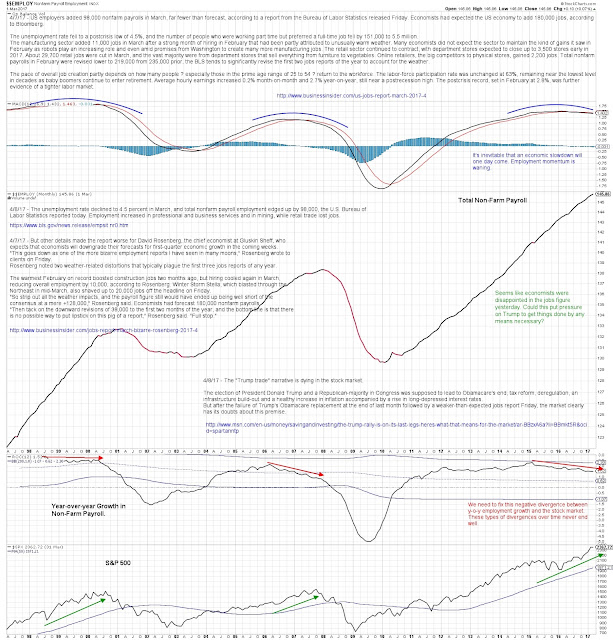

Yesterday’s non-farm payroll numbers whiffed big time. The

stock market had a muted reaction although Industrials moved higher. Vulcan

Materials (VMC) is a stock we own that was up nearly 4% yesterday.

Perhaps the market expects the Trump Administration to

refocus their efforts on infrastructure spending considering the weak jobs

report.

Federal Reserve Bank of Atlanta GDPNow has

lowered their 1Q17 GDP forecast to 0.6%, down from nearly 3.5% at the end of

January.

They state, “The

GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in

the first quarter of 2017 is 0.6 percent on April 7, down from 1.2 percent on

April 4. The forecast for first-quarter real GDP growth fell 0.4 percentage

points after the light vehicle sales release from the U.S. Bureau of Economic

Analysis and the ISM Non-Manufacturing Report On Business from the Institute

for Supply Management on Wednesday and 0.2 percentage points after the

employment release from the U.S. Bureau of Labor Statistics and the wholesale

trade release from the U.S. Census Bureau this morning. Since April 4, the

forecasts for first-quarter real consumer spending growth and real

nonresidential equipment investment growth have fallen from 1.2 percent and 9.7

percent to 0.6 percent and 5.6 percent, respectively.”

On Metals

Copper prices are coiling in a tight fashion. After a

post-election bump on expectations of greater economic growth under the Trump

Administration prices have pulled back. A break to the downside will confirm

the markets suspicion about the Trump Agenda becoming a reality.

Gold and silver on the other hand sold off in the

post-election rally and have found a base and could be poised to move higher.

If the economic picture doesn’t improve and lackluster fiscal policy and

additional economic weakness ensues, the Fed would need to take a more dovish

stance. That would be good for gold and bad for financials.

Speaking of the financial sector, we are watching for a

breakdown in that sector as it has the second greatest weighting in the S&P

500, approximately 15% of the index. The continued flattening of the yield

curve doesn’t bode well for the sector or the entire Trump reflation trade.

On Geopolitical Events

The news of the Syrian bombing on Thursday evening had equity

futures lower and gold rallying. Those fears subsided throughout the trading

day. My risk-off indicators headed lower.

The Aerospace and Defense sector looked strong.

After testing the 38.2% Fibonacci retracement from the post-election rally it

has remained in its bullish uptrend. Looking for a bullish MACD cross and

perhaps we’ll start looking at some defense names.

Joseph S. Kalinowski, CFA

Email: joe@squaredconcept.net

Twitter: @jskalinowski

Facebook: https://www.facebook.com/JoeKalinowskiCFA/

Blog: http://squaredconcept.blogspot.com/

Tumblr: trader-rants

No part of this report may be reproduced in any manner

without the expressed written permission of Squared Concept Asset Management,

LLC. Any information presented in this report is for informational

purposes only. All opinions expressed in this report are subject to

change without notice. Squared Concept Asset Management, LLC is a

Registered Investment Advisory and consulting company. These entities may have

had in the past or may have in the present or future long or short positions,

or own options on the companies discussed. In some cases, these positions

may have been established prior to the writing of the report.

The above information should not be construed as a

solicitation to buy or sell the securities discussed herein. The

publisher of this report cannot verify the accuracy of this information.

The owners of Squared Concept Asset Management, LLC and its affiliated

companies may also be conducting trades based on the firm’s research

ideas. They also may hold positions contrary to the ideas presented in

the research as market conditions may warrant.

This analysis should not be considered investment advice and

may not be suitable for the readers’ portfolio. This analysis has been written

without consideration to the readers’ risk and return profile nor has the

readers’ liquidity needs, time horizon, tax circumstances or unique preferences

been considered. Any purchase or sale activity in any securities or other

instrument should be based upon the readers’ own analysis and conclusions. Past

performance is not indicative of future results.

No comments:

Post a Comment