On FX

On Sentiment

On Yield Analysis

On Energy

On Sector Rotation

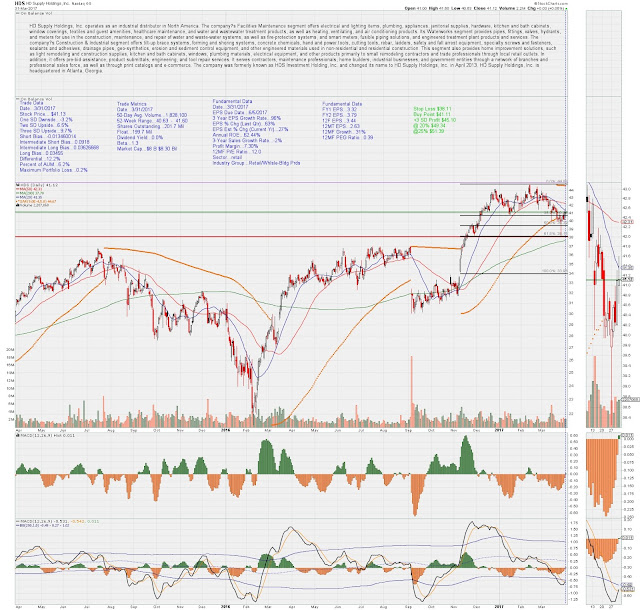

On Stocks I'm Buying

Bottom Line: Post-election sentiment has declined somewhat as investors await improving economic conditions and evidence that the Trump Administration can tame the Washington beast. Yield spreads are at levels usually seen before a market correction.

We would definitely like to see the Financials as well as the Small Caps resume their upward trend to give us confidence in the market. From the S&P 500 daily chart we could see additional 6% to 8% declines from here if we fail to press higher.

That said, one will face career risk if deployed in cash for too long. For our new asset purchases we are deploying slowly and keeping our stops tight. It continues to be our belief that the market will suffer a correction at some point in the first half of this year. That said, we believe it will represent a buying opportunity as recessionary and bear market outcomes are low in our opinion.

Good Trading

Joseph S. Kalinowski, CFA

Email: joe@squaredconcept.net

Twitter: @jskalinowski

Facebook: https://www.facebook.com/JoeKalinowskiCFA/Blog: http://squaredconcept.blogspot.com/

No part of this report may be reproduced in any manner without the expressed written permission of Squared Concept Asset Management, LLC. Any information presented in this report is for informational purposes only. All opinions expressed in this report are subject to change without notice. Squared Concept Asset Management, LLC is a Registered Investment Advisory and consulting company. These entities may have had in the past or may have in the present or future long or short positions, or own options on the companies discussed. In some cases, these positions may have been established prior to the writing of the report.

The above information should not be construed as a solicitation to buy or sell the securities discussed herein. The publisher of this report cannot verify the accuracy of this information. The owners of Squared Concept Asset Management, LLC and its affiliated companies may also be conducting trades based on the firm’s research ideas. They also may hold positions contrary to the ideas presented in the research as market conditions may warrant. This analysis should not be considered investment advice and may not be suitable for the readers’ portfolio. This analysis has been written without consideration to the readers’ risk and return profile nor has the readers’ liquidity needs, time horizon, tax circumstances or unique preferences been considered. Any purchase or sale activity in any securities or other instrument should be based upon the readers’ own analysis and conclusions. Past performance is not indicative of future results.

They have a positive reputation in general, a track record of integrity, fairness and competitive returns. We feel most confident trading https://www.7binaryoptions.com/brokers/ at these sites.

ReplyDelete