We have started to deploy cash in our core Fishbone

portfolio. We understand that October (especially election year October’s) can

be quite volatile so we still have cash available in the portfolio and will use

a pullback (within market support levels) to build additional positions.

Now that the Fed decision and the first debate is out of the

way, we believe there exists several tail winds that could propel the market

higher from here.

Politics

The real clear politics average has Clinton gaining ground

in the national polls. While the results are too close to call by any means, it

is probably likely that the market is satisfied that Trump’s momentum from a

few weeks back has been halted, at least for now.

Clearly the market doesn’t care for the proposition of a

Trump presidency. This was seen during and after Trump’s lackluster debate

performance when market futures and forex moved in tandem with Clinton’s debate

success. According to the NYT,

“During the debate, the overnight futures

markets rallied, raising the value of broad stock market gauges like the

Standard & Poor’s 500-stock index by two-thirds to three-quarters of a

percentage point. This was a consequential move, and because it was driven by

the reduced chance of a Trump presidency, it reveals that the market believes

that stocks would be worth more if he were to lose the election…the rally

played out in virtual lock step with Mr. Trump’s debate performance. When Mrs.

Clinton pummeled him over his tax returns, stocks rose. And this pattern of

stocks rising in response to Mr. Trump’s miscues continued through the evening.”

“Finally, a particularly

large rise in the value of the Mexican peso paralleled the rise in S.&P.

500 stock futures. The peso move, which appears to be linked to the reduced

likelihood of Mr. Trump’s being able to put into effect his immigration and

trade proposals, also suggests that the financial markets’ reaction was a

judgment that Mr. Trump lost the debate.”

If we lay out the electoral map and give each candidate the

state where he or she is winning (even if it’s by an amount within the margin

for error) then Clinton clearly wins the presidency. Political beliefs aside,

that would be a good thing for the market in the very short-term.

We know the election is too close to call but we are also

assured that Trump will consistently do something dumb to make sure he caps his

momentum and doesn’t run away with it prior to election day. That

is good for stocks in our opinion.

The Fed & The

Economy

The market is placing a 60% chance of a rate hike in

December. In our opinion the rate hike is already reflected in prices and we

don’t think it will have an overwhelming effect on the market. A 25bp increase

with dovish language would most likely rally the market in our opinion. Only a surprise

rate increase of more than 25bp may spook equities.

The economy seems to be improving of late but not to the

extent that would push the Fed to get more hawkish in their position in our

opinion.

The Citigroup Economic Surprise Index has been improving.

Year-over-year industrial production has bottomed and has

started to turn higher.

Aggregate manufacturing readings have also started higher

signifying a second half rebound for this year.

The Chemical Activity Barometer (CAB) has also turned higher

recently. According to the American

Chemistry Council, “ACC's Chemical

Activity Barometer is a first-of-its-kind, leading economic indicator that

helps anticipate peaks and troughs in the overall U.S. economy and highlights

potential trends in other industries in the U.S. This barometer can be a

critical tool for predicting broader U.S. economic health.”

The Atlanta Fed’s GDPNow economic growth model has been

moving lower lately but is still showing 2.4% real GDP (seasonally adjusted

annualized) growth for 3Q16. According to the Atlanta Fed GPDNow

website, “The GDPNow model forecast

for real GDP growth (seasonally adjusted annual rate) in the third quarter of

2016 is 2.4 percent on September 30, down from 2.8 percent on September 28. The

forecast of third-quarter real consumer spending growth declined from 3.0

percent to 2.7 percent after this morning's personal income and outlays report

from the U.S. Bureau of Economic Analysis (BEA). Following yesterday's GDP

revision from the BEA and the Advance Economic Indicators release from the U.S.

Census Bureau, the forecast of the contribution of inventory investment to

third-quarter growth decreased from 0.60 percentage points to 0.26 percentage

points and the forecast of the contribution from net exports increased from

-0.13 percentage points to 0.13 percentage points.”

This economic growth isn’t strong enough for the Fed

to aggressively start to tighten but it is strong enough to assure the equity

markets that we are not headed for recession.

The New York Fed also compiles the data to produce an

economic forecast that is the FRBNY Nowcasting

Report. They are looking for 2.2% economic growth in 3Q16 and 1.3% for

4Q16. Once again, not strong enough to enter a tightening policy but not too

weak to threaten recession.

