We are encouraged by the recent market rally and believe we

could rally further as additional bullish sentiment creeps into the financial

picture. A strong dose of FOMO (fear of missing out) could be the catalyst to

drive the market higher. That said our radar is on high alert for a pullback in

the market in the coming weeks and months. We are laying out our strategy on

how we expect to position ourselves through the remainder of the year.

Near-term Technicals

Warrant Caution

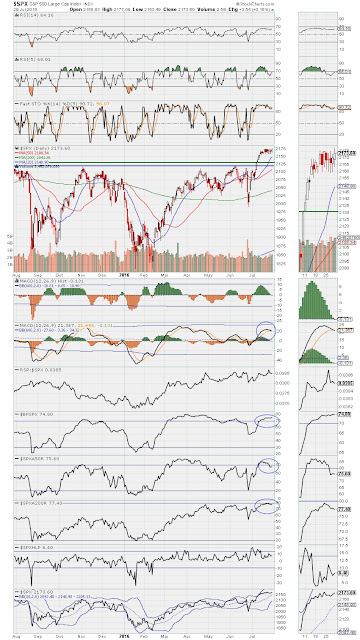

The daily S&P 500 shows a decent consolidation trend

after digesting the gains over the past few weeks but is definitely overbought.

We believe a pullback to its previous high of 2130 (green line) isn’t the end

of the rally and could prove a healthy pullback. Other levels we’ll be watching

are 2120 (blue line) which was the old resistance and 2100 which is the 50-day

moving average (red moving average). We expect a move back to these levels over

the next several weeks, viewing how these levels hold and monitoring volume

activity.

We also note that the daily MACD is very close to a bearish

cross and that loss of momentum could be a sign of coming weakness. The percent

of companies above their 50 and 200-day moving averages have peaked and the

percent of companies in bullish P&F formations are also at extended levels.

This does not guarantee a coming correction. This could just be a period of

cooling until the next leg up occurs.

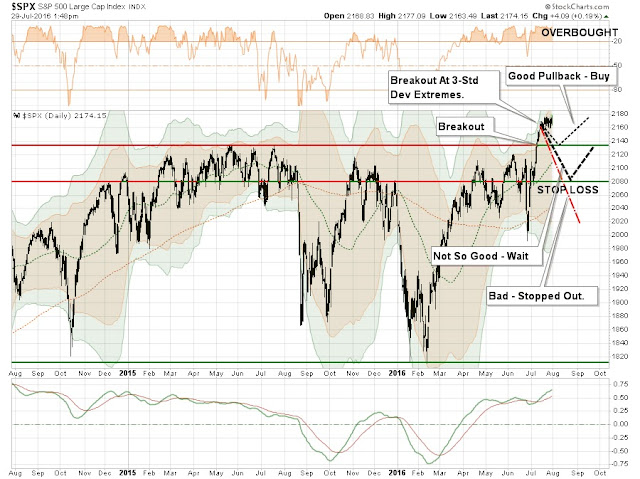

The SPX weekly chart looks good. We can see the breakout from its trading channel, RSI (14) is above 50, although the faster moving oscillators are overbought currently but again, that doesn’t predict a coming correction. The bullish MACD cross that occurred earlier this year still holds and the recent rally has been broad-based by equal weight as seen in the chart below (RSP:$SPX). We can see our levels on this chart. A break back to 2000 would be very discouraging but a significant breach of that level could spell loads of trouble and may have us thinking shorting the market again.

On the daily Nasdaq chart, we are approaching key levels

after the breakout that occurred this month. Tech and Biotech enjoyed a nice

rally recently. We are hitting some overhead resistance and overbought

conditions that could prove challenging but a tepid pullback over the next few

weeks could be exactly what we need to keep this advance going. We like the

fact that volume has been increasing as the Nasdaq went higher last month. The

MACD bullish cross remains intact but is waning somewhat but much less than the

S&P 500.

The weekly Nasdaq chart shows the breakout from its trading

channel along with the overhead resistance on the horizon. The MACD bullish

cross remains intact and the oscillators are overbought but healthy. A pullback

and support to the top of the trading channel near 4900 wouldn’t jeopardize the

current rally in our view.

