Volatility is back. In our core Fishbone model we remain in

cash and are waiting for a clearer picture from the market before wading back

in. On the daily S&P 500 chart the key levels of support are 2120, 2100,

2015 and 2000. The 2120 level has held thus far which was prior resistance. The

2100 level is the bottom of the trend line from the February lows. The 2050 to

2060 level is both the 200 day moving average and the 38.2% Fibonacci

retracement from the February lows and 2000 is both a psychological figure and

the 50% Fibonacci retracement from the February lows.

Ideally we want to see the S&P 500 retake the 20 and 50

day moving averages and have MACD momentum improve before taking aggressive

long positions.

The daily Nasdaq shows waning momentum on all the

oscillators as well as MACD. It’s settling in near the 5190 level that was

previous resistance and is holding the 20 and 50 day moving averages. A

breakdown could send the index to the 5000 level. The next stop below that is

around 4900 which is the 200 day moving average and the 38.2% Fibonacci

retracement from February. Unlike the S&P 500, the Nasdaq isn’t sitting

below its moving average trend lines but ideally we would like to see momentum

improve.

The Russell 2000 bounced off the 1200 support level and has

retaken the 50 day moving average.

Should the market start to rebound strongly from here, we

believe the small cap sector could be a relative outperformer. During the

recent bout of volatility, it appears the small caps have suffered the worst

relative to the S&P 500 and Nasdaq. Looking at the relative performance of

these indices it appears the small caps are sitting on major support levels

relative to the others.

On The Sidelines

Aside from watching the technical picture, we’re waiting for

several key events in September to happen before we move back into equities.

Key central bank meetings from the Fed and BOJ as well as the first

presidential debate.

The Fed

Regarding the Fed, we’re looking at a fairly low probability

of a September rate hike, near 20%. An increase in rates by the Fed in

September would act as a shock to the market and could send the market lower –

or at the very least increase volatility in a very dramatic way. Considering we

are right in front of the elections we do not expect the Fed to raise in

September. The Fed also sees the probabilities and one would imagine they too

wouldn’t want to introduce excessive market volatility at this juncture.

That said they could leave rates unchanged but change to a

more hawkish message to lay the ground work for a rate hike in December. This

is probably a more likely outcome and can have negative effects on equity

prices as well but to a lesser degree.

The markets had recently priced in higher rates. Looking at

utilities vs. financials is a great way to catch a glimpse of how the market views

the interest rate environment. The following chart looks at the relative pricing

comparison between utilities (XLU) and financials (XLF). We had a breakout

earlier this year and have held support a few times. We have recently reached

that support level and are now bouncing off. Ultimately even with a 25bp

increase in the fed funds we believe utilities will remain attractive for

income seeking investors and margins at financial companies will see a slight

improvement. We don’t anticipate the relative outperformance of utilities (up

17% this year) to financials (up 3% this year) to end just yet.

Long-term treasuries (TLT) have also trended higher this

year relative to financials. The price comparison between the two recently

tested the up channel support and will likely hold as the trend of excessively

low interest rates isn’t ending anytime soon, in our opinion. The economy just

doesn’t seem like it’s there yet (see

Our Thoughts On The Economy).

The Election

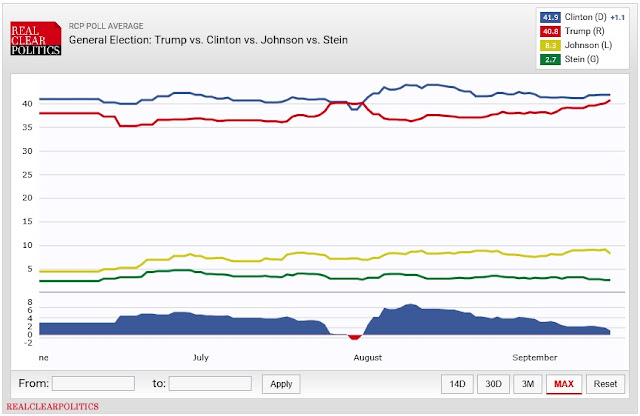

The market frowns on uncertainty and there is little doubt

that Trump is gaining ground on Clinton in the polls. According to real clear

politics Trump is now only 1.1 points behind Clinton nationally, and gaining

ground.