According to research done on XE

Blog by New Deal Democrat, “The

recent wobbling continues. While long leading indicators remain almost

universally positive, different short leading and coincident indicators have

been fluctuating from week to week. For example, this week oil broke its

long positive streak, and temp staffing turned negative, while rail and the

Regional Fed indexes improved enough to score neutral.

Among long leading

indicators, interest rates for corporate bonds, treasuries, the yield curve,

real money supply, real estate loans, mortgage rates, and mortgage applications

are positive. A significant negative, however, is that mortgage rates have not

made new lows for over 3 years.

Among short

leading indicators, stock prices, jobless claims, gas prices, gas

usage, and industrial commodities, are all positive. Oil prices, however,

have turned neutral from being positive for over 2 years. Both readings of the

US$ are now neutral. The volatile regional Fed average have improved

enough to score as neutral.

The coincident

indicators remain mixed. Rail has improved enough again this week to score

neutral. Consumer spending remains neutral to negative. The BDI is now

positive. Steel, the Harpex shipping index, and bank rates remain negative. Tax

withholding is positive. Temp staffing turned from neutral to negative.”

Additionally, there seems to be a dire fear of the markets

correcting in any reasonable measure by policy makers across the globe. The markets

hit a weak patch largely due to the Deutsche Bank fall-out and suddenly we get

leaks of a much more subdued

banking fine and news that Chair Yellen would consider buying

equities as part of her monetary policy toolbox. The market recovers.

A weak but growing economic picture with policy makers

desire to keep the stock market stable ahead of elections will keep the

goldilocks stock market scenario in place for a reasonable period of time in

our view. That is good for stocks in our opinion.

Corporate Earnings

Earnings season is upon us and we believe it could provide a

boost to equity prices. According to FactSet,

“The Q3 bottom-up EPS estimate (which is

an aggregation of the EPS estimates for all the companies in the index) dropped

by 2.9% (to $29.76 from $30.65) during the quarter…Thus, the decline in the

bottom-up EPS estimate recorded during the third quarter was smaller than the

1-year, 5-year, and 10-year averages.”

A slowing in earnings deterioration should be considered a

good thing for equities.

They go on to note, “After

several quarters of year-over-year declines, analysts currently expect revenue

growth to return in Q3 2016 and earnings growth to return in Q4 2016. In terms

of earnings, the estimated growth rates for Q3 2016 and Q4 2016 are -2.1% and 5.6%. In terms of revenues, the

estimated growth rates for Q3 2016 and Q4 2016 are 2.6% and 5.2%. For all of

2016, analysts are projecting earnings to decline year-over-year (-0.2%), but

revenues to increase year-over-year (2.0%).”

It would appear that the profits recession is ending.

We could argue that the market is overvalued based on historical

valuation measurements, but only a damn fool would short this market based on

historical valuation in light of skewed equity risk premiums exacerbated by

aggressive monetary policy easing since the great recession.

The S&P 500 is expected to produce $127.18 in EPS over

the coming twelve months. Using Friday’s price of $2168.27 we get an earnings

yield of 5.9% compared to 1.59% on the ten-year. Risk premium comparisons

between the two are useless at this point. Given historical, five year and ten

year average P/E ratios for the S&P 500 one could make the case that the market

is 15% to 20% overvalued.

That said, shorter term earnings trends are looking

encouraging. The slope of the twelve month forward EPS for the SPX are recovering.

The slope of the earnings trend is a key variable to support higher equity

prices.

SPX book value and free cash flow have also resumed an

uptrend.

The same can be said for the Nasdaq Comp…

…and the Russell 2000

The end of the corporate profits recession and the return of

an upward sloping trajectory of fundamentals should provide fuel to advance

equities. A strong earnings season approaching can act as a catalyst for this

to transpire. That is good for stocks in our opinion.