Reading Lance Roberts from Real

Investment Advice sheds additional light on the near-term market prospects.

He writes, “The consolidation over the

past week DID pull the deviation back from 3-standard deviations above the

50-dma to just 2-standard deviations. This didn’t solve much of the problem as

of yet.

Importantly, there are

TWO ways to solve an overbought and overextended market advance. The first is

for the market to continue this very tight trading range long enough for the

moving average to catch up with the price.

The second is a

corrective pullback, which is notated in the chart above. However, not all

pullbacks are created equal.

1. A pullback to 2135,

the previous all-time high, that holds that level will allow for an increase in

equity allocations to the new targets.

2. A pullback that

breaks 2135 will keep equity allocation increases on “HOLD” until support has

been tested.

3. A pullback that

breaks 2080 will trigger “stop losses” in portfolios and confirm the recent

breakout was a short-term “head fake.””

He goes on to state, “The

next chart shows the 9.3% advance from the “Brexit” low. The momentum “buy”

signal was triggered fairly early in the advance along with an upturn in

volume. However, both of those

indicators are now beginning to turn lower which would also suggest that a

corrective action is likely in store in the days or weeks ahead.”

He also points out a recent study by BAML writing, “Then there is this tidbit:

We’re about to step

into seasonality ditch: lowest 3-month returns Aug-Oct for S&P going back

to 1928

Source: BoA ML

pic.twitter.com/Q5S5JSQdvr

— Babak (@TN) July 29,

2016”

We found more statistics on the potentially soft market

action in the coming weeks and months from The

Fat Pitch. He writes, “An third

reason to expect a reaction in August is that the month is seasonally weak and

often volatile. Recall that July is typically the strongest month of the

summer. In comparison, August is one of the weakest months, especially over the

past 10 and 20 years (data from Ryan Detrick and Bloomberg).”

“But what sets August

(and September) apart is not that the month ends badly but that the interim

drawdown within the month can be severe. A 5% decline in August (or September)

is nearly twice as likely as during any other month (data from Sam Stovall).”

Political Unrest

We are in the throes of election season and one can surely

anticipate the mudslinging to kick into high gear. The race is tight as seen by

the latest polling from Real

Clear Politics. Head-to-head nationally Clinton leads

Trump by 1.1%, but adding in Johnson, Trump leads Clinton by a fraction. Add

Stein to make it a four-way race and both are tied. A close race thus far so

expect the rhetoric to really pick up from here.

According to Almanac

Trader, “July’s big rally has pushed

the DJIA well into incumbent winning territory. As you can see below this has

not been typical July market action. The usual second half of July weakness

never materialized. Once the market realized that Brexit was no imminent threat

or a clear and present danger, stocks quickly erased the two-day post-Brexit

selloff and rallied to new all-time highs on the DJIA and S&P 500 in

relatively short order.

Since economic data

has not impressed the Fed enough and continues to ebb and flow every month,

it’s unlikely we’ll see another rate increase until after the election. Earning

season went off without a hitch as companies overall did not disappoint Wall Street

much, though we were not overly impressed.

Buoyed also by

earnings numbers that mostly beat lowered forecasts and the promise of

continued accommodative monetary policy for the foreseeable future, this rally

has pushed the DJIA well above any of the rosiest scenarios for an election,

which has historically, been a vote of confidence for the incumbent

presidential party.”

The chart below shows that this market has been performing

quite well when compared to other election years. The green line represents

election years when there is no sitting President running and the red line

represents the market performance this year thus far. What’s interesting on

this chart is the orange line that shows how the stock market had traded in the

years when the incumbent party won the election. If the market continues

this pace it appears Clinton will hold the edge going into November.

As far as future market performance Jeff Hirsch writes, “If anything we should all find at least

some solace in the continued civilized, yet enthusiastic and sometimes heated

debates of the open political process that this great nation continues to be

built on. However, as two of the most unfavorable candidates head into the home

stretch of a virtual dead heat presidential election campaign, things are bound

to get uglier and spook the market.”

This election year sell-off will most likely happen in

August through September. According to Almanac

Trader, since 1952 (when agriculture started to play less of a role in our

economy) the third quarter of an election year is historically the weakest

quarter on the year. The fourth quarter of an election year is the strongest.

