It’s been a while since the last blog post. We had mentioned

in our last post that we would be taking some time off to prepare the final

stages of making Squared Concept a Registered Investment Advisory firm and I

was personally studying for the CMT level I exam. The good news is that we have

completed all the steps needed in becoming an RIA and I did pass the exam.

We are now a fully operational RIA and have started to take

in external investment assets. Please visit our new website www.squaredconcept.net. We’d like to

take the opportunity to thank everyone for their patience.

Rocky Balboa Market

We have written about several market concerns including slow

and contracting global economic growth, slowing US economic growth, weak

corporate earnings and deteriorating market technicals as reasons for our somewhat

sullen mood. While our views have not changed we are realigning our methods of

approach.

I was flipping through the channels this weekend and the

movie “Rocky” was on. I’ve seen the movie over 100 times it seems and yet I

always end up watching it again when I find it on the tube. It occurred to me

that this stock market is like Rocky, takes a beating but against all odds it

keeps coming back. How many times over the past several months have short

sellers believed that knock-out blow had been delivered only to be disappointed

when the US equity market lifts itself off the mat. I’m speaking from

experience.

Perhaps this anticipated economic slowdown is so anticipated

that those of us in the doom camp are no longer the minority but now represent the

consensus view. There will be another correction, there will be another

recession and there will be another bear market at some point, but perhaps not

yet.

On Dana

Lyon’s Tumblr they point out, “So

what are these positive developments? Not the least of them is the fact that

the NYSE advance-decline line has gone to a new all-time high. As a refresher,

the advance-decline line is a running cumulative total of the daily difference

between advancing issues on the NYSE and declining issues. If this “A-D” Line

is moving upward along with the stock indexes, it represents strong

participation within the broader market. And as we have said many times, the

better the participation, the healthier the market. Since the mid-February

stock market low, the A-D Line has indeed been moving upward, hitting its first

new high in April after 355 days.”

“So what is the

significance of the new high? The NYSE A-D Line has negatively diverged at

every cyclical top in the S&P 500 in the last 50 years.”

On the daily SPX chart we can see the very sharp but

short-lived impact of “Brexit” and the miraculous “Brebound” that followed. We

were leaning short into the announcement but decided to cover our shorts around

the 2000 SPX level. Given the resiliency of the market, the psychological

importance of 2000 and the 38.2% retracement from the February lows, it seemed

appropriate to cover and wait for further action. That proved to be a

fortuitous decision.

We believe a break and close above 2120 on the SPX and

ultimately a move above the all-time high close of 2130.82 could slingshot the

market much higher. We’ll be watching the “risk-off” assets such as TLT and GLD

for further near-term confirmation that the market will head higher. My guess,

because these safe-haven assets did not sell-off as the stock market rallied

and the sudden overbought near-term condition of US equities, there could be

another opportunity to buy stocks at lower prices in the next few days or

weeks.

On the SPX weekly chart we have seemed to have broken out of

that down channel that started in the middle of last year. Even the Brexit

sell-off was unable to break this trend. RSI (14) on the weekly remains above

50 and the bullish MACD cross that occurred in March remains intact. When

comparing to the SPX equal weight index, it seems this rally goes beyond just a

few large cap leaders and appears to be a broader based move. These are all

positive events.

On a monthly basis the chart seems to be improving as well.

A few months ago I was getting prepared for a major sell-off but the technical

triggers that I was watching have changed. The negative MACD signal cross that

occurred remains intact but has leveled off as seen in the MACD histogram. It

appears a break to new highs on the SPX will provide a bullish MACD cross.

Also, the RSI (14) dipped briefly below 50 but really has been unable to break

to the downside. The market has also solidly regained its 20 month moving

average with the slope of that line improving.

From Stockcharts.com,

“Chartists will look back at the

long-term charts and try to figure out where exactly this big Brexit panic

actually occurred. Was there even such an event? There is something to be said

for monthly close-only charts because they filter a lot of noise, and June was

definitely a month with lots of noise. Despite some volatile swings, the major

indexes ended the month with little change. Outside of the Nasdaq 100, the

monthly gains and losses were between +1% and -1%.”

“The next chart shows

monthly closing prices for the S&P 500. At the risk of over simplification,

the trend and the pattern at work seem obvious to me. After falling some 17% in

2011, the index embarked on a 44 month advance that gained over 85%. $SPX was

certainly entitled to a rest after such a strong advance and the triangle

consolidation provided this rest. At 11 months, the consolidation is around a

quarter as long as the prior advance, which seems reasonable. Most importantly,

the index broke above the upper trend line with the April close and held this breakout

the next two months. This breakout means the uptrend is resuming and the index

is now less than 2% from its all time high. I would not become concerned with

the long-term uptrend unless the index closes below 2000.”

