New Pairs Trades

For more information on our pair’s trading methodology

please click here.

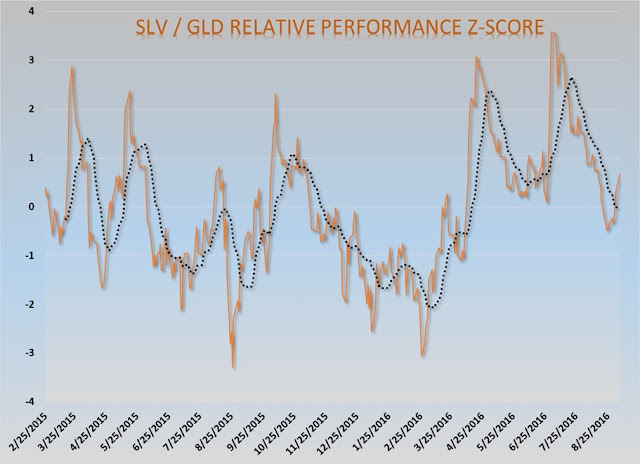

Long Silver (SLV) /

Short Gold (GLD)

Long Utilities (XLU) /

Short S&P 500 (SPY)

Long iShares JPMorgan

USD Emerging Markets Bond (EMB) / Short S&P 500 (SPY)

Long iShares US Home

Construction (ITB) / Short S&P 500 (SPY)

Long PowerShares

Emerging Markets Sov Dbt ETF (PCY) / Short S&P 500 (SPY)

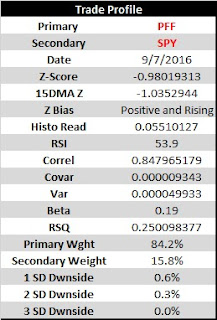

Long iShares US

Preferred Stock (PFF) / Short S&P 500 (SPY)

Portfolio Update

Long Consumer Staples

(XLP) / Short S&P 500 (SPY)

This trade has really moved against us today. We believe it

still rests on support and short-term momentum is still positive. We still

believe the “defense trade” will work over the next several weeks and months.

Long Health Care (XLV)

/ Short S&P 500 (SPY)

Admittedly we should have waited for a MACD bullish cross

before going into this trade. We broke a rule and it hurt us. That said the

Health Care sell-off is overdone and we hold a small position in the pair. We

will be watching for an improvement in momentum and build on this position.

Portfolio Metrics

Joseph S. Kalinowski, CFA

No part of this report may be reproduced in any manner without the expressed written permission of Squared Concept Asset Management, LLC. Any information presented in this report is for informational purposes only. All opinions expressed in this report are subject to change without notice. Squared Concept Asset Management, LLC is a Registered Investment Advisory and consulting company. These entities may have had in the past or may have in the present or future long or short positions, or own options on the companies discussed. In some cases, these positions may have been established prior to the writing of the particular report.

The above information should not be construed as a solicitation to buy or sell the securities discussed herein. The publisher of this report cannot verify the accuracy of this information. The owners of Squared Concept Asset Management, LLC and its affiliated companies may also be conducting trades based on the firm’s research ideas. They also may hold positions contrary to the ideas presented in the research as market conditions may warrant.

This analysis should not be considered investment advice and may not be suitable for the readers’ portfolio. This analysis has been written without consideration to the readers’ risk and return profile nor has the readers’ liquidity needs, time horizon, tax circumstances or unique preferences been taken into account. Any purchase or sale activity in any securities or other instrument should be based upon the readers’ own analysis and conclusions. Past performance is not indicative of future results.

No comments:

Post a Comment