This holds with our notion that a pullback over the next weeks and months

should be followed by an additional thrust upward.

David Kotok, the chief investment officer of Cumberland

Advisors points out (via Business

Insider), “After the Brexit vote took

the wheel of the economy for a while, Japan's recent elections have also influenced

global assets. On the horizon, the US presidential election should have a

pretty firm grip on the market until voting finally happens in November.

"The race between

Trump and Clinton is creating a whole lot of uncertainty," said Kotok.

"People really aren't sure what to make of either candidate or the race,

and it's going to make the market unstable until the election happens."

Add in Spanish and

Italian elections in September and October, respectively, and there's almost no

period for the rest of the year without some sort of political event.”

“Political events are

harder to predict than some business events. Thus, markets are more likely to

be caught flat-footed like they were after the Brexit vote, leading to wild

swings in prices. Dealing with such swings is what will separate the good

investors from the bad, according to Kotok.”

Long-Term Prospects

Are Solid

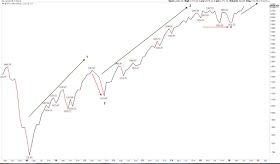

The monthly chart of the S&P 500 shows a potential

upward bias to the market longer-term. The market has recently broke out of its

trading range and the monthly MACD has been improving and is on the verge of a

long-term bullish cross. Both RSI (14) and stochastics have held up well during

the recent sell-off and momentum seems to be improving. The same can be said for

the Nasdaq on the monthly chart.

A recent post in See

It Market states, “While some

near-term trends have cooled, the longer-term industry group trends remain

firm. Some 80% of the industry groups in the S&P 1500 are now in up-trends.

The behavior of this indicator in 2016 is in sharp contrast to the

deterioration that was seen over the course of not only 2015 but 2014 as well

(when the pattern of lower highs and lower lows started to emerge). Without a

significant change in character, this indicator suggests any pullbacks seen

over the near term could limited in degree and duration.”

We recently commented about a potential “melt-up” in the

market as earnings data improves and bullish sentiment takes hold. It has been

stated by many that this coming melt-up will represent the fifth wave of the

bull market according to Elliot Wave Theory. From The

Fat Pitch, “Our best guess is that US

equities are in the final "wave 5" of the 7 year bull market. In

Elliot Wave terminology, bull markets advance in 5 waves: waves 1, 3 and 5 move

higher while waves 2 and 4 are interim corrections. The basic structure is

shown below.”

“One of the main

defining characteristics of this pattern is that "wave 3" is normally

the longest. In the current bull market, that would correspond to the long

2011-15 advance. "Wave 2" was the steep 20% correction in 2011 that

some consider a bear market. In

comparison, "wave 4" is often a "flat" correction: this

corresponds to the flat trading range that persisted through much of 2015 and

the first half of 2016. The new highs for both SPX and NDX indicate that

"wave 5" is now underway.”

“A literal

interpretation of this pattern would imply that SPX is headed above 2500, about

20% higher. Instead of a price or calendar target, we think it makes much more

sense to monitor the data. "Wave 5" will likely top when sentiment

becomes excessively bullish. If waves 1 and 3 are characterized by

"skepticism" and "acceptance", respectively, then the final

push in a bull market is typically "euphoric". At the 2007 market

top, fund managers' equity allocation was nearly 60% overweight and cash was

under 3.5%. At the end of "wave 5", we will also start to see

employment, housing and various measures of consumption start to flatten and

weaken.”

The Return of

Fundamentals

It’s no secret that corporate fundamentals have been weak.

Earnings and revenue growth have been nonexistent through this latest rally.

Some believe the latest rally stems more from a willingness from investors to

move to risky assets as yields on fixed income plummeted. According to the

folks at Deutsche Bank (via Business

Insider), “According to Dominic

Konstam and team, writing in a note Friday, the rally is about the declining

equity risk premium, which is simply the excess return the stock market

provides over a risk-free rate like bond returns.

The premium jumped

after stocks plunged in the financial crisis, with investors demanding as much

as 7% more from choosing stocks over bonds. It has now fallen closer to its

historical norm of 2% as bond yields also fell, implying that the return

investors require to be compensated for their risky investments in stocks has

fallen.