I’m certainly less bearish than I was at the start of the

year but still cautious. That said a break to new highs on the SPX will offer a

big move upward in our opinion. So how do we get to a new high and what will be

the fuel to drive the market higher.

Getting to a New High

What will propel the market to new highs in the face of

deteriorating global economics and earnings? The answer: Central banks of

course. The table below shows the market

pricing in a 0% chance of a rate hike this month and only a 2% chance in

September and November. There is an 11.8% chance of hikes in December. This is

a dramatic change from the start of the year when the Fed was telling us to

expect four rate hikes this year.

From Seeking

Alpha, Jay Unni, MD writes, “These

data stand in stark contrast to the FOMC participants' expressed views on

appropriate monetary policy. As of the last statements, FOMC participants were

still leaning towards two hikes this year:

“Obviously, rate hikes

are a negative event for liquidity. But, if you believe what the futures market

are telling you, we ought to have no negative impact on liquidity from the Fed

this year. In fact, if the Fed changes their outlook to something more dovish,

like one or zero rate hikes this year, the change in expectations might even be

a considered a positive event for liquidity.”

Lance Roberts from Real

Investment Advice summed it up best, “In

this past weekend’s commentary, I discussed the likelihood of Central Banker’s

leaping into action to stabilize the financial markets following the British

referendum to leave the E.U. To wit: “Of course, the reality is that we will

likely see a globally coordinated Central Bank response to the financial

markets over the next few days if the selling pressure picks up steam. This

will come in the form of:

Further interest rate reductions

Deeper moves into negative rate

territories

Increased/accelerate bond purchases by

the ECB

A potential short-term QE program by

the Federal Reserve

A pick up of direct equity/bond buying

by the BOJ.

Liquidity supports through FX swaps or

direct intervention

Lot’s and Lot’s of “Verbal Easing”

Not to be

disappointed, Mario Draghi sprung into action on Tuesday suggesting a greater

alignment of policies globally to mitigate the spillover risks from ultra-loose

monetary measures.

“We can benefit from

the alignment of policies. What I mean by alignment is a shared diagnosis of

the root causes of the challenges that affect us all; and a shared commitment

to found our domestic policies on that diagnosis.” – Mario Draghi at the ECB

Forum in Sintra, Portugal.

Furthermore, as noted

by John Plassard, a senior equity-sales trader in Geneva at Mirabaud Securities

via Bloomberg: “Stocks are rebounding on

the expectation that there will be a coordinated intervention by central banks.

What central banks can do is put confidence back in the market by telling

everyone that they are here and ready to act. If we don’t get that sort of

support, we’ll see further declines.”

Then on Thursday more

announcements came from both the Bank of England and ECB:

BOE: SOME MONETARY POLICY EASING LIKELY

OVER SUMMER

BOE: MPC WILL DISCUSS FURTHER POLICY

INSTRUMENTS IN AUG

ECB: TO WEIGH LOOSER QE RULES AS BREXIT

DEPLETES ASSET POOL

ECB: OPTIONS TO INCLUDE MOVING AWAY FROM QE

CAPITAL KEY

ECB: CONCERNED ABOUT SHRINKING POOL OF

ELIGIBLE DEBT”

We believe the quick rebound in equity prices in the US are

a reflection of central bank intervention expectations. It would also seem that

the Brexit issue is still largely viewed as a political risk as opposed to an

economic risk. In an article in USA

Today, “There’s more than just

cynicism, to suggest that the stock market may be overreacting to the Brexit

decision. Consider a study of 51 major geopolitical crises since the beginning

of the 20th century that was compiled by Ned Davis Research. The list includes

events that most everyone would agree are even more momentous than whether or

not the U.K. ways a member of the EU—events such as the 9/11 terrorist attacks,

Pearl Harbor, the Cuban missile crisis and the Kennedy assassination.

The firm found that,

more often than not, the stock market quickly recovers from the losses it

inevitably incurs in the immediate aftermath of such a crisis. On average

across all 51 crises, the Dow Jones industrial average within six months was

higher than where it stood prior to the market’s initial plunge. Within a year

it was 6.3% higher.”

