Concerns about the current rally are in question. This is a

topic that we have been writing about for some time and the debate continues.

Let’s preface this blog post by saying we are still assuming the bull trend remains

in-tact. We have not altered our investment thesis and remain invested. The

only alteration was a few months back we started capturing interest and

dividends without reinvesting them immediately. This is a slow start to

building cash for better buying opportunities.

We don’t know what will be the catalyst that starts the coming

correction nor when it will occur. That said, we remain on high alert for a

breakdown in the bull trend.

I’ve come across a few compelling articles about market

pressures that call into question the market rally.

We

Might Already Be in a Bear Market – Economy & Markets Daily: “The Nasdaq 100 hit an all-time high on

Friday. It seemed time to pop the champagne and celebrate newfound riches. But

what actually happened is that while the index hit a fresh all-time high, more

stocks actually went down than went up! The last time this happened – when the

index made a 52-week high but more stocks declined than gained – was March 23,

2000. Two days later, the bull market ended. This is not a common occurrence.

Over 8,000 trading days it’s happened nine times. It happened in 1984 then not

again until 1998. Then, after that day in 1998, 356 more stocks more stock went

down. After three months, the market lost 24% of its value. And by early 2000,

the Internet Bubble was over. Bad things happen when fewer and fewer stocks

begin leading the market rally while the rest fall to the side.”

“In prior reports I mentioned

that transport stocks were leading the way down. They’ve been performing poorly

based on softening global demand. I’ve also warned that old-school technology

companies were vulnerable. Many of them have had poor earnings reports or are

hitting 52-week lows. So, we are already seeing pockets of stock market

weakness. The indexes at all-time highs are only a mirage hiding the underlying

weakness. Of course, unless there is an outright crash, not all stocks will go

down at once. Some will signal the way for the rest, like the ones I’ve

mentioned. But in my opinion, we are still in the riskiest end of the spectrum

to allocate new money to the stock market. The recent price action of the

indexes making new highs, with just a handful of companies carrying those highs,

only strengthens my conviction.”

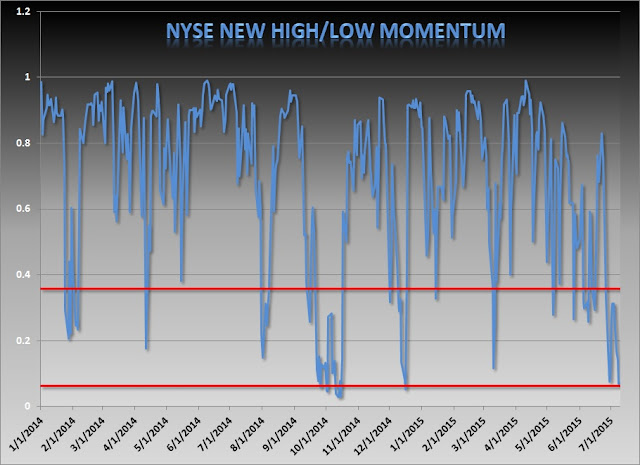

We wrote a recent blog

suggesting the market is rallying on the backs of a few large capitalization companies

and that depth has been deteriorating. We too believe this is not a good signal

for things to come and will be watching closely.

The

Dow just broke a pretty dubious record – CNBC: “On Thursday, the Dow Jones industrial average swung to a negative

year-to-date return, the 21st such time it has moved to either side of

breakeven for 2015. No other year has been so fickle, the closest being the 20

times the blue chip index swung in both 1934 and 1994, according to research

compiled by Bespoke Investment Group. The Dow was off more than 1 percent for

the year as of Friday. That the Dow has topped the mark with more than four

months of trading to go exemplifies a lack of conviction that stretches back to

November, even though the index has posted multiple record highs during the

period.”

Given the run that we’ve had in the market, this kind of

indecisive action can be a harbinger of negative things to come. Charlie Bilello,

CMT from Pension Partners wrote an interesting article entitled The Illusion of Stability.

He notes that there are several warnings on the horizon that indicate U.S. market

troubles. He highlights a deteriorating revenues and earnings environment,

excessively risk tolerant credit spreads, a flattening yield curve, weakening

market technical internals and tightening monetary policy as a few items that

paint a bleak picture. All this and yet the stock market doesn’t appear to be

phased. “Collectively, these factors

point to an equity market that is increasingly fragile and in the past one that

was about to become much more volatile. The response from market participants

today: “no one cares.” Volatility is low, stocks are still acting like a

6-month CD, and monetary policy is easy. All true, but investing is about the

future, not the past. No one knows when the Minsky moment of this cycle will

occur, but a necessary precursor is low volatility and the illusion of

stability. Add fragility to the equation and you have a powder keg just waiting

to explode.”