Technical Picture

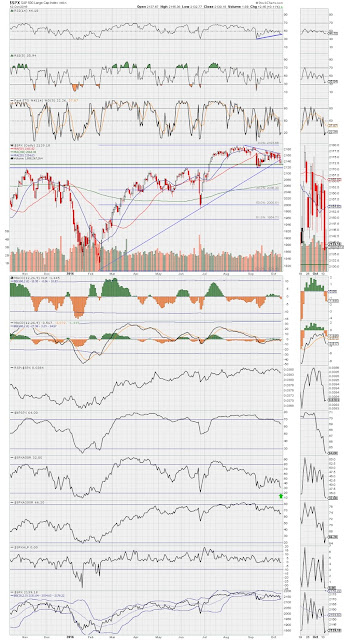

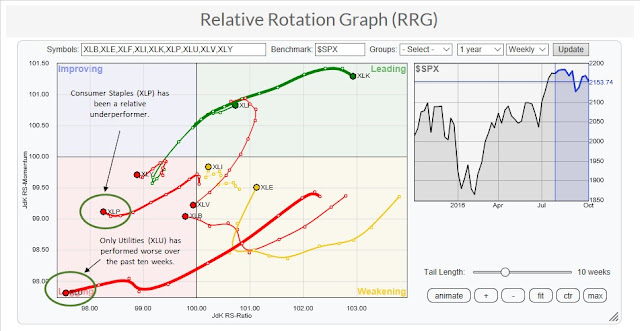

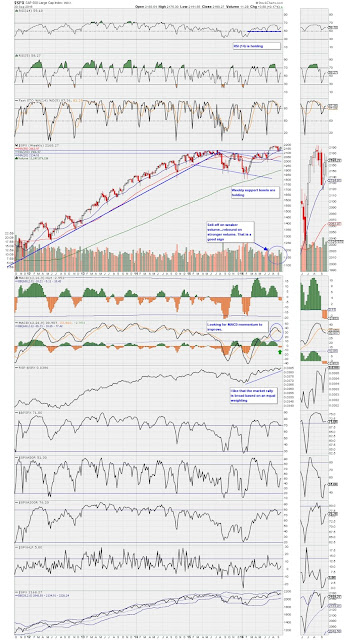

The SPX on a daily picture seems to be holding steady. The

solid support between 2120 and 2130 held up well last month and the index has

regained its 20DMA. It’s now bumping against the 50DMA. A break through that on

strong volume will entice us to deploy the remainder of our cash through 4Q16.

On the SPX weekly, We’re seeing a pick-up in volume and all the proper support

levels are intact. RSI (14) remains above 50 and the rally has been broad based

as seen by the action in the equal weighted SPX equivalent. We would like to

see a bullish MACD cross sometime soon to confirm the resumption of the

uptrend.

On the daily Nasdaq chart all signals are confirming an

uptrend. What we don’t like to see is the waning momentum seen in the MACD and

the various oscillators. As volume picks up we will be comforted in knowing

momentum has returned in a strong fashion. The weekly Nasdaq chart confirms our

bullish stance and has yet to show signs of cracking.

The daily Russell 2000 chart is very interesting. This index

has seen the greatest improvement in the slope of earnings (as seen in the

models above) and appears to be coiling for a nice breakout. A close above the

1260-1265 range with strong volume could launch this index. The uptrend remains

intact. We have taken a small position in ProShares UltraPro Russell2000

(URTY). We are waiting for confirmation before increasing our position. The

weekly Russell 2000 continues to show strong upward momentum from the February

lows. With momentum improving and the possibility of a 4Q breakout and rally, that

is good for stocks in our opinion.

Bottom Line: We

expect volatility through the end of the year but are confident that the market

can go higher from here. Political factors, monetary policy and economics,

earnings trends and technical analysis could be lining up to provide the much

anticipated 4Q rally. We are building positions in anticipation with stops in

place should our thesis prove incorrect.

Joseph S. Kalinowski, CFA

No part of this report may be reproduced in any manner

without the expressed written permission of Squared Concept Asset Management,

LLC. Any information presented in this report is for informational

purposes only. All opinions expressed in this report are subject to

change without notice. Squared Concept Asset Management, LLC is a

Registered Investment Advisory and consulting company. These entities may have

had in the past or may have in the present or future long or short positions,

or own options on the companies discussed. In some cases, these positions

may have been established prior to the writing of the particular report.

The above information should not be construed as a

solicitation to buy or sell the securities discussed herein. The

publisher of this report cannot verify the accuracy of this information.

The owners of Squared Concept Asset Management, LLC and its affiliated

companies may also be conducting trades based on the firm’s research

ideas. They also may hold positions contrary to the ideas presented in

the research as market conditions may warrant.

This analysis should not be considered investment advice and

may not be suitable for the readers’ portfolio. This analysis has been written

without consideration to the readers’ risk and return profile nor has the

readers’ liquidity needs, time horizon, tax circumstances or unique preferences

been taken into account. Any purchase or sale activity in any securities or

other instrument should be based upon the readers’ own analysis and

conclusions. Past performance is not indicative of future results.