The market is so dynamic. The ebb and flow of differing

analyses truly makes every day an education for those of us that are students

of the market. Here are two differing views for the outlook heading forward.

The Bear Case

Carl Swenlin from Stockcharts.com wrote an interesting piece

entitled, “SPY:

Longer-Term Internals Still Looking Bearish” Let’s take a look at his

compelling chart-work and assumptions.

“On Thursday the DP

Trend Model for SPY changed from BUY (long the market) to NEUTRAL (in cash or

fully hedged) when the 20EMA crossed down through the 50EMA. Why doesn't the

model change from BUY to SELL (short the market)? Because the 50EMA is still

above the 200EMA, which, by our definition, means SPY is still in a long-term

bull market. In this type situation the Model design assumes the 20/50

crossover is only signalling a correction, not a bear market. If a correction

turns into a bear market, the model is safely in cash. Otherwise, once the

correction is over, the 20EMA will eventually cross up through the 50EMA and

generate a new BUY signal. The objective of the Model is to exercise caution

when sufficient weakness is shown. Also, the Model signal is an information

flag, not an action command, and we need to look more closely at trend and

condition.”

“Let's zoom out to a

three-year view of SPY. We can see a pretty well defined rising trend channel.

Remember, the rising bottoms line defines the trend, and the rising tops line

defines the top of the channel. The dotted line defines a channel bottom within

the wider channel formed by a line drawn across the November 2013 and October

2014 lows. There is a rising wedge that has resolved downward, as expected, but

in the process price also broke down through the first rising trend line,

making this a more serious issue. We can also see that price has crowded the

top of the channel for nearly two years, but that ended this year when price

began moving nearly sideways across the channel and is close to challenging

support of the second rising trend line. The chart also displays the primary

indicators I use for longer-term analysis. These indicators give us feedback on

price (PMO), breadth (ITBM) and volume (ITVM), and they are all below the zero

line and have been diverging negatively from price for many months. They are

all somewhat oversold, but they still have plenty of room before they reach the

bottom of their normal range, about -250. ”

“A final piece of evidence is that the monthly PMO has

crossed down through its signal line, which gives us a long-term PMO SELL

signal, which hasn't happened since the 2007 market top.”

The author stops short of calling the market top but is

simply highlighting the need to take a less aggressive approach and be prepared

for what looks like a potential top.

The Bull Case

A few days later I read an article (via Business Insider)

entitled, “TOM

LEE: I see a 'buy' signal that wins 93% of the time”. He points to several

separate market indicators that he says puts the odds of a market rally into

the end of the year at 93%. By his estimates, we could see the S&P 500 rise

by 9% from here.

Mr. Lee pointed out that the implied volatility term

structure has inverted. This happens when the vix spot pricing trades above its

three month implied volatility figure. “Excluding

recession years, Lee says, this inversion has happened 11 times since 2004 —

and in seven of them, the sell-off ended within days. Three of the other

inversions saw longer sell-offs during 2010-2011 because of the impeding threat

of a US government shutdown. According to Lee, returns after inversions are

impressive, with markets rallying an average of 6% (in three months) and 10%

(in six months), with 100% and 90% win ratios, respectively.”

He made note that sentiment as a contrarian indicator is

overly somber and that in turn can cause the market to turn higher from these

levels. “The American Association of

Individual Investors' net percentage of bulls minus bears was at -12% on July

2, the second-lowest level since 2013 (the lowest being -13% on June 11). But,

as Lee has pointed out before, extremes in this case usually mean the opposite:

"Historically, the AAII survey is a contrarian indicator with a very good

track record at the extremes," Lee wrote in a note last month.”

When viewing these two indicators together he goes on to

say, “Excluding recession years, there

have been five times in which the VIX term structure was inverted AND net

percentage of bulls minus bears was at or below -12%, as is the case today.

“Each of the five precedent periods was associated with an extended rally in

the S&P 500," Lee wrote. He added that rare occurrences resulted in

rallies averaging 6% (over three months) and 9% (over six months) with a 100%

win ratio.”

He says yield spreads are also confirmation that the market

is due for an upward move. “In the first

six months of this year, the spread between 30-year and 10-year Treasury notes

— known as the long-term yield curve — steepened significantly. This is an

unusual occurrence six years into an expansion. Looking at the 13 times in

which the LT yield curve has steepened in the first half of the year amid

positive market gains, markets further gained 85% of the time, with an average

gain of 9%.”

