The market is still trading in a tight range. The past few

trading sessions has seen the market sell off initially but recoup most if its

losses by the close. It’s a good sign that we are not seeing heavy institutional

selling.

On the daily SPX chart, we see a symmetrical triangle has

developed signifying listless direction. A big volume break up or down may

determine the overall direction of the market through the end of the year.

We are leaning towards a break to the upside for a few

reasons.

(1)

Earnings season is beginning and the preliminary

movements in earnings estimates have been favorable as we pointed out in our

recent blog post Positioning

for 4Q16.

(2)

A December rate hike is currently reflected in

equity prices.

(3)

The Trump campaign appears to be imploding.

(4)

In most cases a symmetrical triangle breaks in

the direction of the overall trend. Since February that trend has been up.

(5)

The Nasdaq and Russell 2000 small caps are

performing better than the S&P 500 and are leading the overall market trend

higher (meaning they are or are close to holding their 20DMA.)

We have deployed some cash in the portfolio but will get

more aggressive should we break to the upside. If we are wrong on our analysis,

we will pull positions off and await a better entry.

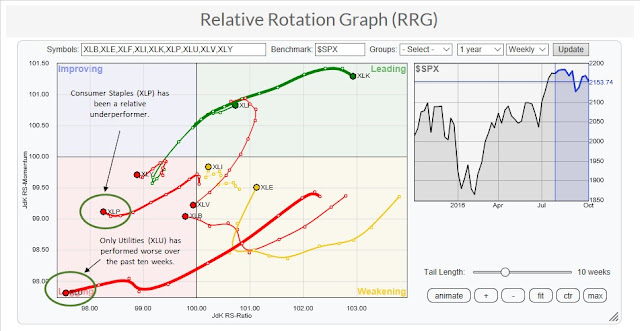

Consumer Staples

The consumer staples sector has been taking a beating. Over

the past ten weeks only utilities have performed worse relative to the S&P

500.

We consider this a buying opportunity and are going to take

a position in the consumer staples sector for several reasons.

The fundamental picture has been steadily improving since

the end of 1Q16 as seen by the EPS, book value and cash flow trends.

Both earnings and book value per share have a meaningful

impact on sector valuation. With twelve month eps forecasts around $27.43 and trailing

twelve-month book value per share near $101.66 for the sector, we estimate the

sector to be 10% to 15% undervalued.

Our value variance measure that examines the distance

between current index prices and perceived fair value is over two standard

deviations from the mean. That has represented great entry points for

opportunistic trading scenarios in the past.

We also track the rate of change of the value variance to

determine the magnitude of the sell-off. This acts as a confirmation of the

value variance measure. The chart below highlights the confirmation pattern of

the value variance buy signals.

While the fundamental screening process is giving us a buy

signal, the technical picture looks a bit rough but one can determine key

levels of support that may confirm our investment thesis. On the daily consumer

discretionary the index is sitting on the 200DMA that has held as the final front

of support on several occasions. We are also seeing a potential bullish

divergence between pricing and RSI and MACD. The volume momentum and breadth

momentum indicators are also showing waning negative deterioration and a

possible bullish divergence.

On the weekly consumer staples chart the uptrend remains in

place and the index is sitting near the 50WMA which has acted as support in the

past. RSI (14) remains at or near the 50 level and given the improving

fundamental picture there isn’t any reason to believe that these previous

support levels will fail.

Happy Trading!

Joseph S. Kalinowski, CFA

Email: joe@squaredconcept.net

Twitter: @jskalinowski

Facebook: https://www.facebook.com/JoeKalinowskiCFA/

Blog: http://squaredconcept.blogspot.com/

Web Site: http://www.squaredconcept.net/

No part of this report may be reproduced in any manner

without the expressed written permission of Squared Concept Asset Management,

LLC. Any information presented in this report is for informational

purposes only. All opinions expressed in this report are subject to

change without notice. Squared Concept Asset Management, LLC is a

Registered Investment Advisory and consulting company. These entities may have

had in the past or may have in the present or future long or short positions,

or own options on the companies discussed. In some cases, these positions

may have been established prior to the writing of the particular report.

The above information should not be construed as a

solicitation to buy or sell the securities discussed herein. The

publisher of this report cannot verify the accuracy of this information.

The owners of Squared Concept Asset Management, LLC and its affiliated

companies may also be conducting trades based on the firm’s research

ideas. They also may hold positions contrary to the ideas presented in

the research as market conditions may warrant.

This analysis should not be considered investment advice and

may not be suitable for the readers’ portfolio. This analysis has been written

without consideration to the readers’ risk and return profile nor has the

readers’ liquidity needs, time horizon, tax circumstances or unique preferences

been taken into account. Any purchase or sale activity in any securities or

other instrument should be based upon the readers’ own analysis and

conclusions. Past performance is not indicative of future results.

No comments:

Post a Comment