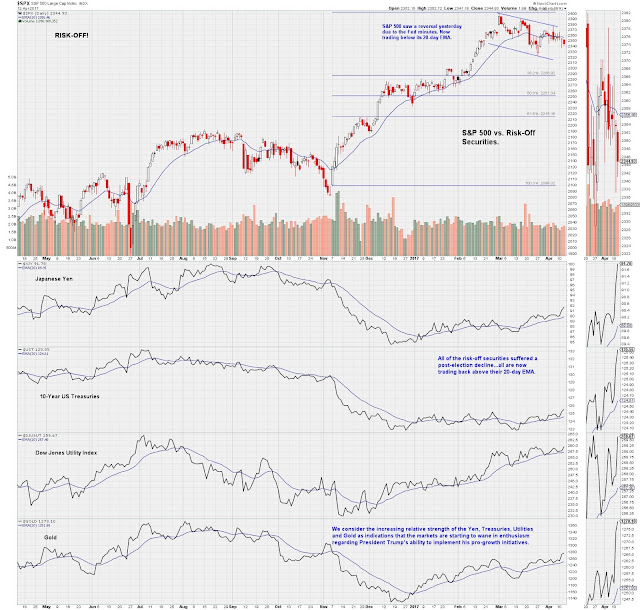

More signs of waning confidence in the economy and the Trump

Administration. Yesterday was yet another “risk-off” day but it would appear

that we are starting to break out in many sectors that would indicate

additional weakness to come.

On the Trump Administration.

President Trump gave an interview to the Wall Street

Journal. One can see why the actions of his policy positions can cause jitters

in the market. It’s one thing to hold a core position and alter that position

as your view changes. It’s a completely different thing to flip positions

entirely. If I were to say I used to drink coffee with milk and sugar but I’ve

changed to drinking it black. My core liking of coffee remains intact but I’ve

changed position on the periphery. If I were to say I love coffee last week but

say I hate coffee this week – that’s a sign of instability and uncertainty. Two

things the market does not appreciate.

President Trump on Chair Yellen yesterday (Business

Insider)…“Janet Yellen may not be

done as the Federal Reserve chair just yet.

President Donald Trump

told The Wall Street Journal that he was undecided to bring Yellen back as Fed

Chair after her term expires in 2018, saying she is "not toast."

"I like her, I

respect her," Trump said. "It's very early."

Trump called out

Yellen multiple times during his campaign, saying the Fed's low interest

rate policy was hurting the economy, in addition to accusing the

central bank of colluding with former President Obama, Hillary Clinton, and the

Democratic Party…In terms of Fed policy, Trump admitted to the Journal that he

is a fan of low interest rates.

"I do like a

low-interest rate policy, I must be honest with you," the president said.”

President Trump on Chair Yellen six months ago (Business

Insider) … “Republican presidential

candidate Donald Trump is going after Janet Yellen again, claiming that the

Federal Reserve is creating an investment bubble.

During the first

presidential debate, Trump said that the economy is having "the worst

revival of an economy since the Great Depression" and that nothing in the

country is healing after the financial crisis.

Additionally, Trump

said that because of record low interest rates from the Fed, the country's

economy is "in a big, fat, ugly bubble," with debt increasing while

the "only thing that looks good is the stock market."

Thus when interest

rates increase, the bubble would burst and the stock market would crash.

Trump also repeated

his claims that the Fed is keeping interest rates low while President Barack

Obama is in office in order to keep the economy going until Obama leaves

office.”

What about China? I can recall the thousands of times Trump

bashed the Chinese trade policies in every debate, stump speech and interview

he had given during the campaign. It was almost laughable the number of times

he attacked China. It was truly one of the staples of his campaign.

Back in June this is what was reported by Time, “At the end of the speech, Trump turned to a

favorite topic: China. The final three points of Trump's seven-point trade plan

concern China's "currency [manipulation]" and "theft."

First, "I am

going to instruct my Treasury Secretary to label China a currency manipulator.

Any country that devalues their currency in order to take advantage of the

United States will be met with sharply," Trump said. Ad-libbing, he

continued, "And that includes tariffs and taxes." This marked a sharp

break from Republican orthodoxy of the last several decades, which is to oppose

new taxes during election campaigns.

Trump argued that

"China's entrance into the World Trade Organization has enabled the

greatest jobs theft in history." According to the McKinsey Global

Institute, the U.S. lost about 1/3rd of its manufacturing base between 2000 and

2010, some 6 million jobs, as TIME recently reported. Only about 700,000 were

lost to China, through 'tradable' areas like apparel and electronics.

Trump also said,

"If China does not stop its illegal activities, including its theft of

American trade secrets, this is very easy. This is so easy, I love saying this.

I will use every lawful presidential power to remedy trade disputes, including

the application of tariffs, consistent with Section 201 and 301 of the Trade

Act of 1974 and Section 232 of the Trade Expansion Act of 1962."”

Now…” Trump, in an

interview with the Wall Street Journal on Wednesday, appeared to acknowledged

that China hasn’t been intervening to weaken its currency recently. “They’re

not currency manipulators," he said.” – Newsmax.

How about his thoughts on the monthly employment figures? On

the campaign trail, “Trump repeatedly

claimed during the campaign that the federal government was understating the

real unemployment rate.