Additionally he says the S&P 500, that has been

underperforming the German Dax is due for a reversion to the mean. “Germany's DAX is an index of the country's

30 largest companies (think Siemens, BMW, Deutsche Bank, etc.) The DAX is

outperforming the S&P 500 year-to-date by 1,500bp — the third-biggest

triumph since 1959. But, as Lee also pointed out last month, US stocks are

"due for a catch-up trade." Lee says that whenever the S&P has

underperformed the DAX by so much, it catches up by rallying through year-end.

The historical average gain is 12% with a 100% win ratio, excluding recession

years. He sees a strong sign of a better second half of the year for stocks.”

Our Indicators

At the end of our last blog entry, we stated that we were

starting to believe in a 2H15 rally. This comes on the heels of interesting

data that we are getting from our internal indicators.

Percentage of NYSE

stocks trading above their 200 day moving average – When the percentage of

stocks trading above their 200 day moving average falls below 35%, it’s usually

a sign that a near-term bottom has been put in place for the stock market. During

times of economic turmoil this indicator can indeed fall much further (sub 15%

is a great buy signal) but as we wrote in our last post, we do not think an

economic recession is on the horizon.

AAII Investor

Sentiment Survey is exceptionally pessimistic – This is one of the indicators

that Mr. Lee pointed to and one that we track as well. As of the last reading,

only 27.9% of respondents said they were “bullish” towards the market and 29.2%

said they were “bearish. We use a ratio of the two scores to determine a “bull/bear”

reading. A bull/bear ratio of 28.5% is an outlier (one standard deviation) and

signifies potential market upside. The percentage of respondents that are

bullish is also below one standard deviation from the mean and is considered to

be positive for the future market direction.

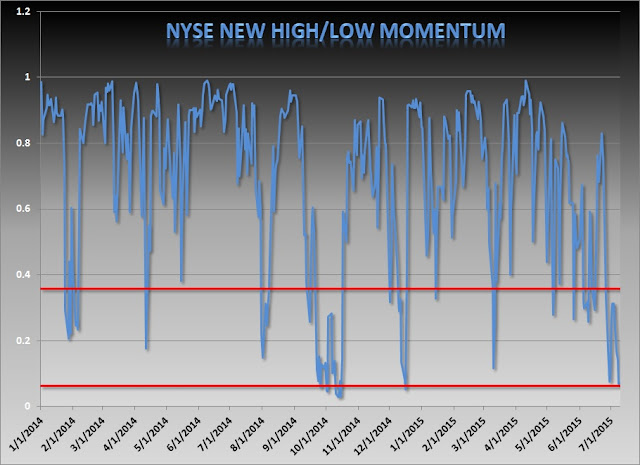

NYSE new high/low

momentum indicator is signaling a buy – We use the number of new highs

divided into total new highs and lows as a measure of market sentiment. For the

S&P 500 this measure is nearly two standard deviations from the mean

currently and signals a buy reading. The same can be said for the Nasdaq

Composite.

Put-Call ratio is signifying

market lows – The CBOE Put-Call ratio hit a high of 1.45 and signifies an extreme

reading of market nervousness. Using a z-score to show where it lies on the

bell curve, reading we are receiving and indicative of a near-term market

rally.

Bottom Line: We

remain in the bullish camp for the time being but are keeping a close watch on

market sentiment. We understand the market is overvalued on a fundamental basis

but as long as the behavioral/sentiment profile holds up, we are still

questioning what

will spark a correction in the market.

Joseph S. Kalinowski, CFA

No part of this report may be reproduced in any manner

without the expressed written permission of Squared Concept Partners, LLC. Any information presented in this report is

for informational purposes only. All

opinions expressed in this report are subject to change without notice. Squared Concept Partners, LLC is an

independent asset management and consulting company. These entities may have

had in the past or may have in the present or future long or short positions,

or own options on the companies discussed.

In some cases, these positions may have been established prior to the

writing of the particular report.

The above information should not be construed as a

solicitation to buy or sell the securities discussed herein. The publisher of this report cannot verify

the accuracy of this information. The

owners of Squared Concept Partners, LLC and its affiliated companies may also

be conducting trades based on the firm’s research ideas. They also may hold positions contrary to the

ideas presented in the research as market conditions may warrant.

This analysis should

not be considered investment advice and may not be suitable for the readers’

portfolio. This analysis has been written without consideration to the readers’

risk and return profile nor has the readers’ liquidity needs, time horizon, tax

circumstances or unique preferences been taken into account. Any purchase or

sale activity in any securities or other instrument should be based upon the

readers’ own analysis and conclusions. Past performance is not indicative of

future results.

No comments:

Post a Comment