Staying on the subject of extreme market complacency - The

clock is ticking for stocks: Acampora – CNBC: “The S&P 500 and Dow Jones Industrial average have been bouncing

around in a tight range for the better part of 2015, but according to top

technician Ralph Acampora, if the market doesn't make new highs soon, it could

lead to major problems down the road.”

The Dow Industrials

vs. Transports

Acampora

goes on to state, “In addition to the

lack of new highs, Acampora turned to the classic technical indicator that

could be flashing a "caution" sign: the Dow Theory. "While the

Dow is going sideways and attempting to make new highs, transportation is

rolling over. That's not a good sign," said Acampora, director of technical

analysis at Altaira Limited. Despite his concerns, Acampora is sticking to his

year-end target of 2,250 to 2,300—for now. "I have to stress, we need new

highs or I'll have a problem later on," he added”. Russ Koesterich,

CFA from BlackRock acknowledges the divergence between the transports and

industrials but isn’t putting too much weight on the readings. In his post Do

Transport Stocks Signal a U.S. Selloff? He writes, “Recent

divergence between Industrials and Transports would be more compelling if it

was confirmed by a sharp drop in any new orders or manufacturing surveys.

However, here the evidence is mixed. For instance, recent factory orders and

Chicago Purchasing Managers data have been soft, but the national ISM Manufacturing

index, particularly its new orders component, rebounded sharply in June. To be

sure, we are witnessing an increasing number of global risks surrounding

unsustainable debt and credit creation—consider this summer’s headlines out of

Greece, Puerto Rico and China. These risks have the potential to further weigh

on global markets, at least in the near term. However, such risk aversion is

likely to be short lived, given continued central bank accommodation in much of

the world and some modest improvement in economic growth. As such, we remain

overweight stocks, cyclicals and credit.”

Portfolio Strategy

These are all sound arguments of events that precede market

corrections. As we stated earlier, we are staying the course in our current

portfolio mix and will remain so until further confirmation of market weakness.

We have to assume that the current bull trend remains.

The 200-day daily moving average is still in an uptrend, the

RSI (14) is approaching support, the RSI (5) is moving into oversold territory

along with the fast stochastics. We anticipate further downside in the

near-term and look for support at the 200DMA and improvement in the aforementioned

technical readings for further confirmation about our bull trend assumption. A

breakdown in these near-term indicators will focus our attention on the

longer-term trend.

The negative cross of the long-term MACD and its signal line

(20, 35, and 10) will entice us to start to take a much more defensive position

in our programs by adding portfolio insurance and raising cash.

Bottom Line: We have

been staying the course as it relates to market exposure with a keen eye on

events that could alter the trend. Market internals as well as economic and

fundamental data seem to be getting tired and that concerns us. We believe the

markets are at important levels currently to either confirm the uptrend or signify

something less desirable.

Joseph S. Kalinowski, CFA

TOM LEE: Stocks just did something they haven't done since 1904 – Business Insider

No part of this report may be reproduced in any manner

without the expressed written permission of Squared Concept Partners, LLC. Any information presented in this report is

for informational purposes only. All

opinions expressed in this report are subject to change without notice. Squared Concept Partners, LLC is an

independent asset management and consulting company. These entities may have

had in the past or may have in the present or future long or short positions,

or own options on the companies discussed.

In some cases, these positions may have been established prior to the

writing of the particular report.

The above information should not be construed as a

solicitation to buy or sell the securities discussed herein. The publisher of this report cannot verify

the accuracy of this information. The

owners of Squared Concept Partners, LLC and its affiliated companies may also

be conducting trades based on the firm’s research ideas. They also may hold positions contrary to the

ideas presented in the research as market conditions may warrant. This analysis should not be considered investment advice and may not be suitable for the readers’ portfolio. This analysis has been written without consideration to the readers’ risk and return profile nor has the readers’ liquidity needs, time horizon, tax circumstances or unique preferences been taken into account. Any purchase or sale activity in any securities or other instrument should be based upon the readers’ own analysis and conclusions. Past performance is not indicative of future results.