"Don't believe

these phony numbers," Trump told supporters early last year. "The

number is probably 28, 29, as high as 35 [percent]. In fact, I even heard

recently 42 percent." - NPR

But after a solid jobs report in February – a full month in

office, President Trump switched stances. “On

Friday, many eagerly waited to see how Trump would characterize February’s

stellar jobs report. He retweeted the Drudge Report’s take, which characterized

the latest jobs report as “GREAT AGAIN.”

The White House Press

Secretary, Sean Spicer, didn’t mince words at a press conference Friday

afternoon when Eamon Javers, a reporter for CNBC, brought up Trump’s previous

doubts about the report’s veracity. “Does the president believe that this jobs

report was an accurate and a fair way to measure the economy?” Javers asked. In

response, Spicer said, “I talked to the president prior to this, and he said to

quote him very clearly. They may have

been phony in the past, but it’s very real now.”” [emphasis ours] – The Atlantic

Really?

Someone needs to get a handle on the Trump Doctrine so

market participants know where he is going to land. Until then, reckless tweets

and mixed signals will not help the stock market.

On Yields Analysis.

Take a look at treasuries yields. The 10Y yield has started

to deteriorate and has fallen back below 2.3%. This does not bode well for the

equity markets or the markets confidence in the economic picture looking

forward.

The yield curve has started to aggressively flatten and the

30Y treasury prices relative to stock prices have start moving in a direction

that is painful for the stock market.

The chart below compares the prices of investment grade

bonds (AGG) to speculative grade bonds (HYG) on a monthly basis. When this

relative price comparison is in an uptrend (above its 5-month exponential

moving average), equity returns have suffered. It seems we are about to see the

cross above the 5-month moving average. We would stay out of the market should

we see this trend continue.

On Metals.

Gold is breaking out. Not a great sign for the economy and

perhaps a response to increased global tensions (China

moving 150,000 troops to the North Korea border).

Copper and steel prices are tumbling and breaking down. Another

blow to the reflation trade theory.

The gold to copper ratio is heading in the wrong direction.

The markets.

The breakdown in financials and small caps continue to be worrisome.

The S&P 500 looks set to fall a bit further. The VIX is

showing inversion now but still can head higher…a bad sign for the market. We’d

like to see a little more “panic” in the market before getting comfortable

deploying additional assets. We usually would like to see inversion accompanied

by a +50% price move in the VIX and a spike in the Put/Call ratio. The past, a

combination of these events usually marks a good buying opportunity – assuming the

economy isn’t heading for a recession.

Utilities are taking off. This is a “risk-off” trade that doesn’t

bode well for the economy and confidence in the Trump Administration.

We consider the Japanese Yen as a risk-off measure. It too

is breaking out.

The strong US dollar will also put a damper on things should

it continue to strengthen. It seems President Trump understands this. Yesterday

he tried to talk down the dollar. From Bloomberg, “The dollar slumped and Treasury bond yields dropped to the lowest

level this year after President Donald Trump said he will not brand China a

currency manipulator and added that the greenback was getting too strong. U.S.

stocks declined for a second day as volatility climbed again across asset

classes.

The Bloomberg Dollar

Spot Index fell as much as 0.4 percent after Trump made the comments in an

interview with the Wall Street Journal on Wednesday, abandoning a core promise

of his election platform that tapped into voter anger about trade-driven job

losses.”

“The remarks are seen

as reducing the risk that China could dump its holding of Treasuries in

retaliation for being tagged a currency manipulator. China’s currency

traded outside of the country gained the most since last month.”

Even with the US dollar pull-back yesterday…it’s still

trading near the top end of its range.

Bottom Line: This is

a discouraging market. Every indication signals to US market weakness ahead. We

have positions in the market with hedges in place. We also don’t feel confident

enough to completely short the market because a single tweet or some encouraging

event can spark the next rally. The bull market remains intact so shorting

outright (as opposed to hedges) is a risky proposition.

We continue to wait

for a better entry point to deploy assets. For now – we just block and tackle.

Joseph S. Kalinowski, CFA

Twitter: @jskalinowski

Facebook: https://www.facebook.com/JoeKalinowskiCFA/

Blog: http://squaredconcept.blogspot.com/

Tumblr: trader-rants

Additional Reading:

A better global economy means the 'reflation trade' could keep going strong

– Business Insider

No part of this report may be reproduced in any manner

without the expressed written permission of Squared Concept Asset Management,

LLC. Any information presented in this report is for informational

purposes only. All opinions expressed in this report are subject to

change without notice. Squared Concept Asset Management, LLC is a

Registered Investment Advisory and consulting company. These entities may have

had in the past or may have in the present or future long or short positions,

or own options on the companies discussed. In some cases, these positions

may have been established prior to the writing of the report.

The above information should not be construed as a

solicitation to buy or sell the securities discussed herein. The

publisher of this report cannot verify the accuracy of this information.

The owners of Squared Concept Asset Management, LLC and its affiliated

companies may also be conducting trades based on the firm’s research

ideas. They also may hold positions contrary to the ideas presented in

the research as market conditions may warrant.

This analysis should not be considered investment advice and

may not be suitable for the readers’ portfolio. This analysis has been written

without consideration to the readers’ risk and return profile nor has the

readers’ liquidity needs, time horizon, tax circumstances or unique preferences

been considered. Any purchase or sale activity in any securities or other

instrument should be based upon the readers’ own analysis and conclusions. Past

performance is not indicative of future results.

No comments:

Post a Comment