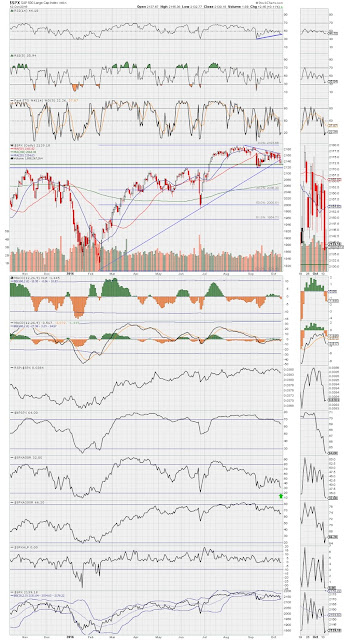

Weak Chinese export figures are depressing futures this

morning. This will be a great test for the U.S. equity markets regarding the resilience

and ability to hold the line. Here is our plan of attack for portfolio

positioning.

1-

If we sell off aggressively on strong volume and

close below the key level of support, then we will introduce hedging

instruments in the portfolio to minimize any damage to the downside. The key

area of support is 2120 on the SPX. The Nasdaq is sitting on its 50DMA and the

Russell 2000 appears to have already broken near-term support.

2-

If we hold the line today, then we will keep our

positions in place until the point where we get a large volume rally and

breakout at least above 2150 on the SPX. At that point we will increase our

long exposure.

Joseph S. Kalinowski, CFA

Email: joe@squaredconcept.net

Twitter: @jskalinowski

Facebook: https://www.facebook.com/JoeKalinowskiCFA/

Blog: http://squaredconcept.blogspot.com/Web Site: http://www.squaredconcept.net/

No part of this report may be reproduced in any manner

without the expressed written permission of Squared Concept Asset Management,

LLC. Any information presented in this report is for informational

purposes only. All opinions expressed in this report are subject to

change without notice. Squared Concept Asset Management, LLC is a

Registered Investment Advisory and consulting company. These entities may have

had in the past or may have in the present or future long or short positions,

or own options on the companies discussed. In some cases, these positions

may have been established prior to the writing of the particular report.

The above information should not be construed as a

solicitation to buy or sell the securities discussed herein. The

publisher of this report cannot verify the accuracy of this information.

The owners of Squared Concept Asset Management, LLC and its affiliated

companies may also be conducting trades based on the firm’s research

ideas. They also may hold positions contrary to the ideas presented in

the research as market conditions may warrant.

This analysis should not be considered investment advice and

may not be suitable for the readers’ portfolio. This analysis has been written

without consideration to the readers’ risk and return profile nor has the

readers’ liquidity needs, time horizon, tax circumstances or unique preferences

been taken into account. Any purchase or sale activity in any securities or

other instrument should be based upon the readers’ own analysis and

conclusions. Past performance is not indicative of future results.

No comments:

Post a Comment