The sovereign bond

yields in many developed countries are at or near record lows. Yields on

benchmark bonds in Germany and Japan plunged deeper into negative territory

after the rush to government-debt markets sparked by the UK's decision to leave

the European Union.

As nominal yields have

fallen, investors have rotated into higher-yielding assets, Konstam said.

From the note:

"The current

cycle stands out in that earnings have played almost no role in the SPX rally.

In fact, earnings were a slight drag on equities and were only offset by an

aggressive multiple expansion. More than 90 percent of the rally was attributed

to a collapse in equity risk premium ... In sharp contrast, the equity gains in

the 1980s and 2000s were all about earnings growth, and in 1990s earnings still

accounted for more than half of the rally."”

Our view is that an improvement in the revenue and earnings

outlook could be a net positive in a market that has already priced in a mild

earnings recession. It still appears the US economy, albeit quite weak will

avoid a recession and that may be enough to drive equities.

Indeed we seem to have gotten good news on the earnings

front this week from FactSet.

They write, “During the month of July,

analysts lowered earnings estimates for companies in the S&P 500 for the

quarter. The Q3 bottom-up EPS estimate (which is an aggregation of the EPS

estimates for all the companies in the index) dropped by 0.7% (to $30.44 from

$30.66) during this period…During the past year (4 quarters), the average

decline in the bottom-up EPS estimate during the first month of a quarter has

been 2.7%. During the past five years (20 quarters), the average decline in the

bottom-up EPS estimate during the first month of a quarter has been 2.3%.

During the past ten years, (40 quarters), the average decline in the bottom-up

EPS estimate during the first month of a quarter has also been 2.3%. Thus, the

decline in the bottom-up EPS estimate recorded during the first month of the

third quarter was smaller than the 1-year, 5-year, and 10-year averages.”

It is understood that analysts will reduce their quarterly

and annual estimates as the year progresses, but a significant decline in the

rate of change in those downward revisions are a positive event. That appears

to be what we are seeing.

They also note, “The

blended (combines actual results for companies that have reported and estimated

results for companies yet to report) revenue growth rate for the S&P 500

increased to 0.1% this past week, which is above the year-over-year decline of

-0.3% at the end of last week and the year-over-year decline of -0.8% at the

end of the second quarter (June 30). If the index reports growth in revenues

for the quarter, it will mark the first time the index has seen year-over-year

growth in sales Q4 2014 (2.0%).”

The revenue figures that have been reported thus far for

2Q16 have pushed the expected revenue growth figure into positive territory for

2Q16. Earnings growth expectations are still negative for 2Q16 but have also

improved. Given the slowdown in the rate of deterioration of financial

projections along with the magnitude of positive surprises (both revenue and

earnings beats are above historical norms according to FactSet) means we could

see corporate fundamentals improve beyond expectations. Should the global

economic picture worsen then all bets are off. We need to keep a close watch on

this.

One professional that isn’t convinced of the rebound in

corporate fundamentals is Byron Wien, vice chairman at Blackstone Group. In a

recent article by Business

Insider they go on to state, “The

main problem is wage growth, according to Wien. Modest revenue growth, coupled

with a lack of pricing power among companies, means that margins have to be

squeezed as wages climb.

"Profit margins are coming down and labor

share of corporate GDP is going up," he said. "So my view is that

there's a margins squeeze going on. You saw it in the first-quarter earnings,

and I think you'll see it manifested throughout the year."

He also thinks that a

correction is likely because of high stock market valuations and investor

euphoria, although a bear market and recession are unlikely to happen.”

Indeed we have written in the past that margins have begun

to deteriorate and significant margin contraction can lead to bad things in the

US equity markets as seen in the chart below.