While Trump has a long way to election, a path is starting

to materialize. The chart below shows the current electoral map giving Clinton

the edge.

Within the battleground states, Trump is polling ahead of Clinton

in Ohio, Florida, Iowa, Arizona and Georgia. He is virtually tied in Nevada and

North Carolina. If we give Trump all these states and the remaining to Clinton

she will win the presidency.

That said, if we keep our electoral map assumptions constant

but Trump pulls an upset in any of the states that are circled in Red. Trump

wins!

The current campaign strategy that Trump is utilizing is

working. Tone down the rhetoric and stick to the issues. The Clinton campaign

is up against major difficulties at this point. They have to (1) promote the

existing policies that are largely unpopular with a large portion of the

country; (2) continually try to deflect and defend past misdeeds and health

issues which is difficult to do with a daily drip of perceived indiscretions by

Clinton and; (3) continually attack Trump which is becoming an annoyance for

those that are interested in the issues and haven’t yet made up their mind to

vote.

This has the makings of an upset and we believe the first

debate this month will set that tone and could conceivably decide the race. If

Trump comes out on top it could initiate a more aggressive equity sell-off in

the near-term.

As mentioned the market does not like uncertainty. Perhaps

the new Trump will surprise the market with a more focused and pinpointed way

to get his message across but historically he has said things that could have

caused an equity sell-off if he were a serious contender. If the situation

arises and he is the front-runner the market will start paying attention to his

words much more than they have in the past, in our opinion.

What was said in the past that could damage investor

sentiment:

“Trump:

Americans should avoid stock market - Donald Trump suggested Tuesday that

Americans should not place their retirement funds into the stock market,

warning of “some very scary scenarios.”” – The Hill 8/2/16.

There are those that share the unease of having a leader

that talks first and thinks later.

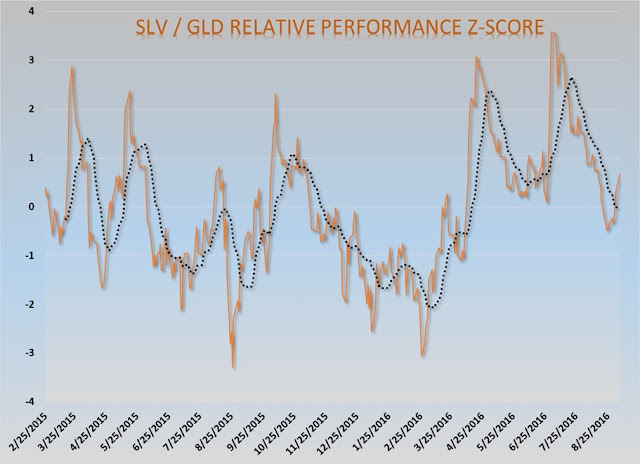

“Wall

Street is unprepared for a Trump victory - Should Trump continue to rebound

in the polls, watch for market volatility to increase as investors brace for

uncertainty. Citigroup recommends increasing exposure to precious metals like

gold as an offset. Yet any associated selloff could prove a buying opportunity.”

– Business Insider 9/2/16.

“Opinion:

Politics is the bull market’s biggest hurdle - David Woo, head of global

interest rate and foreign exchange strategy for Bank of America Merrill Lynch,

said Wall Street is pricing in a big Clinton victory, but investors could start

selling if she lags in the polls. He argues investors prefer the likely

gridlock, slow growth and easy monetary policy a Clinton presidency would offer

to a potential bull-in-the-china-shop Trump administration. As the old saying

goes, the devil you know. ...” – Market Watch 9/9/16.

“If

Trump wins, stocks will crash 50%: Wedbush pro - All in all, Winer {Ian

Winer, Wedbush's director of equity sales trading} believes Trump's policies would lead to a nation on weaker fiscal

footing, with a lack of cheap labor and a lack of cheap goods. In this

environment, the multiple paid on S&P 500 earnings would dramatically

decrease, he said.

"If all the

policies are enacted," the S&P's price-to-earnings ratio "could

go as low as 11," which is how you "get to 1,000 on the

S&P," Winer wrote. That would represent a 50 percent drop from current

levels.” – CNBC 3/16/16.