Another article in USA

Today, Sam Stovall, chief equity strategist at S&P Capital IQ discusses the impact of political vs. economic

shocks, “In general, the stock market

tends to rebound quickly following shocks, once it is determined that the

economy won't be irreparably harmed by the event, says Stovall… In fact, on a

median basis, shocks normally cause stocks to bottom out six days after the

shock hits, with a total drop of 5.3%. And in looking at the 14 market

"shocks" since World War II, the market has taken a median of just 14

days to recover all its losses, S&P Capital data show.”

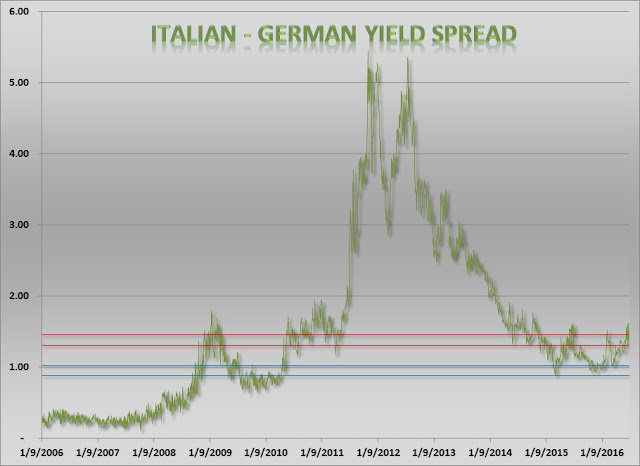

We believe that to be the case given the massive declines in

European government yields (and global sovereign yields for that matter) but

yield spreads between European nations are elevated but not running wild like

in 2011 during the Euro banking crisis.

The slingshot Effect

If we break new highs on the SPX (Nasdaq and Russell 2000

have a little further to go than the S&P 500 but I believe a rising tide

will lift all boats) then we expect the market to slingshot further from there.

As I mentioned earlier, this anticipated correction is so anticipated that many

investors will probably jump into the market looking to capitalize on gains for

the year. I certainly know I will be one of them. I say this because market

sentiment is unusually subdued given how close we are to new all-time highs in

the stock market.

AAII Investor

Sentiment

Looking at the AAII Investor Sentiment Survey, the latest

reading of those surveyed show 28.9% of those surveyed as bullish, 33.4% as

bearish and 37.7% as neutral. The 28.9% bullish read is less than the long-term

average of 38.8% and the bearish reading is slightly more than the 30.6%

long-term average. Given the contrarian nature of this index, these readings

are a bit unusual while the market is near all-time highs. The bullish/bearish

ratio that we track is clearly giving a contrarian buy signal.

In a recent poll taken, AAII

states, “Last month’s Asset Allocation

Survey special question asked AAII members what, if any, allocation changes

they expect to make during the second half of this year. One out of three

respondents (33%) intend to increase their equity exposure. Several of these

respondents said they would do so if stock prices were to drop by putting cash

to work. Conversely, 18% intend to raise cash, with several selling stocks to

do so. Approximately 10% plan on

boosting their bond exposure. More than 26% of respondents do not intend to

make any changes or to make only very modest changes.”

We believe the results of this poll provide further evidence

that there is new money on the sidelines waiting to be deployed.

What is most impactful in this reading is the amount of

people that say they are neutral towards the market. While the percent bullish

reading is very low, many participants that would normally be bearish are

neutral. We tend to think that if the market starts hitting new highs, you will

see more participants in this survey gravitate from neutral/bearish to bullish.

That change in sentiment could propel the market higher.

Fund Flows

Looking at total ICI fund flows, we find money flows into

pure equity funds has been on the decline for roughly a year and equity

investments as a percent of total investments is elevated but not near the

super-euphoric levels last seen before the prior two bear markets. One tends to

think with the market starting to hit new highs, and as the fear of being left

behind takes hold, money will start to gravitate back into the equity markets

providing addition buying power.

In a recent post on The

Fat Pitch, “Fund managers cash levels

at the equity low in February were 5.6%, the highest since the post-9/11 panic

in November 2001, and lower than at any time during the 2008-09 bear market.

This was an extreme that has normally been very bullish for equities.

Remarkably, with the SPX having since risen 17%, cash in June is now even

higher (5.7%) and at the highest level in 14 years (since November 2001). Even November 2001, which wasn't a bear

market low, saw equities rise nearly 10% in the following 2 months. This is

supportive of further gains in equities.”

