We look to take a pragmatic value approach towards our pair’s

trading portfolio. The two sectors that look appealing to us are the packaged

food and consumer durables & apparel industries.

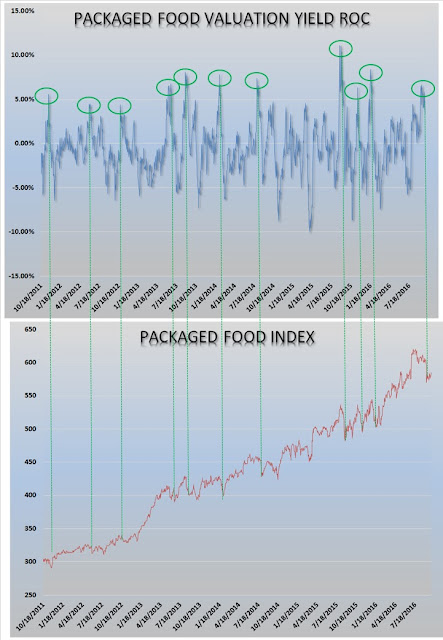

Packaged Food

The chart below shows our fair valuation model for the

industry. To derive this figure, we compute the earnings, book value and free

cash flow yield for the aggregated industry and weight them according to

historical pricing correlation. When the trend is higher, then we consider the

industry “investable”. Clearly the fair value trend is rising over a longer period

of time. There has been a recent dip in the fair value trend that we will watch

closely.

We also find that the earnings, book value and free cash

flow upward trend remains intact. That is an important consideration.

We find the value variance between the industry price and its

fair value expressed as a z-score. Typically, when this model drops below -1.0

standard deviations the industry has offered us excellent trading

opportunities.

We also note that the second derivative rate of change often

confirms the trading opportunity. Both the value variance and the rate of

change figures are signaling a buy for this industry that has an up trending

fundamental picture.

On the daily chart the industry has bounced off the 38.2% Fibonacci

retracement support from the February lows, it has retaken its 20DMA and both

RSI and MACD are showing improving momentum.

On the daily relative rotation graph the packaged food

industry has moved from a lagging to an improving industry relative to the SPX.

Taking into account there is no actively traded packaged

food industry ETF, we will purchase the individual components in the industry

weighted appropriately to mimic the movement of the index.

Long USDJFO / Short

XLP

Our relative price performance z-score shows a large

divergence between the packaged food industry and the overall consumer staples

sector. We will trade this as a pair’s in anticipation of a closing of the gap.

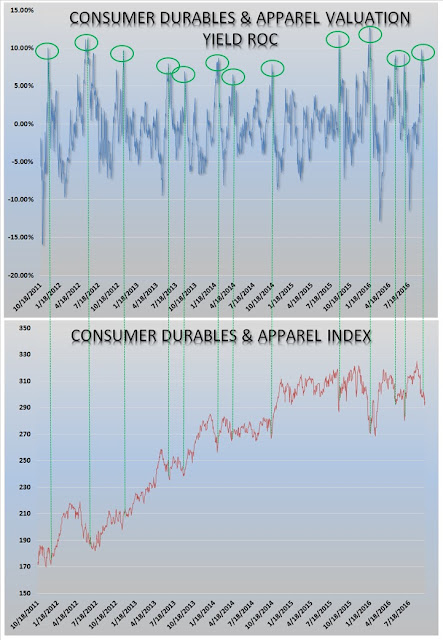

Consumer Durables

& Apparel

The fair value and fundamental picture remains in an

uptrend.

The value variance model is signaling a buy.

The rate of change is confirming the buy signal.

On the relative rotation graph we are finding the industry

is still in the lagging category relative to the SPX but it is moving towards the

improving quadrant. We will be monitoring this closely for improvement.

On the daily chart we would like to see the marked support

level hold and a bullish MACD cross. We are also seeing a bullish divergence

between the index price and the RSI.

On the weekly chart we are sitting at support on the marked ascending

wedge. We will keep our stops tight should this pattern fail. Given the

fundamental picture, we believe the industry is due for a bounce from these

levels. A break through the 320 level could launch this industry much higher.

Taking into account there is no actively traded consumer

durables & apparel industry ETF, we will purchase the individual components

in the industry weighted appropriately to mimic the movement of the index.

Long GSPLP (S5COND on

Bloomberg) / Short XLY

The relative price performance z-score is showing an extreme

level of mispricing between the industry and the sector.

Joseph S. Kalinowski, CFA

No part of this report may be reproduced in any manner

without the expressed written permission of Squared Concept Asset Management,

LLC. Any information presented in this report is for informational

purposes only. All opinions expressed in this report are subject to

change without notice. Squared Concept Asset Management, LLC is a

Registered Investment Advisory and consulting company. These entities may have

had in the past or may have in the present or future long or short positions,

or own options on the companies discussed. In some cases, these positions

may have been established prior to the writing of the particular report.

The above information should not be construed as a

solicitation to buy or sell the securities discussed herein. The

publisher of this report cannot verify the accuracy of this information.

The owners of Squared Concept Asset Management, LLC and its affiliated

companies may also be conducting trades based on the firm’s research

ideas. They also may hold positions contrary to the ideas presented in

the research as market conditions may warrant. This analysis should not be considered investment advice and may not be suitable for the readers’ portfolio. This analysis has been written without consideration to the readers’ risk and return profile nor has the readers’ liquidity needs, time horizon, tax circumstances or unique preferences been taken into account. Any purchase or sale activity in any securities or other instrument should be based upon the readers’ own analysis and conclusions. Past performance is not indicative of future results.

No comments:

Post a Comment