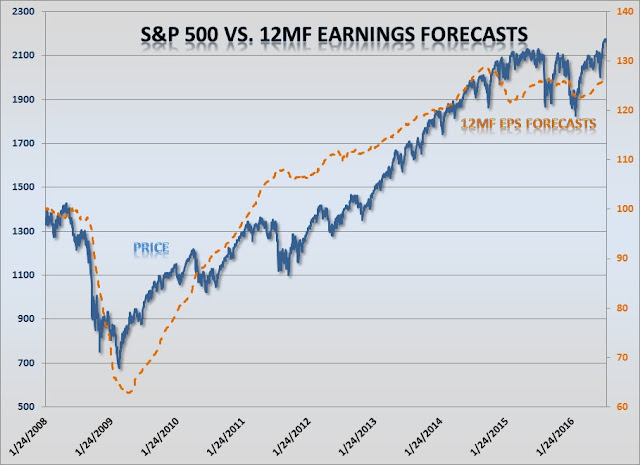

We could also make the argument that the market is 10% to

15% overvalued at current levels but the one bright spot is that the

fundamental picture has started to improve. The chart below shows the

trajectory of analysts twelve month forward bottom up EPS forecasts relative to

the market. We can see that the downward trend in forward earnings forecasts

have turned higher with the market. The chart below that confirms the trend

showing an uptick in the slope of forecasted earnings. A pick-up in the rate of

EPS acceleration would surely benefit stock prices.

Even the point of valuation is defended by some of the

greatest minds on Wall Street. Richard Bernstein of Richard Bernstein Advisors in his latest

commentary states, “Many income-centric

investors believe that the equity market is significantly overvalued simply

because the market PE seems high relative to history. However, PE ratios in

isolation have not historically been good forecasters of future returns because

PEs must be related to interest rates and inflation.

There is an old

investment rule-of-thumb called the Rule of 20 that uses combinations of

headline inflation and the S&P 500® PE to determine fair value. Our

valuation models are, of course, more elaborate than the simple Rule of 20, but

based on a more rigorous analysis of inflation and PE ratios, the current

equity market appears, at worse, to be fairly valued. Investors forget that

inflation was increasing leading up to the 2008 bear market. In fact, the CPI,

which is a lagging indicator, peaked at 5.6% in July 2008. Today’s headline

inflation is 1.0%.

The chart below shows

combinations of inflation and valuations over the past 50 years or so. The

current observation does not suggest investors need to be as defensive and

income-centric as they are currently.”

Bottom Line: We have

changed our thinking from the beginning of the year. We initially thought the

market top was in but as the technical, behavioral and fundamental picture

changed, so have our investment thesis.

We are preparing for

a market melt-up as sentiment catches up with the easy monetary policy driven

rally and improving corporate fundamentals. That said we believe the months of

August and/or September will offer a pull-back in the market as an opportunity

to increase long exposure.

We are nearly fully

invested towards the long side currently but will start to raise cash (not go

short) after one or two distribution days. Once the sell-off completes its

course and as long as the new technical levels hold, we will use the opportunity

of a pullback to rebalance our positions.

Joseph S. Kalinowski, CFA

Email: joe@squaredconcept.net

Twitter: @jskalinowski

Facebook: https://www.facebook.com/JoeKalinowskiCFA/

Blog: http://squaredconcept.blogspot.com/

Web Site: http://www.squaredconcept.net/

Additional Reading

No part of this report may be reproduced in any manner

without the expressed written permission of Squared Concept Asset Management,

LLC. Any information presented in this

report is for informational purposes only.

All opinions expressed in this report are subject to change without

notice. Squared Concept Asset

Management, LLC is a Registered Investment Advisory and consulting company.

These entities may have had in the past or may have in the present or future

long or short positions, or own options on the companies discussed. In some cases, these positions may have been

established prior to the writing of the particular report.

The above information should not be construed as a

solicitation to buy or sell the securities discussed herein. The publisher of this report cannot verify

the accuracy of this information. The

owners of Squared Concept Asset Management, LLC and its affiliated companies

may also be conducting trades based on the firm’s research ideas. They also may hold positions contrary to the

ideas presented in the research as market conditions may warrant.

This analysis should not be considered investment advice and

may not be suitable for the readers’ portfolio. This analysis has been written

without consideration to the readers’ risk and return profile nor has the

readers’ liquidity needs, time horizon, tax circumstances or unique preferences

been taken into account. Any purchase or sale activity in any securities or

other instrument should be based upon the readers’ own analysis and

conclusions. Past performance is not indicative of future results.

No comments:

Post a Comment