“US exposure is still

near an 8 year low (-15% underweight; it was -19% underweight in February).

Despite low exposure, US equities have outperformed during the past year. US

equities have been under-owned and should continue to outperform other regions

on a relative basis”

Corporate Insider

Sentiment

The Sabrient Insider Sentiment Index is an equal- dollar

weighted index comprising publicly-traded companies that reflect positive

sentiment among those 'insiders' closest to a company's financials &

business prospects (top mgmt., directors, and analysts) Index base value 100 as

of 1/3/2000. This sentiment index has a fairly tight fit with the S&P 500.

As can be seen in the charts below, there has been a bit of a divergence of

late. While the market is approaching new highs, the sentiment index has been

declining. When you look at the year-over-year change in this sentiment index,

the levels currently seen are more indicative of a market bottom than a market

top. This feeds into my general thesis that a coming correction is anticipated

even by corporate insiders. Breaks to new highs should improve this reading as

well.

While insider sentiment remains quite high, should it start

to increase again it would be a bullish sign for the market as corporate

buybacks, increasing dividends and acquisitions are all considered a positive.

From Seeking

Alpha, “Note in the above figure,

that companies spent all of their accumulated cash, and are now actually

issuing debt to buy back shares and invest in acquisitions. Creating debt for

buybacks or acquisitions directly adds liquidity to markets, and I believe it

is a huge factor holding up the market. Dividends also increase liquidity in

markets because of dividend reinvestment.”

Put/Call Spread

The US equity put/call ratio briefly nudged into the panic

region but quickly can down as the dust settled. If we look at the long term

put/call z-score we’ll see the long-term average (200 day moving average) is

nearly 1 standard deviation more than the mean, which signifies a very high

level of market nervousness usually indicative of a contrarian buy signal.

Further proof in our opinion that the anticipation of a coming correction in

the near-term is not an outlier notion but more of a consensus view.

Bottom Line: Our

views on the health of the global and US economy and corporate earnings remain

pessimistic and we do believe we are near a cyclical top in the US equity

markets. That said this Rocky Balboa market seems to be trading more on central

banking monetary policy events and sentiment. The fundamentals need to be

placed on the back burner for the time being.

We think the market

breaking new highs is a likely event due to the Brexit outcome (ironically) and

central banking responses to that outcome. Once that happens there is enough

sentiment fuel to drive the market significantly higher from there, perhaps to

a blow-off top where fundamentals become more important in the investment

decision-making process. A failure to break new highs results in a continued

trading range and challenging trading environment. Breaks below February lows

in the S&P 500 and we will start trading to the short side once again.

To all of our friends

and family, have a safe and healthy July 4th. God Bless America.

Joseph S. Kalinowski, CFA

Email: joe@squaredconcept.net

Twitter: @jskalinowski

Web Site: http://www.squaredconcept.net/

Additional Reading

The Latest Margin Debt Figures Show Risk Still Outweighs

Reward In Owning Stocks – The

Felder Report

Oops! - TradeFollowers

Mooning the Elite – Acting Man

Price To Sales Ratio – Another Nail In The Coffin? – Real

Investment Advice

What the Bond Market is Telling Investors – Sober

Look

Pimco Says Market Underestimates Fed Rate Path, Recommends

TIPS - Bloomberg

No part of

this report may be reproduced in any manner without the expressed written

permission of Squared Concept Asset Management, LLC. Any information presented in this report is

for informational purposes only. All

opinions expressed in this report are subject to change without notice. Squared Concept Asset Management, LLC is a

Registered Investment Advisory and consulting company. These entities may have

had in the past or may have in the present or future long or short positions,

or own options on the companies discussed.

In some cases, these positions may have been established prior to the

writing of the particular report.

The above

information should not be construed as a solicitation to buy or sell the

securities discussed herein. The

publisher of this report cannot verify the accuracy of this information. The owners of Squared Concept Asset

Management, LLC and its affiliated companies may also be conducting trades

based on the firm’s research ideas. They

also may hold positions contrary to the ideas presented in the research as

market conditions may warrant.

This analysis

should not be considered investment advice and may not be suitable for the

readers’ portfolio. This analysis has been written without consideration to the

readers’ risk and return profile nor has the readers’ liquidity needs, time

horizon, tax circumstances or unique preferences been taken into account. Any

purchase or sale activity in any securities or other instrument should be based

upon the readers’ own analysis and conclusions. Past performance is not

indicative of future results.

No comments:

Post a Comment