily change is closest

to the median stock price change.”

“The index created a

“Monthly reversal” pattern at (1) and sellers stepped forward.

The index rallied in

2007, coming up just short of 2000 levels, where selling pressure came forward

at (2).

The index rallied back

to 2000 and 2007 highs last year, where it created back to back monthly

reversal patterns at (3). Since creating those monthly reversal patterns, the

index has created a series of lower highs, just along line (4).

This index remains

inside of a 6-year rising bullish channel, despite the weakness over the past

18-months. If the index would break below this 6-year rising channel, suspect

selling pressure would take place.”

Indeed, we have been watching the long-term chart for the

SPX all year. The MACD line passed through the signal line in a bearish way

last year and has recently turned lower. The RSI (14) dipped briefly below 50

earlier this year but has retaken the level. We will be watching for a break

below to confirm a longer-term down trend. The index also breached the 20-month

moving average earlier this year. It has since regained the moving average.

We have long stated the market will need to exhibit a

long-term bearish cross, a break below the RSI (14) 50 level and a downside

breach & a failed resistance retest for us to take a long-term bearish

outlook on this chart. We will see how the remainder of the year plays out.

Bottom Line: We are

waiting until after the election to reposition ourselves should the market

catch a bid. There are a few near-term momentum items that give us a clue as to

near-term market direction and we are prepared to capitalize on this

opportunity. Should the market fail to find strength at these levels we will

keep hedges in place and raise additional cash.

Joseph S. Kalinowski, CFA

Email: joe@squaredconcept.net

Twitter: @jskalinowski

Facebook: https://www.facebook.com/JoeKalinowskiCFA/

Blog: http://squaredconcept.blogspot.com/

Web Site: http://www.squaredconcept.net/

No part of this report may be reproduced in any manner

without the expressed written permission of Squared Concept Asset Management,

LLC. Any information presented in this report is for informational

purposes only. All opinions expressed in this report are subject to

change without notice. Squared Concept Asset Management, LLC is a

Registered Investment Advisory and consulting company. These entities may have

had in the past or may have in the present or future long or short positions,

or own options on the companies discussed. In some cases, these positions

may have been established prior to the writing of the particular report.

The above information should not be construed as a

solicitation to buy or sell the securities discussed herein. The publisher

of this report cannot verify the accuracy of this information. The owners

of Squared Concept Asset Management, LLC and its affiliated companies may also

be conducting trades based on the firm’s research ideas. They also may

hold positions contrary to the ideas presented in the research as market

conditions may warrant.

This analysis should not be considered investment advice and

may not be suitable for the readers’ portfolio. This analysis has been written

without consideration to the readers’ risk and return profile nor has the

readers’ liquidity needs, time horizon, tax circumstances or unique preferences

been taken into account. Any purchase or sale activity in any securities or

other instrument should be based upon the readers’ own analysis and conclusions.

Past performance is not indicative of future results.