“Clinton

Health Another Land Mine for Suddenly Vulnerable Markets – “If Clinton’s

health becomes a larger factor with regard to voter decision-making, the market

may have to recalculate the risk-reward of a regime change in the White House,

as Clinton right now is assumed as a continuity from the current

administration,” Yousef Abbasi, global market strategist at JonesTrading

Institutional Services LLC, said by phone. “Obviously today is another thing

that’s going to draw closer attention.” – Bloomberg 9/11/16.

Bank of Japan

The last event of September that we will be watching closely

are the monetary policy decisions that will come out of Japan. With $13

trillion of global debt sitting at yields below 0% the folks at the BOJ are

seeking new and innovative ways to keep their economy chugging along. It would

seem that they are talking about instituting their own version of “operation twist”

and are exploring the idea of manipulating the steepness of the yield curve on

their sovereign debt. The idea is that artificially low rates and a flat yield

curve has pinched banking institutions, pensions, savers, insurance companies,

etc. - basically any corporation or person that relied on an income and/or

yield spread strategy to profit are suffering. Their argument as I understand

it is that the flatness of the yield curve is hindering economic growth.

There are two problems we see here. The first is that the

steepness of the yield curve should be a market driven function that reflects

market participants’ views towards future economic growth expectations.

Attempting to manipulate rates over the long term is futile and we don’t

understand the consequences of such actions yet, in our view. With all the

experimental monetary policy happening in the global economy today, the truth

is that we haven’t really seen the return to a robust global economy.

That said, because of the low/zero interest rate policies

that have been in place for so long and the relative flatness of the yield

curve, many of these banking institutions, pensioners, savers, insurance

companies, etc. have spent years making adjustments to minimize the profit

impact of these policies. Thus they may have a greater than wanted exposure to

longer term instruments, exposure to increased leverage and concentrated

portfolios. If the BOJ were to deliberately attempt to steeped the long yield,

these types of investment structures would suffer dramatically as the duration

on their portfolios may be higher than desired and more sensitive to adverse

pricing pressure.

This type of market event could exacerbate a sell-off in the

fixed income market that could very well spill over to equities.

Bottom Line: We

continue to sit on the sidelines as this coming week contains a few pitfalls

that could have an effect on the US equity markets. If market volatility

continues then we will remain in cash in our core Fishbone portfolio and will

continue to wait for an appropriate entry point. If we sail through the

remainder of the month and the market regains its footing, then we will

redeploy and take advantage of the upside.

Key Dates

September 21 – Both the

Fed and BOJ meet to determine the future direction of monetary policy.

September 26 – The first

presidential debate.

Joseph S. Kalinowski, CFA

Email: joe@squaredconcept.net

Twitter: @jskalinowski

Facebook: https://www.facebook.com/JoeKalinowskiCFA/

Blog: http://squaredconcept.blogspot.com/

Web Site: http://www.squaredconcept.net/

Additional Reading

No part of this report may be reproduced in any manner

without the expressed written permission of Squared Concept Asset Management,

LLC. Any information presented in this

report is for informational purposes only.

All opinions expressed in this report are subject to change without

notice. Squared Concept Asset

Management, LLC is a Registered Investment Advisory and consulting company.

These entities may have had in the past or may have in the present or future

long or short positions, or own options on the companies discussed. In some cases, these positions may have been

established prior to the writing of the particular report.

The above information should not be construed as a

solicitation to buy or sell the securities discussed herein. The publisher of this report cannot verify

the accuracy of this information. The

owners of Squared Concept Asset Management, LLC and its affiliated companies

may also be conducting trades based on the firm’s research ideas. They also may hold positions contrary to the

ideas presented in the research as market conditions may warrant.

This analysis should not be considered investment advice and

may not be suitable for the readers’ portfolio. This analysis has been written

without consideration to the readers’ risk and return profile nor has the

readers’ liquidity needs, time horizon, tax circumstances or unique preferences

been taken into account. Any purchase or sale activity in any securities or

other instrument should be based upon the readers’ own analysis and

conclusions. Past performance is not indicative of future results.