On the economy...the debate on "soft" vs. "hard" data continues. We anticipate a pull-back in the S&P 500 and will deploy additional assets at that time. Should we have monetary and/or fiscal policy error we will be on the look out for something worse at that time.

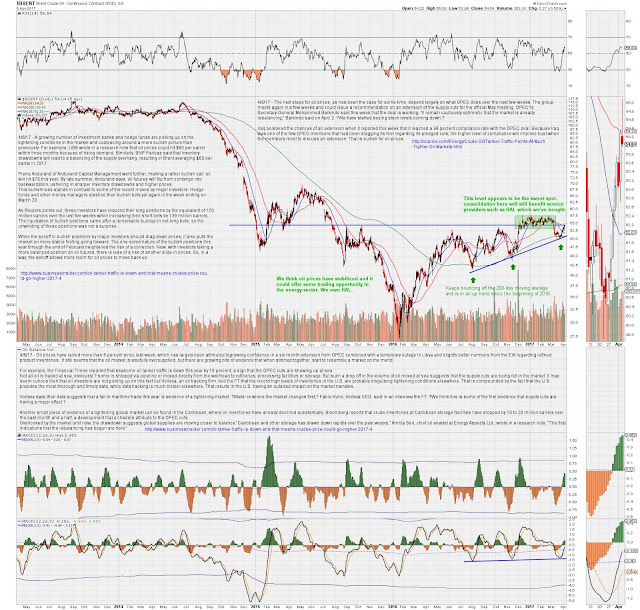

On energy...we believe the oil price comeback is solid. We own HAL.

Bottom Line: We don't believe we are heading towards recession and a bear market at this time. We do believe that market sentiment has gotten ahead of itself and would like to see a pull-back before aggressively deploying additional assets.

Joseph S. Kalinowski, CFA

Email: joe@squaredconcept.net

Twitter: @jskalinowski

Facebook: https://www.facebook.com/JoeKalinowskiCFA/Blog: http://squaredconcept.blogspot.com/

Tumblr: trader-rants

No part of this report may be reproduced in any manner without the expressed written permission of Squared Concept Asset Management, LLC. Any information presented in this report is for informational purposes only. All opinions expressed in this report are subject to change without notice. Squared Concept Asset Management, LLC is a Registered Investment Advisory and consulting company. These entities may have had in the past or may have in the present or future long or short positions, or own options on the companies discussed. In some cases, these positions may have been established prior to the writing of the report.

The above information should not be construed as a solicitation to buy or sell the securities discussed herein. The publisher of this report cannot verify the accuracy of this information. The owners of Squared Concept Asset Management, LLC and its affiliated companies may also be conducting trades based on the firm’s research ideas. They also may hold positions contrary to the ideas presented in the research as market conditions may warrant. This analysis should not be considered investment advice and may not be suitable for the readers’ portfolio. This analysis has been written without consideration to the readers’ risk and return profile nor has the readers’ liquidity needs, time horizon, tax circumstances or unique preferences been considered. Any purchase or sale activity in any securities or other instrument should be based upon the readers’ own analysis and conclusions. Past performance is not indicative of future results.

No comments:

Post a Comment